how to calculate loan payment in excel using pmt function

Jul 14, 2025 am 01:10 AMUsing Excel's PMT function, it is easy to calculate the monthly loan payment. The key is to enter the parameters correctly and ensure that the interest rate and period match. 1. Prepare the loan amount (PV), the monthly interest rate (rate) and the total repayment period (nper); 2. If the annual interest rate or annual number is provided, it needs to be converted into monthly data, such as the annual interest rate is converted to 0.5% per month, and the 5-year loan is converted to 60 months; 3. Use the formula =PMT(rate, nper, pv, [fv], [type]), where fv is usually 0, type can be selected as 0 or 1 to represent payment time; 4. Pay attention to avoid common mistakes, such as confusing annual interest rate with monthly interest rate, numerical symbol errors, period calculation errors, etc.; 5. In actual applications, if the annual interest rate of US$30,000 is 4% repaid in 5 years, the monthly interest rate is 0.003333, the period number is 60, formula =PMT(0.003333, 60, 30000) will return a monthly payment of approximately -552.50 USD; 6. It is recommended to refer to cells instead of directly entering values for increased flexibility. As long as you understand these key points, you can accurately calculate the monthly loan payment using Excel.

Calculating loan payments in Excel using the PMT function is straightforward once you understand how the function works and what inputs it requires. The PMT function helps you determine the fixed monthly payment for a loan based on constant payments and a constant interest rate.

What You Need Before Using the PMT Function

Before jumping into the formula, gather the following details:

- Loan amount (PV) – The total amount of the loan.

- Interest rate (rate) – The interest rate per period, usually monthly.

- Number of payments (nper) – Total number of payments over the life of the loan.

If you only have an annual interest rate or annual payment schedule, you'll need to convert those to monthly figures since most loans are paid monthly.

For example:

- Annual interest rate: 6% → Monthly rate = 6% / 12 = 0.5%

- Loan term: 5 years → Number of payments = 5 × 12 = 60 months

How to Use the PMT Function in Excel

The syntax for the PMT function is:

=PMT(rate, nper, pv, [fv], [type])

-

rate– Interest rate per period (monthly) -

nper– Total number of payments -

pv– Present value or loan amount -

fv– Future value (optional, usually 0 for loans) -

type– When payments are due (0 = end of period, 1 = beginning of period; optional)

Let's say you have a $20,000 loan at 5% annual interest over 4 years (48 months):

- Convert annual rate to monthly:

5% / 12 = 0.004167 - Enter the formula:

=PMT(0.004167, 48, 20000)

This will give you the monthly payment amount (a negative number, indicating an outflow).

Common Mistakes to Avoid

It's easy to mess up the PMT calculation if you're not careful with your inputs. Here are some common issues:

- Mixing up annual and monthly rates – Always make sure your rate matches the frequency of payments.

- Wrong sign for values – In Excel, cash outflows are negative, so the loan amount should be positive and the result will be negative.

- Incorrect number of periods – If you're making monthly payments over 5 years, use 60 periods, not 5.

Also, remember that the PMT function assumes a fixed interest rate and consistent payments throughout the loan term. It won't work well for variable-rate loans or irregular payments.

Practical Example: Car Loan Calculation

Say you're buying a car and taking a $30,000 loan at 4% annual interest, to be paid back over 5 years (60 months). Here's how to calculate the monthly payment step by step:

- Convert the annual interest rate:

4% / 12 = 0.003333 - Total number of payments:

5 * 12 = 60 - Use the formula:

=PMT(0.003333, 60, 30000)

Excel will return approximately -552.50 , meaning your monthly payment would be $552.50.

You can also reference cells instead of typing values directly. For example, if cell A1 contains the rate, A2 has the number of periods, and A3 holds the loan amount, your formula becomes:

=PMT(A1, A2, A3)

This makes it easier to adjust inputs without rewriting the formula.

Basically that's it. As long as you understand the matching relationship between interest rates and period numbers, and then use the function parameters correctly, you can easily calculate the monthly loan payment using Excel.

The above is the detailed content of how to calculate loan payment in excel using pmt function. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

how to group by month in excel pivot table

Jul 11, 2025 am 01:01 AM

how to group by month in excel pivot table

Jul 11, 2025 am 01:01 AM

Grouping by month in Excel Pivot Table requires you to make sure that the date is formatted correctly, then insert the Pivot Table and add the date field, and finally right-click the group to select "Month" aggregation. If you encounter problems, check whether it is a standard date format and the data range are reasonable, and adjust the number format to correctly display the month.

How to Fix AutoSave in Microsoft 365

Jul 07, 2025 pm 12:31 PM

How to Fix AutoSave in Microsoft 365

Jul 07, 2025 pm 12:31 PM

Quick Links Check the File's AutoSave Status

how to repeat header rows on every page when printing excel

Jul 09, 2025 am 02:24 AM

how to repeat header rows on every page when printing excel

Jul 09, 2025 am 02:24 AM

To set up the repeating headers per page when Excel prints, use the "Top Title Row" feature. Specific steps: 1. Open the Excel file and click the "Page Layout" tab; 2. Click the "Print Title" button; 3. Select "Top Title Line" in the pop-up window and select the line to be repeated (such as line 1); 4. Click "OK" to complete the settings. Notes include: only visible effects when printing preview or actual printing, avoid selecting too many title lines to affect the display of the text, different worksheets need to be set separately, ExcelOnline does not support this function, requires local version, Mac version operation is similar, but the interface is slightly different.

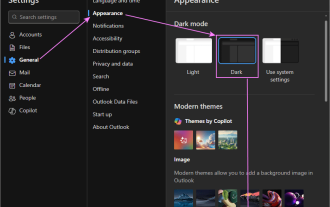

How to change Outlook to dark theme (mode) and turn it off

Jul 12, 2025 am 09:30 AM

How to change Outlook to dark theme (mode) and turn it off

Jul 12, 2025 am 09:30 AM

The tutorial shows how to toggle light and dark mode in different Outlook applications, and how to keep a white reading pane in black theme. If you frequently work with your email late at night, Outlook dark mode can reduce eye strain and

How to Screenshot on Windows PCs: Windows 10 and 11

Jul 23, 2025 am 09:24 AM

How to Screenshot on Windows PCs: Windows 10 and 11

Jul 23, 2025 am 09:24 AM

It's common to want to take a screenshot on a PC. If you're not using a third-party tool, you can do it manually. The most obvious way is to Hit the Prt Sc button/or Print Scrn button (print screen key), which will grab the entire PC screen. You do

Where are Teams meeting recordings saved?

Jul 09, 2025 am 01:53 AM

Where are Teams meeting recordings saved?

Jul 09, 2025 am 01:53 AM

MicrosoftTeamsrecordingsarestoredinthecloud,typicallyinOneDriveorSharePoint.1.Recordingsusuallysavetotheinitiator’sOneDriveina“Recordings”folderunder“Content.”2.Forlargermeetingsorwebinars,filesmaygototheorganizer’sOneDriveoraSharePointsitelinkedtoaT

how to find the second largest value in excel

Jul 08, 2025 am 01:09 AM

how to find the second largest value in excel

Jul 08, 2025 am 01:09 AM

Finding the second largest value in Excel can be implemented by LARGE function. The formula is =LARGE(range,2), where range is the data area; if the maximum value appears repeatedly and all maximum values ??need to be excluded and the second maximum value is found, you can use the array formula =MAX(IF(rangeMAX(range),range)), and the old version of Excel needs to be executed by Ctrl Shift Enter; for users who are not familiar with formulas, you can also manually search by sorting the data in descending order and viewing the second cell, but this method will change the order of the original data. It is recommended to copy the data first and then operate.

how to get data from web in excel

Jul 11, 2025 am 01:02 AM

how to get data from web in excel

Jul 11, 2025 am 01:02 AM

TopulldatafromthewebintoExcelwithoutcoding,usePowerQueryforstructuredHTMLtablesbyenteringtheURLunderData>GetData>FromWebandselectingthedesiredtable;thismethodworksbestforstaticcontent.IfthesiteoffersXMLorJSONfeeds,importthemviaPowerQuerybyenter