Opportunity cost is a fundamental concept in financial planning and investment decision-making, representing the potential benefits lost when one option is chosen over another. This article introduces an Opportunity Cost Calculator in Microsoft Excel, demonstrating how to quantify these trade-offs to make informed financial decisions.

Key Takeaways:

- Opportunity cost is essential in financial planning, guiding the optimal use of limited resources such as time and money.

- Investors benefit from calculating opportunity cost as it aids in strategic planning and highlights the long-term effects of their choices.

- An effective Opportunity Cost Calculator should be simple, flexible, accurate, allow for comparisons, and account for the time value of money.

- Excel's financial functions like FV, PV, NPV, RATE, NPER, and PMT enhance the accuracy and efficiency of opportunity cost analysis.

Table of Contents

Introduction to Opportunity Cost in Financial Planning

Understanding the Concept of Opportunity Cost

Opportunity cost is a vital yet often overlooked aspect of financial planning. It represents the path not taken; for every financial decision, there is a potential benefit that is missed. Recognizing this helps determine if you are maximizing your resources.

Opportunity cost is not just theoretical; it's a practical guide for life. When considering a significant purchase or investment, remember that the value of what you choose to forgo can sometimes exceed the benefit of your chosen path. This is particularly relevant when resources like time and money are scarce.

Why Calculating Opportunity Cost is Essential for Investors

For investors, calculating opportunity cost is not merely helpful—it's crucial for strategic financial planning. With numerous investment options available, understanding the true cost of choosing one over another can significantly affect long-term gains.

Imagine standing at a crossroads with different potential futures ahead. This is the situation investors often face with multiple investment opportunities. Calculating opportunity cost effectively reveals which path might lead to a better financial outcome by showing the potential benefits missed by not choosing the alternative. It's about making comparisons, gaining clarity, and aligning choices with financial goals.

The Fundamentals of an Opportunity Cost Calculator

Key Features of an Effective Opportunity Cost Calculator

An effective Opportunity Cost Calculator must include certain essential features:

- Simplicity and Usability: A user-friendly design ensures easy navigation and use.

- Flexibility: The ability to adapt inputs for various scenarios and financial variables is crucial.

- Accuracy: Reliable algorithms ensure precise calculations, fostering confidence in decision-making.

- Comparative Functionality: The ability to compare different investment outcomes side-by-side is invaluable.

- Incorporation of Time Value of Money: Adjusting for the time value of money provides a more comprehensive financial assessment.

These features are the foundation for financial success, not only revealing the cost of opportunities but also the implications of choices against long-term financial objectives.

Examples of How Opportunity Cost Calculators Work

Examples best illustrate how to use an Opportunity Cost Calculator:

Example Problem:

- Return on the Best Option (RB): $5,000

- Return on the Chosen Option (RC): $3,000

-

Opportunity Cost (OC): ? Using the formula

OC = RB - RC, we find that the opportunity cost is $2,000.

These examples highlight the direct financial impact of choices. An Opportunity Cost Calculator simplifies this calculation, offering investors immediate insights into the value of foregone alternatives.

By applying these examples in real-life situations, one can appreciate the wisdom of quantifying lost benefits and thereby optimize financial decisions.

Crafting Your Financial Blueprint with Excel

Streamlining Financial Analysis Using Excel Functions

Excel functions are invaluable tools that streamline financial analysis, particularly when dealing with complex concepts like opportunity cost. Excel's robust suite enables sophisticated calculations with ease, ensuring accuracy and saving time.

- The FV (Future Value) function predicts the future worth of an investment.

- PV (Present Value) calculates the current value of a future sum of money.

- NPV (Net Present Value) evaluates the value of future cash flows against the initial investment.

- The RATE function determines the implied interest rate in a financial transaction.

- NPER (Number of Periods) calculates the time required to achieve financial goals.

- Use the PMT (Payment) function to determine the periodic payment for an annuity.

These functions not only facilitate time value of money analysis but also pinpoint the most profitable course of action by calculating opportunity costs accurately and efficiently.

Calculate NPV of a Project

Calculating the Net Present Value (NPV) of a project in Excel is a straightforward process using the NPV function. NPV assesses the profitability of a project by discounting all cash flows back to the present value and subtracting the initial investment.

Here’s a basic example to guide you through the process:

Example Scenario:

- Initial Investment: $100,000 (entered as a negative number since it’s an outflow).

- Discount Rate: 10% (the rate at which future cash flows are discounted to their present value).

- Projected Cash Flows over the next 5 years:

- Year 1: $20,000

- Year 2: $25,000

- Year 3: $30,000

- Year 4: $35,000

- Year 5: $40,000

Steps to Calculate NPV in Excel:

STEP 1: Organize your data in Excel, preferably in a single column or row. For this example, assume your initial investment and projected cash flows are listed from cells B2 to B7, with B2 containing the initial investment (as a negative number), and B3:B7 containing the projected cash flows for years 1 through 5.

STEP 2: Click on the cell where you want the NPV result to appear.

STEP 3: Enter the NPV formula: To calculate NPV, use the formula =NPV(rate, value1, [value2], …) initial investment. For our example, with a discount rate of 10%, enter the formula as follows: =NPV(10%, B3:B7) B2.

STEP 4: Press Enter. Excel will calculate and display the NPV of your project in the selected cell.

Case Studies: Real-world Applications of Opportunity Cost Analysis

Success Stories: Enhanced Investment Decisions Through Opportunity Cost

Success stories illustrate the practical benefits of incorporating opportunity cost into investment decisions. Many investors have improved their decision-making and achieved greater financial success by considering the path not taken.

For instance, a tech startup used an Opportunity Cost Calculator to decide between marketing and product development. The calculator showed that marketing would yield a 20% higher return in the short term. This insight led to a reallocation of funds, resulting in increased revenue.

Key Takeaways:

- Opportunity cost analysis can highlight the most profitable areas for investment.

- The clarity provided by such calculations can transform a struggling business into a profitable one.

- Regular use encourages strategic thinking and prevents financial missteps.

By learning from these success stories, you can apply similar principles and strategies to make well-informed decisions that positively impact your financial future.

From Theory to Practice: Tips for Maximizing Your Financial Potential

Avoiding Common Pitfalls in Opportunity Cost Estimation

Navigating the complexities of opportunity cost estimation can be challenging, but awareness of common pitfalls helps avoid them:

- Overlooking Hidden Costs: Include indirect costs like time and effort, not just direct monetary expenses.

- Failing to Update Estimates: As circumstances change, so should your opportunity cost estimations to remain relevant.

- Ignoring Non-Financial Factors: Opportunity costs are not solely about money; consider qualitative aspects like customer satisfaction and brand reputation.

- Short-term Thinking: While immediate gains are tempting, don't undervalue long-term benefits that may outweigh short-term returns.

- Confirmation Bias: Maintain objectivity and avoid letting preconceptions influence the estimation process.

By being thorough and holistic in your approach, you'll minimize the risk of making decisions that could negatively affect your financial health.

Pro Strategies for Aligning Opportunity Cost with Financial Goals

Aligning opportunity cost with financial goals requires a strategic approach that balances immediate decisions with long-term objectives. Here are some professional strategies:

- Clear Goal Setting: Define your financial goals clearly to measure opportunity costs against them effectively.

- Regular Monitoring: Periodically review and adjust your financial plan to ensure it aligns with opportunity cost evaluations.

- Diversification: Spread resources across different investments to mitigate risks associated with opportunity costs.

- Risk Assessment: Understand your risk tolerance and incorporate it into your opportunity cost analysis for balanced decision-making.

- Continual Learning: Stay informed about financial trends and concepts to refine your approach to calculating opportunity costs.

By adopting these strategies, your financial decisions will become more robust, resilient, and reflective of your future aspirations.

Frequently Asked Questions

What is the Opportunity cost calculator?

The Opportunity Cost Calculator is a tool that quantifies the potential benefits you forgo when choosing one investment or action over another. It provides clarity on financial trade-offs, ensuring you make informed decisions aligned with your economic goals.

What is the formula for opportunity cost in Excel?

The formula for opportunity cost in Excel is OC = RB - RC, where OC is Opportunity Cost, RB is the Return on the Best Alternative, and RC is the Return on the Chosen Option. Use cell references to calculate the cost automatically.

How Do I Determine What Costs to Include in Opportunity Cost Calculations?

In opportunity cost calculations, include all relevant monetary and non-monetary factors such as potential income, cost savings, time, and personal satisfaction associated with the next best alternative forgone.

Can Opportunity Cost Calculators Account for Variable Expenses and Risks?

Yes, Opportunity Cost Calculators can be customized to include variable expenses and risks by using dynamic inputs and probability assessments, providing a more comprehensive financial analysis.

How do I interpret NPV?

Interpret NPV (Net Present Value) as the difference between the present value of cash inflows and outflows over time. A positive NPV indicates an investment is expected to generate more value than it costs, and vice versa for a negative NPV.

The above is the detailed content of Free Opportunity Cost Calculator in Excel. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

how to group by month in excel pivot table

Jul 11, 2025 am 01:01 AM

how to group by month in excel pivot table

Jul 11, 2025 am 01:01 AM

Grouping by month in Excel Pivot Table requires you to make sure that the date is formatted correctly, then insert the Pivot Table and add the date field, and finally right-click the group to select "Month" aggregation. If you encounter problems, check whether it is a standard date format and the data range are reasonable, and adjust the number format to correctly display the month.

How to Fix AutoSave in Microsoft 365

Jul 07, 2025 pm 12:31 PM

How to Fix AutoSave in Microsoft 365

Jul 07, 2025 pm 12:31 PM

Quick Links Check the File's AutoSave Status

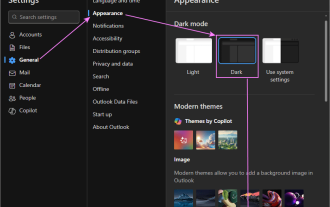

How to change Outlook to dark theme (mode) and turn it off

Jul 12, 2025 am 09:30 AM

How to change Outlook to dark theme (mode) and turn it off

Jul 12, 2025 am 09:30 AM

The tutorial shows how to toggle light and dark mode in different Outlook applications, and how to keep a white reading pane in black theme. If you frequently work with your email late at night, Outlook dark mode can reduce eye strain and

how to repeat header rows on every page when printing excel

Jul 09, 2025 am 02:24 AM

how to repeat header rows on every page when printing excel

Jul 09, 2025 am 02:24 AM

To set up the repeating headers per page when Excel prints, use the "Top Title Row" feature. Specific steps: 1. Open the Excel file and click the "Page Layout" tab; 2. Click the "Print Title" button; 3. Select "Top Title Line" in the pop-up window and select the line to be repeated (such as line 1); 4. Click "OK" to complete the settings. Notes include: only visible effects when printing preview or actual printing, avoid selecting too many title lines to affect the display of the text, different worksheets need to be set separately, ExcelOnline does not support this function, requires local version, Mac version operation is similar, but the interface is slightly different.

How to Screenshot on Windows PCs: Windows 10 and 11

Jul 23, 2025 am 09:24 AM

How to Screenshot on Windows PCs: Windows 10 and 11

Jul 23, 2025 am 09:24 AM

It's common to want to take a screenshot on a PC. If you're not using a third-party tool, you can do it manually. The most obvious way is to Hit the Prt Sc button/or Print Scrn button (print screen key), which will grab the entire PC screen. You do

Where are Teams meeting recordings saved?

Jul 09, 2025 am 01:53 AM

Where are Teams meeting recordings saved?

Jul 09, 2025 am 01:53 AM

MicrosoftTeamsrecordingsarestoredinthecloud,typicallyinOneDriveorSharePoint.1.Recordingsusuallysavetotheinitiator’sOneDriveina“Recordings”folderunder“Content.”2.Forlargermeetingsorwebinars,filesmaygototheorganizer’sOneDriveoraSharePointsitelinkedtoaT

how to find the second largest value in excel

Jul 08, 2025 am 01:09 AM

how to find the second largest value in excel

Jul 08, 2025 am 01:09 AM

Finding the second largest value in Excel can be implemented by LARGE function. The formula is =LARGE(range,2), where range is the data area; if the maximum value appears repeatedly and all maximum values ??need to be excluded and the second maximum value is found, you can use the array formula =MAX(IF(rangeMAX(range),range)), and the old version of Excel needs to be executed by Ctrl Shift Enter; for users who are not familiar with formulas, you can also manually search by sorting the data in descending order and viewing the second cell, but this method will change the order of the original data. It is recommended to copy the data first and then operate.

how to get data from web in excel

Jul 11, 2025 am 01:02 AM

how to get data from web in excel

Jul 11, 2025 am 01:02 AM

TopulldatafromthewebintoExcelwithoutcoding,usePowerQueryforstructuredHTMLtablesbyenteringtheURLunderData>GetData>FromWebandselectingthedesiredtable;thismethodworksbestforstaticcontent.IfthesiteoffersXMLorJSONfeeds,importthemviaPowerQuerybyenter