Quick CD Interest Calculator for Financial Growth in Excel

May 20, 2025 am 03:03 AMWhen it comes to investing in Certificates of Deposit (CDs), understanding how interest accumulates is essential. Excel simplifies the process of calculating CD interest with its built-in formulas and functions. In this guide, I will guide you through various methods to calculate CD interest, whether it's simple interest or compounded interest.

Key Takeaways:

- CDs offer a secure way to increase savings, and Excel makes interest calculations straightforward.

- Knowledge of simple and compound interest formulas is vital for precise CD interest calculations.

- The frequency of compounding greatly influences the total returns over the CD's term.

- Excel's FV function streamlines CD interest calculations with accuracy and ease.

- Using charts in Excel to visualize CD growth aids in financial planning and decision-making.

Table of Contents

Introduction

Unlocking the Potential of CDs for Financial Growth

Understanding Certificates of Deposit (CDs) is a vital step for anyone aiming to enhance their financial well-being. These financial tools offer a safe way to grow savings over a set period.

I've come to value the security and predictability that CDs provide, and many others feel the same, viewing them as a reliable investment during volatile economic times. With some research and strategic choices, CDs can be a valuable addition to one's financial portfolio.

The Excel Advantage in Calculating CD Interest

Manually calculating CD interest can be cumbersome, but using Excel transforms the process. I've personally experienced the benefits of using Excel—unparalleled accuracy and simplicity. It not only reduces the chance of errors that can happen with manual calculations but also offers a high level of customization and automation.

Users can explore different scenarios based on varying interest rates or time periods, significantly improving their financial planning capabilities. Excel's functions and features, from basic formulas to advanced financial functions, provide a versatile tool that can adapt to the unique aspects of each CD investment.

The Basics of Certificates of Deposit (CDs)

Understanding Compound Interest

CDs offer a fixed interest rate over a specified term, typically ranging from a few months to several years. The interest can be calculated using either simple or compound interest formulas.

Simple Interest Formula: A = P * (1 rt)

where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (in decimal form)

- t = Time in years

Compound Interest Formula: A = P * (1 r/n)^nt

where:

- A = Final amount

- P = Principal

- r = Annual interest rate (decimal)

- n = Number of times interest is compounded per year

- t = Time in years

Interest Compounding Frequencies Explained

The frequency at which interest on a CD is compounded is a crucial factor in determining the total return on investment. Compounding can occur at various intervals: annually, semi-annually, quarterly, or monthly, and in some rare instances, even daily. Simply put, the more frequent the compounding, the higher the earnings.

For example, with annual compounding, the interest earned in one year is added to the principal at year-end. In contrast, monthly compounding adds interest monthly, resulting in interest being calculated on a slightly larger principal each month. Although the difference may seem minor in the short term, over the CD term, it can significantly affect the total amount. Understanding these nuances is key for accurate forecasting and maximizing financial growth using Excel.

CD Interest Calculation

Calculating Simple Interest in Excel

To calculate simple interest in Excel, I use a basic formula:

STEP 1: Enter the principal amount in cell A2.

STEP 2: Enter the interest rate (as a decimal) in cell B2.

STEP 3: Enter the time (in years) in cell C2.

STEP 4: In cell D2, use the formula:

=A2(1 B2C2)

STEP 5: Press Enter, and Excel will display the final amount.

Calculating Compound Interest in Excel

To compute compound interest, follow these steps:

STEP 1: Enter the principal amount in cell A2.

STEP 2: Enter the annual interest rate (as a decimal) in cell B2.

STEP 3: Enter the number of times interest is compounded per year in cell C2.

STEP 4: Enter the time in years in cell D2.

STEP 5: In cell E2, use the formula:

=A2(1 B2/C2)^(C2D2)

STEP 6: Press Enter, and Excel will display the final amount after compounding.

Using Excel Functions to Calculate CD Interest

Understanding the Future Value (FV) Function

Exploring Excel's financial functions, the Future Value (FV) function is particularly useful for calculating potential earnings from CDs. It's designed to forecast the value of an investment after a specific number of periods, at a given interest rate, considering deposits and withdrawals, if any.

The syntax for the FV function is FV(rate, nper, pmt, [pv], [type]), where 'rate' is the interest rate per period, 'nper' is the total number of periods, 'pmt' is the payment made each period, 'pv' is the present value, and 'type' indicates when payments are due.

When using this function for CDs, I focus on adjusting the rate to reflect the compounding frequency and setting the term's length for 'nper'. Payments ('pmt') are typically zero since no additional investments are made into the CD. The initial deposit is entered as a negative number in 'pv' to indicate it's an outflow from my perspective. With these inputs in place, Excel performs the calculations, minimizing errors compared to manual computations.

Example: If I invest $5,000 in a CD at a 4% annual interest rate, compounded quarterly for 3 years, I would use:

=FV(4%/4, 4*3, 0, -5000, 0)

Excel will return the final amount after 3 years.

Creating a CD Interest Calculator in Excel

To simplify the process even further, I like to create a basic CD interest calculator:

STEP 1: Label the following cells:

- A2: Principal

- A3: Annual Interest Rate

- A4: Compounding Periods per Year

- A5: Number of Years

- A6: Final Amount

STEP 2: Enter input values in B2 to B5.

STEP 3: In B6, enter the FV formula:

=FV(B3/B4, B4*B5, 0, -B2, 0)

STEP 4: Press Enter, and Excel will instantly compute the final amount.

Visualizing Your Growth with Excel Charts

Incorporating Charts for Easier Interpretation of Data

Visual representations in Excel make complex data more digestible. After entering the numbers, I add charts to show the growth of CD investments at a glance. For instance, I might use a line chart to illustrate the growth of a CD over time, highlighting how incremental deposits and compound interest accumulate.

The clarity provided by a well-designed chart is invaluable. It enables me to quickly identify trends, compare different investment strategies, and grasp the broader financial picture without getting lost in the numbers.

With Excel's versatile charting tools, I select the type that best suits the narrative I'm trying to convey with my data, whether it's a pie, bar, line, or even a scatter plot.

FAQs on CD Interest Calculation in Excel

How do you calculate CD interest in Excel?

To calculate CD interest in Excel, use the Future Value (FV) function: =FV(rate, nper, pmt, pv, type). Substitute 'rate' with the interest rate per period, 'nper' with the number of periods, 'pmt' with the periodic payment (usually 0 for CDs), 'pv' with the present value (principal), and 'type' with 0 if at the end of the period, or 1 if at the beginning. Ensure the rate aligns with the compounding frequency for an accurate calculation.

How does compounding frequency affect CD interest?

The more frequent the compounding, the higher the total earnings. This is because each compounding period adds interest to the principal, which then earns more interest in subsequent periods. Monthly or quarterly compounding typically yields higher returns than annual compounding.

How Do I Account for Taxes in My CD Interest Calculations?

To account for taxes in CD interest calculations in Excel, first determine your marginal tax rate. Then, adjust the interest earned by that rate: After-Tax Interest = Interest - (Interest × Tax Rate). Add a row to your spreadsheet for the tax rate and subtract the tax from the gross interest to find the net, after-tax interest. This provides a more realistic view of what you'll actually earn from your CD investment.

Can I Track Multiple CDs at Once Using Excel?

Yes, you can track multiple CDs at once in Excel by setting up a portfolio sheet. List each CD with its identifier, principal, interest rate, compounding periods, and time to maturity in separate rows. Calculate future value for each using the FV function. To manage your CD portfolio, you can sort, filter, and apply Excel's SUM function to assess total value or maturing CDs, aiding in strategic planning and reinvestment decisions.

Can I visualize CD interest growth in Excel?

Yes, Excel charts can illustrate how your CD balance grows over time. Line charts and bar graphs help track compounding effects, making it easier to compare different CD options and investment strategies.

The above is the detailed content of Quick CD Interest Calculator for Financial Growth in Excel. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

how to group by month in excel pivot table

Jul 11, 2025 am 01:01 AM

how to group by month in excel pivot table

Jul 11, 2025 am 01:01 AM

Grouping by month in Excel Pivot Table requires you to make sure that the date is formatted correctly, then insert the Pivot Table and add the date field, and finally right-click the group to select "Month" aggregation. If you encounter problems, check whether it is a standard date format and the data range are reasonable, and adjust the number format to correctly display the month.

How to Fix AutoSave in Microsoft 365

Jul 07, 2025 pm 12:31 PM

How to Fix AutoSave in Microsoft 365

Jul 07, 2025 pm 12:31 PM

Quick Links Check the File's AutoSave Status

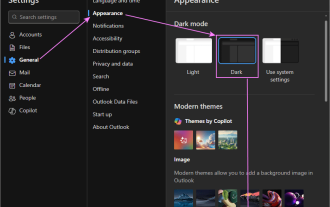

How to change Outlook to dark theme (mode) and turn it off

Jul 12, 2025 am 09:30 AM

How to change Outlook to dark theme (mode) and turn it off

Jul 12, 2025 am 09:30 AM

The tutorial shows how to toggle light and dark mode in different Outlook applications, and how to keep a white reading pane in black theme. If you frequently work with your email late at night, Outlook dark mode can reduce eye strain and

how to repeat header rows on every page when printing excel

Jul 09, 2025 am 02:24 AM

how to repeat header rows on every page when printing excel

Jul 09, 2025 am 02:24 AM

To set up the repeating headers per page when Excel prints, use the "Top Title Row" feature. Specific steps: 1. Open the Excel file and click the "Page Layout" tab; 2. Click the "Print Title" button; 3. Select "Top Title Line" in the pop-up window and select the line to be repeated (such as line 1); 4. Click "OK" to complete the settings. Notes include: only visible effects when printing preview or actual printing, avoid selecting too many title lines to affect the display of the text, different worksheets need to be set separately, ExcelOnline does not support this function, requires local version, Mac version operation is similar, but the interface is slightly different.

How to Screenshot on Windows PCs: Windows 10 and 11

Jul 23, 2025 am 09:24 AM

How to Screenshot on Windows PCs: Windows 10 and 11

Jul 23, 2025 am 09:24 AM

It's common to want to take a screenshot on a PC. If you're not using a third-party tool, you can do it manually. The most obvious way is to Hit the Prt Sc button/or Print Scrn button (print screen key), which will grab the entire PC screen. You do

Where are Teams meeting recordings saved?

Jul 09, 2025 am 01:53 AM

Where are Teams meeting recordings saved?

Jul 09, 2025 am 01:53 AM

MicrosoftTeamsrecordingsarestoredinthecloud,typicallyinOneDriveorSharePoint.1.Recordingsusuallysavetotheinitiator’sOneDriveina“Recordings”folderunder“Content.”2.Forlargermeetingsorwebinars,filesmaygototheorganizer’sOneDriveoraSharePointsitelinkedtoaT

how to find the second largest value in excel

Jul 08, 2025 am 01:09 AM

how to find the second largest value in excel

Jul 08, 2025 am 01:09 AM

Finding the second largest value in Excel can be implemented by LARGE function. The formula is =LARGE(range,2), where range is the data area; if the maximum value appears repeatedly and all maximum values ??need to be excluded and the second maximum value is found, you can use the array formula =MAX(IF(rangeMAX(range),range)), and the old version of Excel needs to be executed by Ctrl Shift Enter; for users who are not familiar with formulas, you can also manually search by sorting the data in descending order and viewing the second cell, but this method will change the order of the original data. It is recommended to copy the data first and then operate.

how to get data from web in excel

Jul 11, 2025 am 01:02 AM

how to get data from web in excel

Jul 11, 2025 am 01:02 AM

TopulldatafromthewebintoExcelwithoutcoding,usePowerQueryforstructuredHTMLtablesbyenteringtheURLunderData>GetData>FromWebandselectingthedesiredtable;thismethodworksbestforstaticcontent.IfthesiteoffersXMLorJSONfeeds,importthemviaPowerQuerybyenter