web3.0

web3.0

Coin Metrics In-depth Analysis: Key Factors Drive the Crypto Market to Soar to $4 trillion

Coin Metrics In-depth Analysis: Key Factors Drive the Crypto Market to Soar to $4 trillion

Coin Metrics In-depth Analysis: Key Factors Drive the Crypto Market to Soar to $4 trillion

Jul 30, 2025 pm 08:24 PMTable of contents

- Key points:

- introduction

- Bitcoin has achieved a market value of over US$1 trillion, and its market activity continues to expand

- Accelerating demand: a dual driving force from ETFs and corporate vaults

- On-chain positions: divided by address balance

- The GENIUS Act opens up a new era of stablecoins

- Summarize

Key points:

- Bitcoin’s achieved market value exceeds $1 trillion, reflecting the deepening of capital commitments and confidence of long-term holders, and the total market value of the entire crypto market is approaching $4 trillion.

- Demand for Bitcoin (BTC) and Ethereum (ETH) has exceeded the issuance of SGD, driven mainly by the ongoing inflow of spot ETF funds and the continuous increase in corporate vaults.

- The market-leading pattern began to spread, Ethereum showed relatively strong strength, and altcoins such as SOL and XRP also attracted more funds to participate due to the increase in spot trading volume.

- The GENIUS Act establishes the first federal regulatory framework for fiat currency stablecoins in the United States, bringing compliance clarity and bringing greater participation and competitive environment to the stablecoin market worth more than $250 billion.

introduction

The crypto asset market approached the $4 trillion mark for the first time, an important milestone in the industry's development history. This round of rise comes from the superposition of a variety of structural and cyclical forces: from the continuous inflow of funds from spot Bitcoin and Ethereum ETFs, to the accelerated increase in holdings of crypto asset vault companies, and then to key regulatory breakthroughs such as the GENIUS Act. It can be said that the "happy" factors driving the crypto market are increasing.

This article will dismantle the key market forces and on-chain capital flows that drive this round of expansion.

Bitcoin has achieved a market value of over US$1 trillion, and its market activity continues to expand

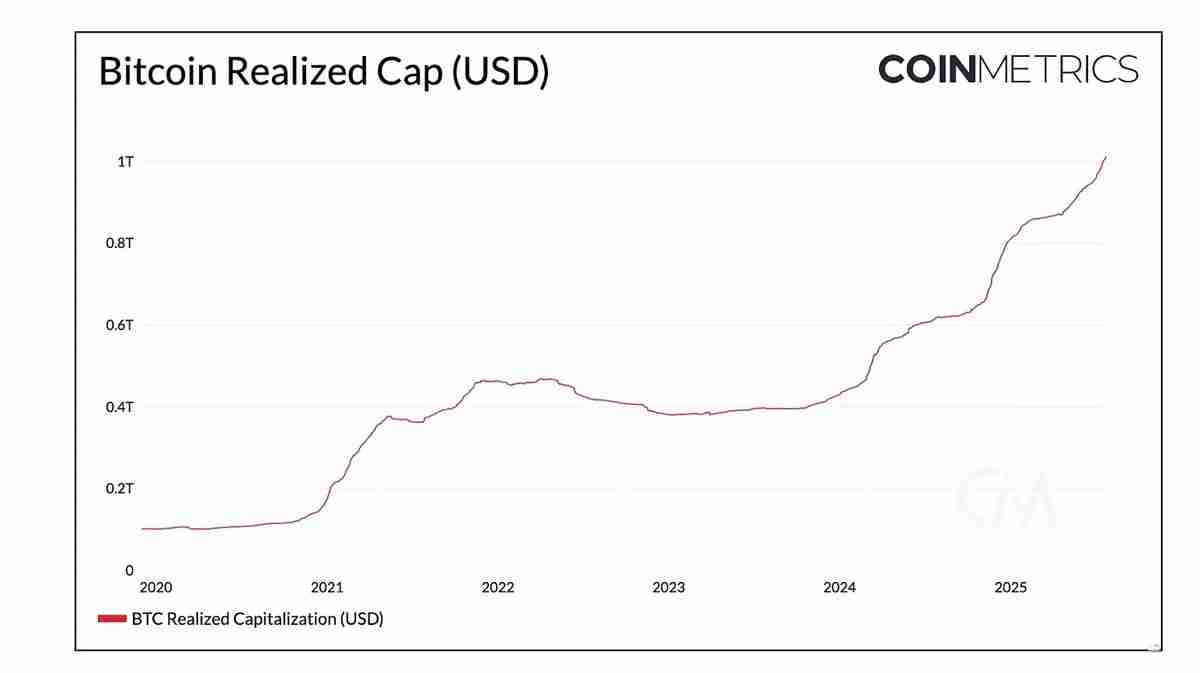

Bitcoin (BTC) hit a new high at $123,000, with a total market cap climbing to $2.38 trillion, and its realized market cap (i.e., the total value of each Bitcoin at the price at the last on-chain transfer) also exceeded $1 trillion for the first time. This data shows that even at high levels, a large amount of capital continues to enter the market, highlighting the increased market confidence in Bitcoin’s long-term role as a global asset, especially in the context of the continued growth of ETF funds and institutional interest.

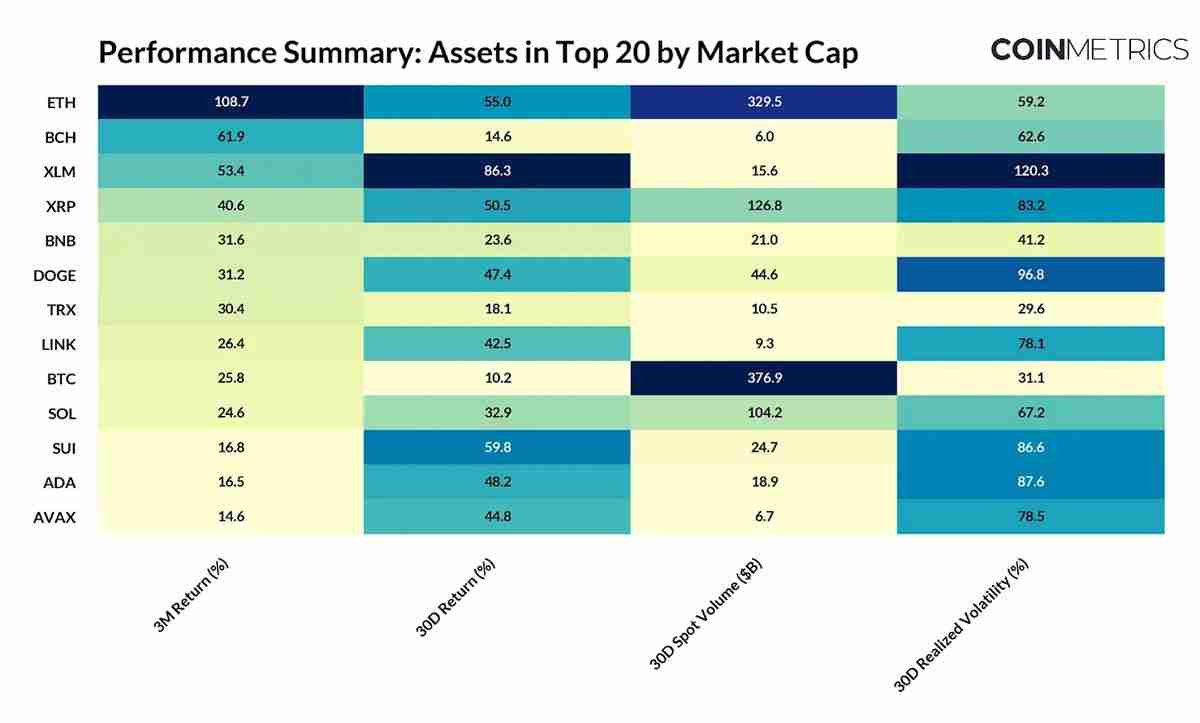

Market activities also show early signs of "leading the rise and spreading". Ethereum (ETH) has begun to show relatively strongness, with ETH/BTC rising 73% since May, with ETH breaking $3,900. This momentum is supported by multiple factors such as record inflows of ETF funds, accelerated adoption of corporate vaults, and the positive effects of the Ethereum ecosystem (especially stablecoins) after the passage of the GENIUS Act.

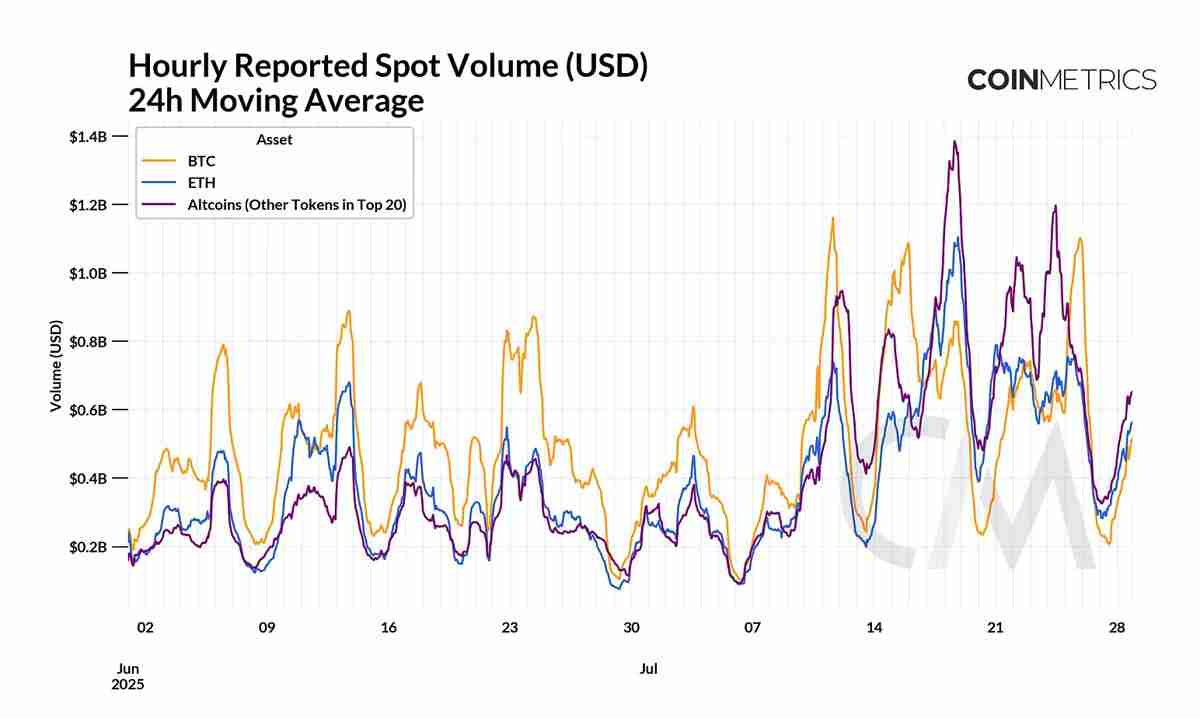

This "diffusion" trend is also reflected in spot trading data: not only BTC trading volume remains strong, but ETH and large altcoins such as SOL and XRP have also increased significantly in the past few weeks. Meanwhile, Bitcoin’s market dominance has dropped to 59%, while the total altcoin market capitalization is approaching $1.6 trillion. Although there are initial signs of "leading the rise and spreading", it remains to be seen whether this trend will continue.

The following table summarizes the market statistics for tokens with market caps, excluding stablecoins and other on-chain derivatives:

Accelerating demand: a dual driving force from ETFs and corporate vaults

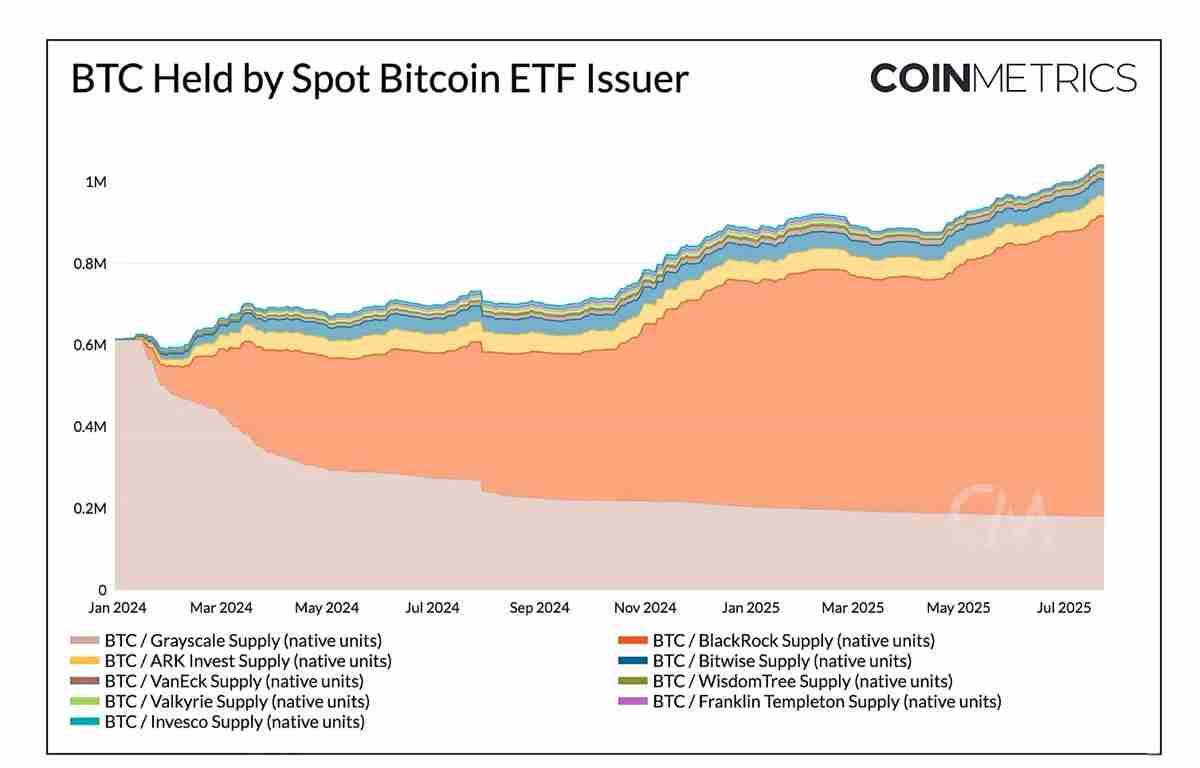

One of the important forces driving demand growth of Bitcoin (BTC) and Ethereum (ETH) are spot trading funds (ETFs). After a brief slowdown in March and April, inflows of Bitcoin ETFs accelerated again in May, bringing the total holdings of U.S. spot Bitcoin ETFs to exceed 1.27 million BTC (about 6.4% of the total supply). Among them, iShares Bitcoin Trust (IBIT), a subsidiary of BlackRock, is still the largest holder, currently holding approximately 735,000 BTC (worth approximately US$87 billion).

Ethereum (ETH) is also experiencing a similar surge in demand. Over the past few weeks, spot Ethereum ETFs have seen continuous net inflows, even surpassing Bitcoin inflows in some periods. The total holdings of ETH ETFs have reached 5.8 million ETH, accounting for about 4.8% of the total ETH supply, with most of the growth concentrated in recent months – although these ETFs were launched more than a year ago.

The demand for ETH is also supported by more and more corporate vaults focusing on Ethereum, making ETH accumulate faster than new issuances. Unlike corporate vaults that passively hold BTC, ETH vaults earn native income through staking and DeFi, this model is currently extended to other large token ecosystems such as Solana (SOL), Tron (TRX) and Ethena (ENA).

On-chain positions: divided by address balance

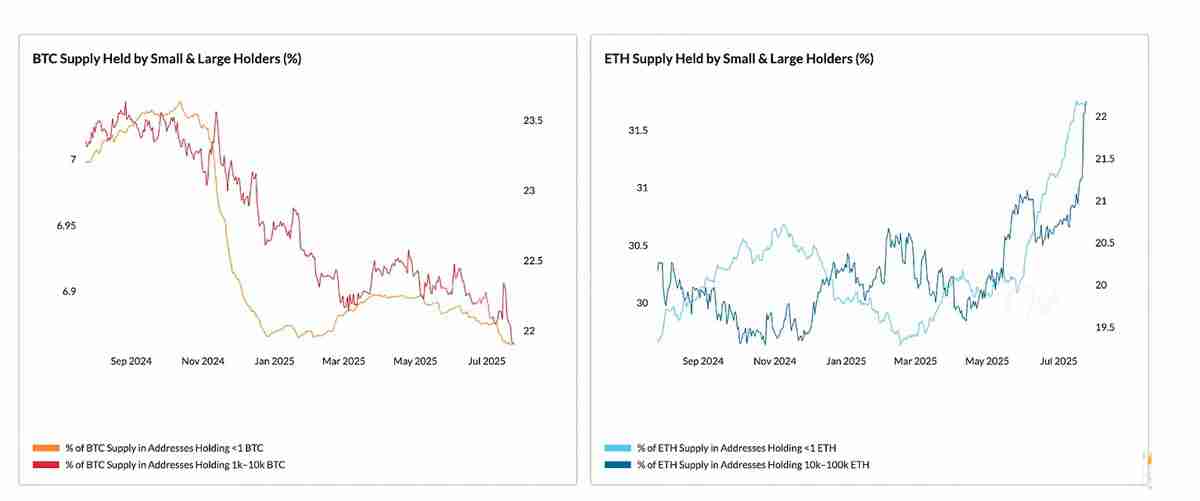

As shown in the above chart, supply held by small holders (

The GENIUS Act opens up a new era of stablecoins

The GENIUS Act was officially signed into law on July 18, establishing the first federal regulatory framework for anchoring fiat currency stablecoins in the United States. The bill creates a level playing field for stablecoin issuers, requiring:

- Full reserve support

- Reserve assets must be low-risk, short-term U.S. Treasury bonds or cash

- Conduct regular audits

- The issuer must obtain a license

This is similar to the impact of the approval of the spot Bitcoin ETF, bringing regulatory clarity and legitimacy to the US dollar-denominated stablecoin market.

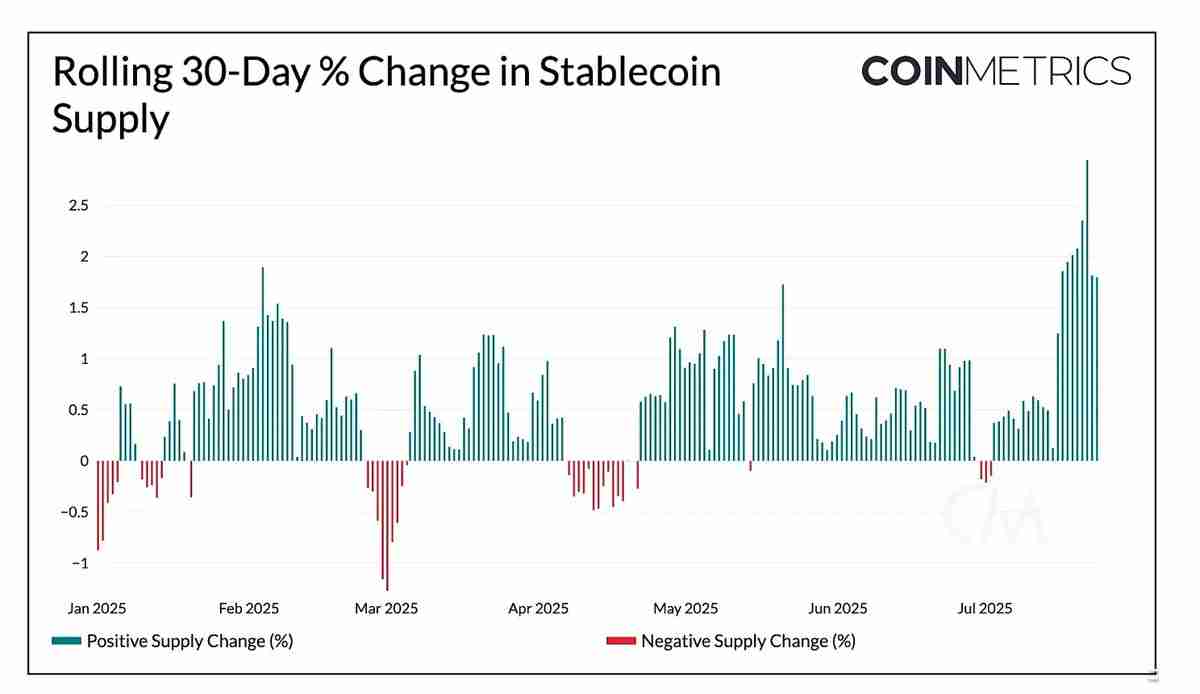

Recently, the growth of stablecoin supply has accelerated significantly, and it can be seen from the 30-day rolling supply changes. The total supply has now exceeded US$255 billion.

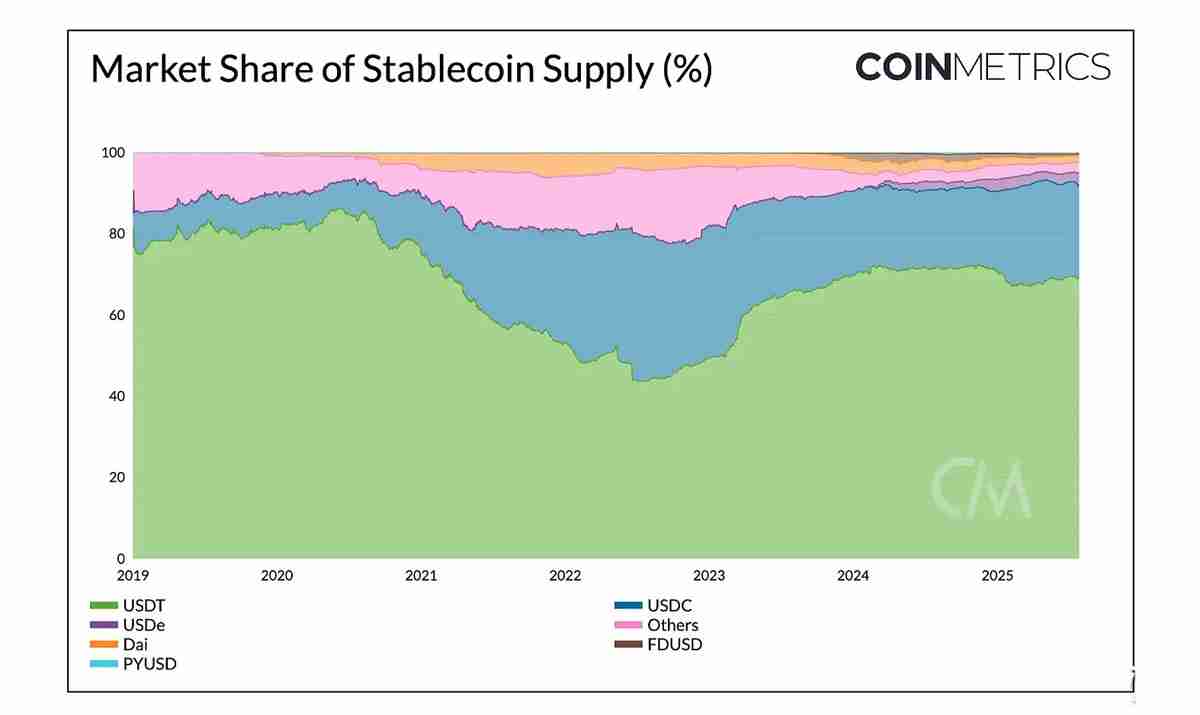

This regulatory framework is expected to enhance public trust in fiat stablecoins, lower the threshold for new entrants, and bring more full competition to the payment market. From existing issuers such as Tether and Circle to potential new players such as regulated banks and fintech companies, the competition is expected to drive transaction costs down, enhancing the payment experience for consumers and businesses, while also further strengthening global demand for the US dollar.

Among existing stablecoin issuers, Circle and Paxos appear to be most qualified to meet the requirements of the GENIUS Act, as USDC and PayPal USD (PYUSD) have long adopted full reserve support and regularly provided audit reports. Circle is actively applying for a federal trust banking license from the U.S. Office of the Comptroller of the Currency (OCC) to achieve full compliance with the GENIUS Act and to provide custody services to institutional clients. Other major issuers are also undergoing structural adjustments to meet the requirements of the new law.

For example, Anchorage Digital, a crypto bank that has obtained a federal license, has partnered with Ethena Labs to launch USDtb through its stablecoin issuance platform. Thanks to Anchorage's federal regulation and reserve management, this makes Ethena's USDtb one of the first stablecoins to fully comply with the GENIUS Act. This issuance model provides a one-stop compliance solution for projects that want to continue operating in the U.S. market.

In contrast, Tether (USDT), which accounts for about 68% of the stablecoin market, faces a more complex adjustment path. USDT has long operated outside the U.S. regulatory system, and its reserve assets include assets that do not meet GENIUS standards, such as Bitcoin and precious metals. In response, Tether plans to launch a compliant stablecoin for institutional payments and interbank settlements, which will comply with all requirements of the GENIUS Act. The existing USDT of $162 billion will continue to operate overseas, mainly serving emerging markets.

Stablecoin issuers have three years to complete compliance requirements of the GENIUS Act. After this, only stablecoins that meet GENIUS standards can be supported by exchanges and custodians, which provides an adequate period of adjustment for all parties.

Summarize

The recent crypto market's total market value sprint of $4 trillion reflects the growing market confidence in the entire asset class. Demand from ETFs and corporate vaults continues to exceed the new supply, further improving the supply and demand structure of BTC and ETH. Valuation indicators such as Bitcoin’s market value to realized value ratio (MVRV) show that the market has not overheated yet.

Although the market is still dominated by strong ETF inflows and long-term holders, market leadership is showing a gradual spread.

In addition, the passage of the GENIUS Act marks a key turning point in US crypto regulation: it not only brings a clear regulatory framework for stablecoins, but also paves the way for the deep integration of the competitive landscape and traditional finance. Although there may still be fluctuations in the short term, the combination of solid structural demand, clear regulatory prospects and expanded participants' scope indicates that the market will continue to strengthen in the future.

The above is the detailed content of Coin Metrics In-depth Analysis: Key Factors Drive the Crypto Market to Soar to $4 trillion. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Ethena treasury strategy: the rise of the third empire of stablecoin

Jul 30, 2025 pm 08:12 PM

Ethena treasury strategy: the rise of the third empire of stablecoin

Jul 30, 2025 pm 08:12 PM

The real use of battle royale in the dual currency system has not yet happened. Conclusion In August 2023, the MakerDAO ecological lending protocol Spark gave an annualized return of $DAI8%. Then Sun Chi entered in batches, investing a total of 230,000 $stETH, accounting for more than 15% of Spark's deposits, forcing MakerDAO to make an emergency proposal to lower the interest rate to 5%. MakerDAO's original intention was to "subsidize" the usage rate of $DAI, almost becoming Justin Sun's Solo Yield. July 2025, Ethe

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

Domestic purchase of Bitcoin must be carried out through compliance channels, such as Hong Kong licensed exchanges or international compliance platforms; 2. Complete real-name authentication after registration, submit ID documents and address proof and perform facial recognition; 3. Prepare legal currency and recharge it to the trading account through bank transfer or electronic payment; 4. Log in to the platform to select Bitcoin trading pairs, set limit orders or market orders to complete the transaction; 5. Pay attention to market fluctuations and platform security, enable dual certification and comply with domestic regulatory policies; overall, investors should operate cautiously under the premise of compliance and participate in Bitcoin investment rationally.

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

The total amount of Bitcoin is 21 million, which is an unchangeable rule determined by algorithm design. 1. Through the proof of work mechanism and the issuance rule of half of every 210,000 blocks, the issuance of new coins decreased exponentially, and the additional issuance was finally stopped around 2140. 2. The total amount of 21 million is derived from summing the equal-scale sequence. The initial reward is 50 bitcoins. After each halving, the sum of the sum converges to 21 million. It is solidified by the code and cannot be tampered with. 3. Since its birth in 2009, all four halving events have significantly driven prices, verified the effectiveness of the scarcity mechanism and formed a global consensus. 4. Fixed total gives Bitcoin anti-inflation and digital yellow metallicity, with its market value exceeding US$2.1 trillion in 2025, becoming the fifth largest capital in the world

Bitcoin market stages a 'long-short war' and investors are in high mood

Jul 30, 2025 pm 08:00 PM

Bitcoin market stages a 'long-short war' and investors are in high mood

Jul 30, 2025 pm 08:00 PM

The Bitcoin market has staged a long-short war, and investors' sentiment is high; 1. The bulls believe that the Fed's interest rate hike cycle is coming to an end, and the inflow of Bitcoin spot ETF funds and the halving event will drive the price up; 2. The short side is worried that high interest rates continue, regulatory risks are intensified and profit-taking sell-offs trigger a pullback; 3. The open contracts and volatility in the derivatives market rise to high levels, indicating that funds are accelerating entry game; 4. The fear and greed index enters the "extreme greed" range, retail investors chase the rise and hedging coexist, and emotions are polarized; 5. The historical trend before the halving shows that the upward possibility is possible, but they face liquidity tightening and black swan event risks in the short term; 6. Investors should pay attention to macro indicators and on-chain data, balance long-term holdings and short-term risk control, and avoid emotional trading. The current long-short duel may

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

Jul 30, 2025 pm 09:33 PM

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

Jul 30, 2025 pm 09:33 PM

What are directory Maker and pending orders? How to calculate MakerFee? MakerFee calculation formula. Is it necessary to use limit orders? Taker and eat orders? How to calculate TakerFee How to determine whether you are Maker or Taker lazy package – Maker/taker fee spot maker/taker fee lazy package contract maker/taker fee lazy package How to reduce Maker/taker transaction fees for various virtual currency exchanges

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

The comparison between the opening price and the closing price can effectively judge the trend direction of the digital currency. 1. The opening price reflects the initial strength of long and short, which is significantly higher than the previous closing price and the increase in volume is a short-term bullish signal; 2. The closing price verifies the trend, breaking through the resistance level or continuously standing firm in the moving average is a sign of medium-term strength; 3. In combination of the combination analysis, the long positive line indicates a strong rise, the long negative line shows downward pressure, and the cross star indicates a possible reversal or stabilize; 4. Combining the moving average and the Bollinger band can enhance judgment. If the 5-day moving average is stable and the high opening is a long signal, the Bollinger band closes positive or oversold rebound; 5. It needs to be supplemented by capital flow and market sentiment. The high volume increase in the opening indicates that the main force enters the market. The high opening and high closing or low opening and low closing caused by major news will strengthen the trend. Investors should integrate K-line patterns, technical indicators and market trends

What is Binance Treehouse (TREE Coin)? Overview of the upcoming Treehouse project, analysis of token economy and future development

Jul 30, 2025 pm 10:03 PM

What is Binance Treehouse (TREE Coin)? Overview of the upcoming Treehouse project, analysis of token economy and future development

Jul 30, 2025 pm 10:03 PM

What is Treehouse(TREE)? How does Treehouse (TREE) work? Treehouse Products tETHDOR - Decentralized Quotation Rate GoNuts Points System Treehouse Highlights TREE Tokens and Token Economics Overview of the Third Quarter of 2025 Roadmap Development Team, Investors and Partners Treehouse Founding Team Investment Fund Partner Summary As DeFi continues to expand, the demand for fixed income products is growing, and its role is similar to the role of bonds in traditional financial markets. However, building on blockchain

Cryptocurrency funds attract $1.9 billion in a single week, and Ethereum (ETH) leads the rise and becomes the main force of capital

Jul 30, 2025 pm 08:09 PM

Cryptocurrency funds attract $1.9 billion in a single week, and Ethereum (ETH) leads the rise and becomes the main force of capital

Jul 30, 2025 pm 08:09 PM

?Cryptocurrency investment products have recorded net inflows for the 15th consecutive week, despite slight outflows from Bitcoin-related funds last week. Last week, the overall performance of crypto asset investment products rebounded, continuing the net inflow of funds for up to 15 weeks, despite a brief net outflow of Bitcoin funds. Global cryptocurrency exchange-traded products (ETPs) attracted as much as $1.9 billion inflows in the seven days ending Friday, according to the latest report released by European-based digital asset management company CoinShares on Monday, July 28. Despite the significant fluctuations in the market, Bitcoin (BTC) fell to $115,000 on the weekend, while Ethereum (ETH) briefly fell below 360 on Thursday, July 24.