web3.0

web3.0

Cryptocurrency funds attract $1.9 billion in a single week, and Ethereum (ETH) leads the rise and becomes the main force of capital

Cryptocurrency funds attract $1.9 billion in a single week, and Ethereum (ETH) leads the rise and becomes the main force of capital

Cryptocurrency funds attract $1.9 billion in a single week, and Ethereum (ETH) leads the rise and becomes the main force of capital

Jul 30, 2025 pm 08:09 PM?

Cryptocurrency investment products have recorded net inflows for the 15th consecutive week, despite slight outflows from Bitcoin-related funds last week.

Last week, the overall performance of crypto asset investment products rebounded, continuing the net inflow of funds for up to 15 weeks, despite a brief net outflow of Bitcoin funds.

Global cryptocurrency exchange-traded products (ETPs) attracted as much as $1.9 billion inflows in the seven days ending Friday, according to the latest report released by European-based digital asset management company CoinShares on Monday, July 28.

Despite the significant volatility of the market - Bitcoin (BTC) fell to $115,000 on the weekend, while Ethereum (ETH) briefly fell below $3,600 on Thursday, July 24 - funds continued to pour into crypto ETP.

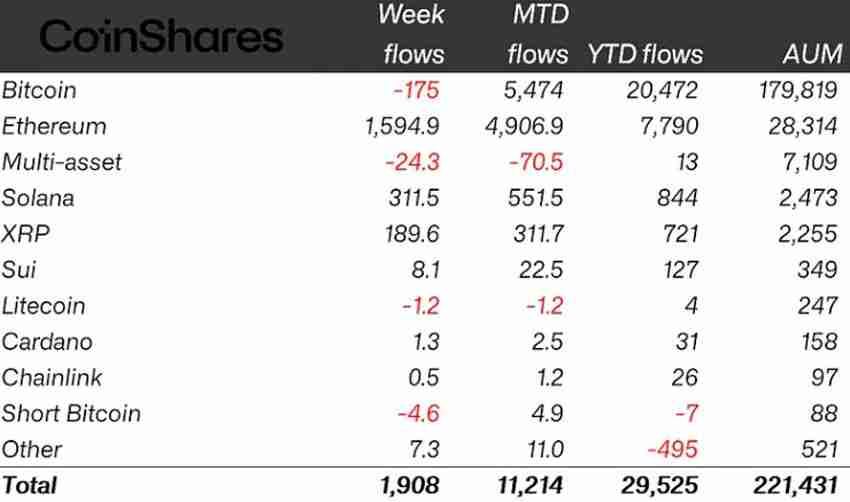

This inflow pushes the total inflow of funds from 2025 to date (YTD) to US$29.5 billion, setting a new record. At the same time, the total assets managed by the industry (AUM) exceeded US$221.4 billion for the first time. The inflows so far this month alone reached $11.2 billion, far exceeding the previous high of $7.6 billion set after the US election in December 2024.

Ethereum ETP achieves the second highest inflow in history

Last week's funding growth was driven mainly by Ethereum-related products, with its ETP recording a net inflow of $1.59 billion. James Butterfill, head of research at CoinShares, noted that this is the second highest single-week inflow record in Ethereum ETP history.

Following closely behind are Solana (SOL) and Ripple (XRP), whose ETP attracts $311.5 million and $189.6 million inflows, respectively.

By contrast, Bitcoin ETP recorded a net outflow of $175 million, ending the net inflow of funds for 12 consecutive trading days, which ended on July 21.

The flow of each crypto ETP fund in the week ended July 25 (unit: million US dollars). Source: CoinShares

Butterfill said that the differentiation in capital flows between Bitcoin and mainstream altcoins reflects the rising market expectations that specific altcoins may launch US ETFs, rather than entering the "altcoin season" in full.

“These inflows are more likely to be due to bets approved for potential U.S. ETFs than the broad enthusiasm of the overall market for altcoins,” Butterfill explained.

He also pointed out that some altcoin ETP had a small outflow of funds, including $1.2 million and $700,000, respectively.

The above is the detailed content of Cryptocurrency funds attract $1.9 billion in a single week, and Ethereum (ETH) leads the rise and becomes the main force of capital. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the websites for real-time price query of Bitcoin? Recommended websites that can view Bitcoin K-line and depth chart

Jul 31, 2025 pm 10:54 PM

What are the websites for real-time price query of Bitcoin? Recommended websites that can view Bitcoin K-line and depth chart

Jul 31, 2025 pm 10:54 PM

In the digital currency market, real-time mastering of Bitcoin prices and transaction in-depth information is a must-have skill for every investor. Viewing accurate K-line charts and depth charts can help judge the power of buying and selling, capture market changes, and improve the scientific nature of investment decisions.

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

1. Ordinary users can purchase Ethereum through mainstream digital asset trading platforms such as Binance, Ouyi OK, HTX Huobi, etc. The process includes registering an account, identity authentication, binding payment methods and trading through market or limit orders. The assets can be stored on the platform or transferred to personal money sacrificial pie; 2. Ethereum has no fixed issuance limit, with about 72 million initial issuance, and it is continuously issued through the PoS mechanism and the destruction mechanism is introduced due to EIP-1559, which may achieve deflation; 3. Before investing, you need to understand the risk of high volatility, enable two-factor verification to ensure account security, and learn asset custody methods such as hardware or software money sacrificial pie; 4. Ethereum is the core platform of decentralized applications, DeFi protocols and NFT ecosystem, supporting the operation of smart contracts and promoting digital asset rights confirmation and flow

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

Ethereum is a decentralized application platform based on smart contracts, and its native token ETH can be obtained in a variety of ways. 1. Register an account through centralized platforms such as Binance and Ouyiok, complete KYC certification and purchase ETH with stablecoins; 2. Connect to digital storage through decentralized platforms, and directly exchange ETH with stablecoins or other tokens; 3. Participate in network pledge, and you can choose independent pledge (requires 32 ETH), liquid pledge services or one-click pledge on the centralized platform to obtain rewards; 4. Earn ETH by providing services to Web3 projects, completing tasks or obtaining airdrops. It is recommended that beginners start from mainstream centralized platforms, gradually transition to decentralized methods, and always attach importance to asset security and independent research, to

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

First, choose a reputable trading platform such as Binance, Ouyi, Huobi or Damen Exchange; 1. Register an account and set a strong password; 2. Complete identity verification (KYC) and submit real documents; 3. Select the appropriate merchant to purchase USDT and complete payment through C2C transactions; 4. Enable two-factor identity verification, set a capital password and regularly check account activities to ensure security. The entire process needs to be operated on the official platform to prevent phishing, and finally complete the purchase and security management of USDT.

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

1. First, ensure that the device network is stable and has sufficient storage space; 2. Download it through the official download address [adid]fbd7939d674997cdb4692d34de8633c4[/adid]; 3. Complete the installation according to the device prompts, and the official channel is safe and reliable; 4. After the installation is completed, you can experience professional trading services comparable to HTX and Ouyi platforms; the new version 5.0.5 feature highlights include: 1. Optimize the user interface, and the operation is more intuitive and convenient; 2. Improve transaction performance and reduce delays and slippages; 3. Enhance security protection and adopt advanced encryption technology; 4. Add a variety of new technical analysis chart tools; pay attention to: 1. Properly keep the account password to avoid logging in on public devices; 2.

The latest price of Bitcoin price Bitcoin price query app

Aug 01, 2025 pm 06:00 PM

The latest price of Bitcoin price Bitcoin price query app

Aug 01, 2025 pm 06:00 PM

The top Bitcoin price query apps include: 1. Binance provides real-time market trends, deep trading and powerful K-line tools, and is the first choice platform for integration of trading and investment research; 2. OkX supports multi-market data and professional chart analysis, and the interface is flexible to adapt to all kinds of users; 3. Huobi is known for its stability and security, and the market page is simple and efficient, suitable for quickly viewing core price information; 4. Gate.io, rich currency, suitable for tracking Bitcoin and many niche tokens at the same time; 5. TradingView, the world's leading chart analysis platform, aggregates data from multiple exchanges, and has extremely powerful technical analysis functions; 6. CoinMarketCap, an authoritative data aggregation platform, provides weighted average

With the price of Ethereum exceeding $3,800, can the DeFi and NFT markets hit new highs?

Aug 01, 2025 pm 06:24 PM

With the price of Ethereum exceeding $3,800, can the DeFi and NFT markets hit new highs?

Aug 01, 2025 pm 06:24 PM

Ethereum price exceeded US$3,800, and the DeFi and NFT markets are expected to hit new highs. 1. Spot ETFs are expected to bring in institutional capital inflows and enhance market confidence; 2. Cancun upgrade significantly reduces Layer 2 transaction costs and enhances network scalability; 3. The recovery of macro sentiment promotes the overall crypto market activity. In this context, the DeFi market will benefit from new narrative developments such as TVL improvement, increased user participation and re-pled; the NFT market has ushered in a recovery due to the enhanced wealth effect, decreased transaction costs and transformation to practical value. Both have the basis to hit new highs, but this growth will be driven more by technological progress and application implementation rather than simply speculation, marking the Ethereum ecosystem towards a healthier and sustainable development stage.

Ouyi app download and trading website Ouyi exchange app official version v6.129.0 download website

Aug 01, 2025 pm 11:27 PM

Ouyi app download and trading website Ouyi exchange app official version v6.129.0 download website

Aug 01, 2025 pm 11:27 PM

Ouyi APP is a professional digital asset service platform dedicated to providing global users with a safe, stable and efficient trading experience. This article will introduce in detail the download method and core functions of its official version v6.129.0 to help users get started quickly. This version has been fully upgraded in terms of user experience, transaction performance and security, aiming to meet the diverse needs of users at different levels, allowing users to easily manage and trade their digital assets.