Ethena treasury strategy: the rise of the third empire of stablecoin

Jul 30, 2025 pm 08:12 PMTable of contents

- Dual currency system battle kill

- Real adoption has not yet occurred

- Conclusion

In August 2023, Spark, the MakerDAO ecological lending protocol, gave an annualized return of 8% of $DAI. Then Sun Chi entered in batches, investing a total of 230,000 $stETH, accounting for up to 15% of Spark's deposits, forcing MakerDAO to make an emergency proposal to lower the interest rate to 5%.

MakerDAO's original intention was to "subsidize" the usage rate of $DAI, almost becoming Justin Sun's Solo Yield.

In July 2025, Ethena played the "coin-stock-debt" treasury strategy, and $sUSDe's APY quickly rose to around 12%, while $ENA rose 20% in a single day.

As a treasury strategy that originated from the BTC ecosystem, it flew past $SBET/$BMNR and finally fell on USDe.

Ethena once again utilizes the capital market to successfully manufacture the two-way flywheel of $ENA and $USDe in the on-chain market and stock markets.

Dual currency system battle kill

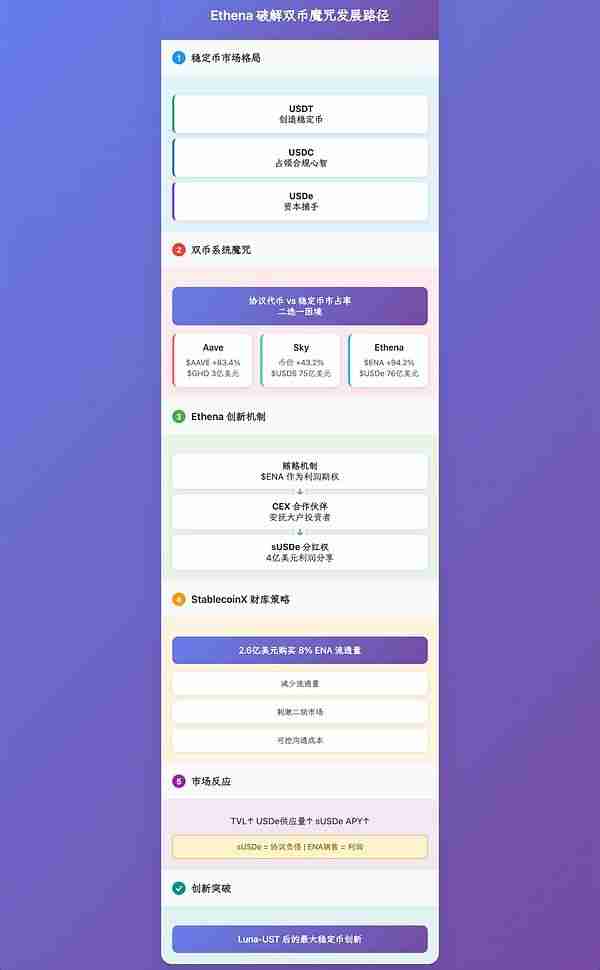

USDT creates stablecoins, USDC captures user compliance minds, and USDe is the capital catcher.

When the $ENA treasury strategy was launched, I subconsciously thought it was a simple imitation of the current Strategy trend, but after careful review, Ethena was actually trying to break the curse of the "dual currency" system.

The curse is that the issuer of the on-chain stablecoin must choose one of the protocol token price and stablecoin market share.

- ? Aave chooses to empower $AAVE, and the three-month coin price has risen by 83.4%, but the $GHO issuance is only $300 million

- ? MakerDAO evolved Sky's three-month coin price rose 43.2%, and $USDS issuance is $7.5 billion

- ? Ethena token ENA three-month coin price rose 94.2%, $USDe issuance of $7.6 billion

Coupled with the collapsed Luna-UST dual token system, we will find that maintaining a balance between the two is extremely difficult. The fundamental reason is that the protocol revenue is limited and the traffic flows to the market share, so the token price is unstable, and vice versa.

In the entire stablecoin market, this is a latecomer barrier opened by USDT. USDT invented the stablecoin track, so naturally there is no need to worry. Circle needs to share profits with partners, but it still will not share them with USDC holders.

Through the bribery mechanism, Ethena shares ENA as a profit "option" with CEX partners, temporarily appeases major investors, investors and CEXs, and gives priority to protecting USDe holders' dividend rights.

According to A1 Research's estimates, since its establishment, Ethena has shared approximately US$400 million in profits with USDe holders through sUSDe, breaking the entry threshold set by USDT/USDC.

It is no accident that Ethena not only surpassed Sky in stablecoin market share (not counting the residual DAI share), but also surpassed Aave in the performance of the main token project.

Although Ethena's ENA price rise is certainly stimulating the upbit, Ethena is deeply transforming the value transmission method of the dual currency system by introducing stock market treasury strategies.

Going back to the previous question, in addition to prioritizing the protection of USDe's market share, ENA's dividend rights still need to be fulfilled. Ethena's choice is to imitate the treasury strategy to launch StablecoinX, but to transform it.

- BTC treasury strategy, taking Strategy as an example, bet on the long-term upward trend of BTC’s price. The holding of 600,000 BTC is an upward combustion aid, and it will also be the hell of a decline;

- ETH treasury strategy, taking Bitmine (BMNR) as an example, bets that one can eventually buy 5% of the circulation share, become a new dealer, take the path of Sunci and Yi Lihua in the stock market, and make volatility trends.

- The BNB/SOL/HYPE treasury strategy is a project foundation or a single entity that raises the share price to stimulate local currency growth. This is the most follow-up group because these assets have not yet achieved similar market value as BTC/ETH.

ENA's treasury StablecoinX is different from the above. On the surface, it is an entity on the ENA chain that injects and raises funds, spending US$260 million to purchase 8% of the ENA circulation, and the left hand is turning to the right hand to stimulate the price increase of ENA.

The market responded positively, with Ethena TVL, USDe supply, and sUSDe APY rising, but note that sUSDe is essentially a liability for the agreement, and ENA's sales revenue is profit.

StablecoinX reduces ENA circulation and stimulates sales growth in the secondary market. The communication costs are controllable. Ethena can negotiate with investors Pantera, Dragonfly, and Wintermute.

Among them, Dragonfly is the leading investor of Ethena seed round, and Wintermute is also a participating investor. Compared with new investment, this is more like accounting accounting.

Ethena is following the capital manipulation path and successfully escaped in the dual currency system. This should be the largest stablecoin innovation after Luna-UST.

Real adoption has not yet occurred

When false prosperity is destroyed, those things that have been rooted for a long time will be exposed.

ENA's new upward trend is one of the sources of project profits, and the holdings of USDe/sUSDe will also increase accordingly. At least USDe now has the possibility of becoming a truly applied stablecoin.

ENA's treasury strategy imitates BNB/SOL/HYPE, pushing up yields to stimulate the adoption of stablecoins, which can not only earn volatility trends, but also reduce the selling pressure during declines under the negotiation mechanism.

Capital operations can only stimulate currency prices. After stabilizing the growth flywheel of USDe and ENA, long-term development still requires the real application of USDe to cover market making costs.

At this point, Ethena has always walked on two legs off the chain and on the chain:

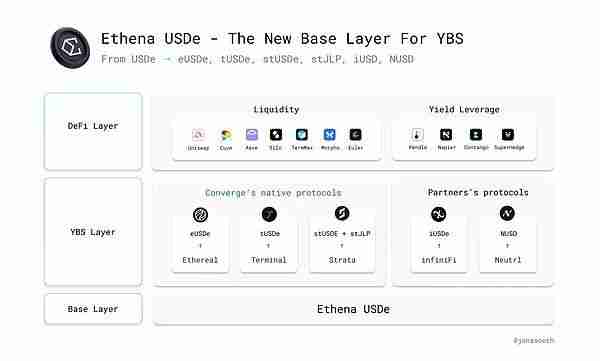

- On-chain: Ethena has cooperated with Pendle for a long time to revitalize the on-chain interest rate market, and gradually cooperated with Hyperliquid, and also supported Ethreal as a Perp DEX alternative internally.

- Off-chain: Cooperate with BlackRock partner Securities to issue Converge EVM chain, targeting institutions to adopt the latest Genius Act and Anchorage Digital to increase the issuance of compliant stablecoins USDtb.

In addition, Anchorage Digital and Galaxy Digital are both the most recent fire institutions. In a sense, they are the main players in the third wave of market makers after Jump Trading/Alameda Research, and the second wave is market makers such as DWF/Wintermute, which will be discussed in detail later.

Ethena Outside the on-chain and off-chain capital bureau, the real adoption of reality is still lacking.

Compared with USDT and USDC, USDe/USDtb is just a brief taste in cross-border payments, tokenized funds, and DEX/CEX pricing. The only praise is its cooperation with TON. It is difficult for the cooperation of DeFi agreements to enter thousands of households.

If Ethena's purpose is on-chain DeFi, it has been very successful at present, but if institutions entering the off-chain adopt and retail investors use it, it can only be said that Long March has just completed its first step.

In addition, ENA has hidden worries, and the Fee Switch is also on the way. Do you still remember that Ethena is only sharing profits to USDe holders at the moment, and the Fee Agreement Switch requires ENA holders to share their income through sENA.

Ethena stabilizes CEX through ENA in exchange for USDe's living space, and stabilizes the interests of ENA's big investors and investors through treasury strategies, but it can never escape what should be. Once ENA starts to share the agreement income, ENA will become Ethena's debt rather than income.

Only when ENA truly becomes a USDT/USDC analog can ENA enter the real hematopoietic cycle, and it is still moving around and the pressure will never really disappear.

Conclusion

Ethena's capital manipulation has inspired more stablecoins and YBS (interest-generating stablecoins) projects. Even Genius Act compliant payment stablecoins, it does not mean that interest can not be calculated on RWA.

Following Ethena, Resolv also announced the activation of the fee switch agreement, but will not really share the profits to token holders for the time being. After all, the prerequisite for sharing the profits with the agreement is to have the agreement income.

Uniswap has been cautious about the fee switch for many years, with the core of maximizing the agreement between LP and UNI holders, and most YBS/stablecoin projects currently lack the ability to last long-term profits.

Capital stimulation is a pacemaker, and real adoption is a hematopoietic protein.

This is the article about Ethena's treasury strategy: The rise of the third empire of the stablecoin. For more information related to cryptocurrency, please search for previous articles on this site or continue browsing the related articles below. I hope everyone will support this site in the future!

The above is the detailed content of Ethena treasury strategy: the rise of the third empire of stablecoin. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the websites for real-time price query of Bitcoin? Recommended websites that can view Bitcoin K-line and depth chart

Jul 31, 2025 pm 10:54 PM

What are the websites for real-time price query of Bitcoin? Recommended websites that can view Bitcoin K-line and depth chart

Jul 31, 2025 pm 10:54 PM

In the digital currency market, real-time mastering of Bitcoin prices and transaction in-depth information is a must-have skill for every investor. Viewing accurate K-line charts and depth charts can help judge the power of buying and selling, capture market changes, and improve the scientific nature of investment decisions.

The Ethereum price rose by more than 20% in 7 days. What is the reason behind it?

Jul 31, 2025 pm 10:48 PM

The Ethereum price rose by more than 20% in 7 days. What is the reason behind it?

Jul 31, 2025 pm 10:48 PM

The recent surge of Ethereum price by more than 20% is mainly driven by four major factors: 1. The Cancun Upgrade is approaching, especially the "prototype data sharding" technology introduced by EIP-4844 will significantly reduce the transaction costs of Layer 2, improve network scalability, and attract investors to make advance arrangements; 2. The DeFi ecosystem continues to flourish, and the total value of locked positions (TVL) has grown steadily. New protocols such as liquid staking derivatives (LSD) and restaking (Restaking) have risen, increasing the rigid demand for ETH as a Gas fee and pledged assets; 3. The market has strong expectations for the approval of Ethereum spot ETF, believing that it will provide convenient channels for institutional investors, introduce a large amount of funds and enhance market confidence.

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

1. Ordinary users can purchase Ethereum through mainstream digital asset trading platforms such as Binance, Ouyi OK, HTX Huobi, etc. The process includes registering an account, identity authentication, binding payment methods and trading through market or limit orders. The assets can be stored on the platform or transferred to personal money sacrificial pie; 2. Ethereum has no fixed issuance limit, with about 72 million initial issuance, and it is continuously issued through the PoS mechanism and the destruction mechanism is introduced due to EIP-1559, which may achieve deflation; 3. Before investing, you need to understand the risk of high volatility, enable two-factor verification to ensure account security, and learn asset custody methods such as hardware or software money sacrificial pie; 4. Ethereum is the core platform of decentralized applications, DeFi protocols and NFT ecosystem, supporting the operation of smart contracts and promoting digital asset rights confirmation and flow

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

Ethereum is a decentralized application platform based on smart contracts, and its native token ETH can be obtained in a variety of ways. 1. Register an account through centralized platforms such as Binance and Ouyiok, complete KYC certification and purchase ETH with stablecoins; 2. Connect to digital storage through decentralized platforms, and directly exchange ETH with stablecoins or other tokens; 3. Participate in network pledge, and you can choose independent pledge (requires 32 ETH), liquid pledge services or one-click pledge on the centralized platform to obtain rewards; 4. Earn ETH by providing services to Web3 projects, completing tasks or obtaining airdrops. It is recommended that beginners start from mainstream centralized platforms, gradually transition to decentralized methods, and always attach importance to asset security and independent research, to

Digital Currency Recharge Safety Guide: Prevent Operational Mistakes

Jul 31, 2025 pm 10:33 PM

Digital Currency Recharge Safety Guide: Prevent Operational Mistakes

Jul 31, 2025 pm 10:33 PM

1. Choose a reputable trading platform; 2. Confirm currency and network type; 3. Check the official recharge address; 4. Ensure the network security environment; 5. Double check the head and tail characters of the address; 6. Confirm the amount and decimal points; 7. Pay attention to the minimum recharge amount; 8. Fill in necessary labels or notes; 9. Beware of clipboard hijacking; 10. Don’t trust the non-official channel address; 11. Test the small amount before large recharge; 12. Save the transaction ID for inquiry; 13. Wait patiently for network confirmation; 14. Contact customer service in time when the account is not arrived. To ensure the safety of digital currency recharge, the above steps must be strictly followed. From platform selection to information verification to risk prevention, every step needs to be carefully operated. Finally, through retaining vouchers and timely communication, the asset is securely received, and avoid negligence.

BTC digital currency account registration tutorial: Complete account opening in three steps

Jul 31, 2025 pm 10:42 PM

BTC digital currency account registration tutorial: Complete account opening in three steps

Jul 31, 2025 pm 10:42 PM

First, select well-known platforms such as Binance Binance or Ouyi OKX, and prepare your email and mobile phone number; 1. Visit the official website of the platform and click to register, enter your email or mobile phone number and set a high-strength password; 2. Submit information after agreeing to the terms of service, and complete account activation through the email or mobile phone verification code; 3. After logging in, complete identity authentication (KYC), enable secondary verification (2FA), and regularly check security settings to ensure account security. After completing the above steps, you can successfully create a BTC digital currency account.

Ethereum price approaches historical highs, and the risk of a pullback cannot be ignored

Jul 31, 2025 pm 10:39 PM

Ethereum price approaches historical highs, and the risk of a pullback cannot be ignored

Jul 31, 2025 pm 10:39 PM

Ethereum is pushing prices to approach historical highs due to factors such as Ethereum 2.0 upgrade, DeFi and NFT ecosystem boom, influx of institutions and macro environment, but the risks of the pullback cannot be ignored. Investors need to be vigilant about profit-taking, overheating of emotions, regulatory uncertainty, technical overbought, policy tightening and competitive risks. The response strategies include 1. Formulate clear plans, set stop-profit and stop losses, set up positions and shipments in batches, and determine the time frame; 2. Diversify investment portfolios, diversify assets and understand correlations; 3. Pay close attention to fundamentals and technical indicators and maintain independent thinking; 4. Choose reliable exchanges and use hardware storage to ensure the security of funds; 5. Avoid emotional trading and accept market uncertainty to achieve stable investment.

With the price of Ethereum exceeding $3,800, can the DeFi and NFT markets hit new highs?

Aug 01, 2025 pm 06:24 PM

With the price of Ethereum exceeding $3,800, can the DeFi and NFT markets hit new highs?

Aug 01, 2025 pm 06:24 PM

Ethereum price exceeded US$3,800, and the DeFi and NFT markets are expected to hit new highs. 1. Spot ETFs are expected to bring in institutional capital inflows and enhance market confidence; 2. Cancun upgrade significantly reduces Layer 2 transaction costs and enhances network scalability; 3. The recovery of macro sentiment promotes the overall crypto market activity. In this context, the DeFi market will benefit from new narrative developments such as TVL improvement, increased user participation and re-pled; the NFT market has ushered in a recovery due to the enhanced wealth effect, decreased transaction costs and transformation to practical value. Both have the basis to hit new highs, but this growth will be driven more by technological progress and application implementation rather than simply speculation, marking the Ethereum ecosystem towards a healthier and sustainable development stage.