A complete tutorial on USDT cross-chain transfers

Jan 27, 2024 am 10:00 AMphp editor Youzi will introduce you to a complete tutorial on USDT cross-chain transfer. USDT is a cryptocurrency based on blockchain technology. Cross-chain transfer refers to transferring USDT from one blockchain network to another blockchain network. This tutorial details the steps and operation methods of USDT cross-chain transfer, and is suitable for beginners to get started. By studying this tutorial, you will be able to easily implement cross-chain transfers of USDT and enjoy a more convenient digital asset management experience. Come and follow our tutorial and master the skills of USDT cross-chain transfer!

How to transfer USDT across chains?

The following uses Math Wallet as an example to introduce USDT cross-chain transfer. The cross-chain process from Ethereum to Binance Smart Chain is as follows:

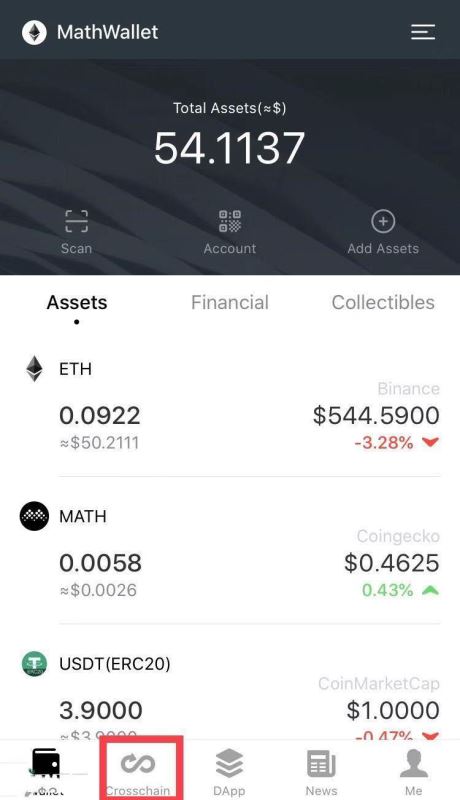

1. Log in to Math Wallet, switch to ETH wallet, and click Crosschain

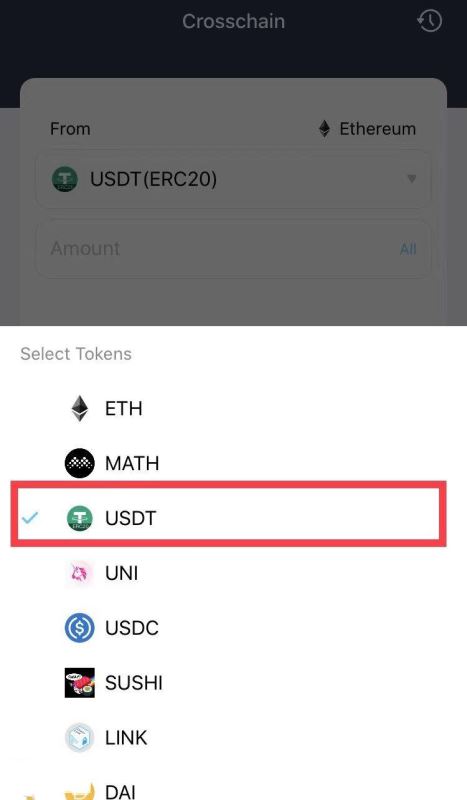

2. Enter On the cross-chain page, select the transfer asset. Currently, it supports: ETH/USDT/MATH/UNI/USDC/SUSHI/LINK/DAI

Here we take USDT as an example

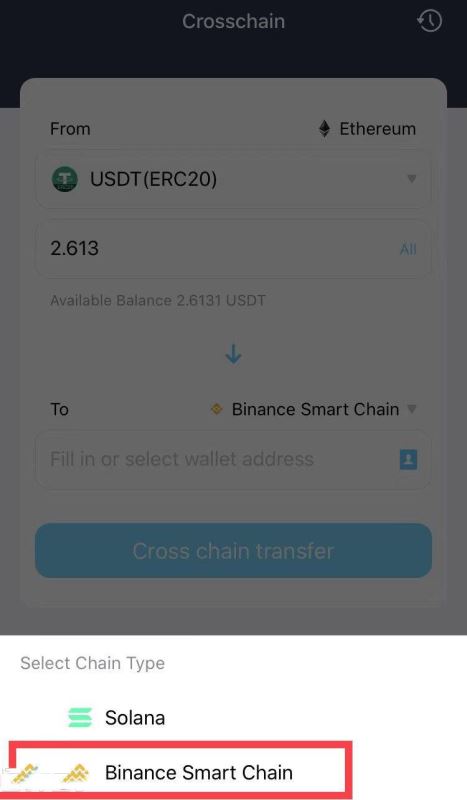

3. After entering the amount, select Binance Smart Chain (Maiz Wallet currently supports 7 cross-chain functions)

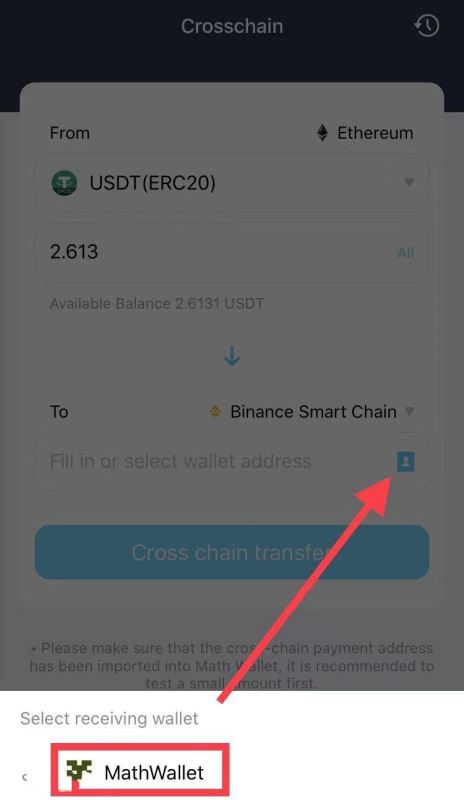

4. Select the address

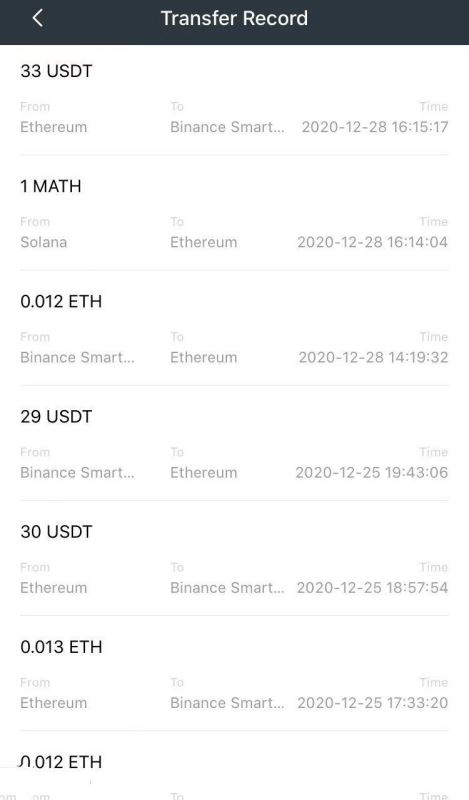

5. Click on cross-chain transfer and wait for on-chain confirmation to complete the transaction. You can click on the transfer record in the upper right corner to view order details.

What currency does USDT belong to?

USDT is a cryptocurrency that is a type of stablecoin, which is designed to be pegged to the value of some stable asset, such as a fiat currency or commodity, to maintain a relatively stable value. USDT stands for Tether, which is a stable currency issued by Tether Limited. It was originally a token based on the Bitcoin blockchain and was later also issued on other blockchain platforms, such as Ethereum and Wave. field and sol.

USDT aims to maintain a fixed exchange rate of 1:1 with the value of the US dollar, that is, the value of each USDT token should be equal to 1 US dollar. This fixed value makes USDT widely used in cryptocurrency transactions as a store of value, a medium of exchange, and a tool for transferring funds.

USDT aims to be pegged to the value of the US dollar, but it is not a completely decentralized cryptocurrency, but is issued and managed by Tether Limited, a centralized entity.

USDT cross-chain transfer is the transfer of USDT tokens between different blockchain platforms. This process may involve transfer fees and transfer speeds. Make sure you need to understand before making cross-chain transfers. Associated fees, transfer speed and possible risks. Additionally, always ensure that the digital wallet you use is safe and secure and that appropriate security measures are in place to protect your assets and personal information. Of course, the fee structure and security of the relevant blockchain platform also need to be paid attention to.

The above is the detailed content of A complete tutorial on USDT cross-chain transfers. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

Ethereum is a decentralized application platform based on smart contracts, and its native token ETH can be obtained in a variety of ways. 1. Register an account through centralized platforms such as Binance and Ouyiok, complete KYC certification and purchase ETH with stablecoins; 2. Connect to digital storage through decentralized platforms, and directly exchange ETH with stablecoins or other tokens; 3. Participate in network pledge, and you can choose independent pledge (requires 32 ETH), liquid pledge services or one-click pledge on the centralized platform to obtain rewards; 4. Earn ETH by providing services to Web3 projects, completing tasks or obtaining airdrops. It is recommended that beginners start from mainstream centralized platforms, gradually transition to decentralized methods, and always attach importance to asset security and independent research, to

How to buy stablecoins for Apple phones? Where to buy stablecoins for Apple phones?

Jul 24, 2025 pm 09:18 PM

How to buy stablecoins for Apple phones? Where to buy stablecoins for Apple phones?

Jul 24, 2025 pm 09:18 PM

Purchase USDT and other stablecoins on Apple phones, you must download the compliant exchange app through the overseas Apple ID and complete the authentication and conduct transactions. The specific steps are as follows: 1. Use Apple ID in the non-mainland region to log in to the App Store; 2. Download recommended platforms such as OKX, Binance, Huobi (HTX), Gate.io or KuCoin; 3. Complete registration and identity authentication (KYC); 4. Enter the "Buy Coin" or "C2C/P2P Transaction" page to select USDT; 5. Filter merchants according to the payment method and place orders; 6. Pay through Alipay, WeChat or bank card and confirm transactions; 7. Wait for the merchant to put the coins into the account, and the entire process is completed.

How to choose a free market website in the currency circle? The most comprehensive review in 2025

Jul 29, 2025 pm 06:36 PM

How to choose a free market website in the currency circle? The most comprehensive review in 2025

Jul 29, 2025 pm 06:36 PM

The most suitable tools for querying stablecoin markets in 2025 are: 1. Binance, with authoritative data and rich trading pairs, and integrated TradingView charts suitable for technical analysis; 2. Ouyi, with clear interface and strong functional integration, and supports one-stop operation of Web3 accounts and DeFi; 3. CoinMarketCap, with many currencies, and the stablecoin sector can view market value rankings and deans; 4. CoinGecko, with comprehensive data dimensions, provides trust scores and community activity indicators, and has a neutral position; 5. Huobi (HTX), with stable market conditions and friendly operations, suitable for mainstream asset inquiries; 6. Gate.io, with the fastest collection of new coins and niche currencies, and is the first choice for projects to explore potential; 7. Tra

Ethena treasury strategy: the rise of the third empire of stablecoin

Jul 30, 2025 pm 08:12 PM

Ethena treasury strategy: the rise of the third empire of stablecoin

Jul 30, 2025 pm 08:12 PM

The real use of battle royale in the dual currency system has not yet happened. Conclusion In August 2023, the MakerDAO ecological lending protocol Spark gave an annualized return of $DAI8%. Then Sun Chi entered in batches, investing a total of 230,000 $stETH, accounting for more than 15% of Spark's deposits, forcing MakerDAO to make an emergency proposal to lower the interest rate to 5%. MakerDAO's original intention was to "subsidize" the usage rate of $DAI, almost becoming Justin Sun's Solo Yield. July 2025, Ethe

Ethereum (ETH) NFT sold nearly $160 million in seven days, and lenders launched unsecured crypto loans with World ID

Jul 30, 2025 pm 10:06 PM

Ethereum (ETH) NFT sold nearly $160 million in seven days, and lenders launched unsecured crypto loans with World ID

Jul 30, 2025 pm 10:06 PM

Table of Contents Crypto Market Panoramic Nugget Popular Token VINEVine (114.79%, Circular Market Value of US$144 million) ZORAZora (16.46%, Circular Market Value of US$290 million) NAVXNAVIProtocol (10.36%, Circular Market Value of US$35.7624 million) Alpha interprets the NFT sales on Ethereum chain in the past seven days, and CryptoPunks ranked first in the decentralized prover network Succinct launched the Succinct Foundation, which may be the token TGE

What is a stablecoin? Understand stablecoins in one article!

Jul 29, 2025 pm 01:03 PM

What is a stablecoin? Understand stablecoins in one article!

Jul 29, 2025 pm 01:03 PM

Stablecoins are cryptocurrencies with value anchored by fiat currency or commodities, designed to solve price fluctuations such as Bitcoin. Their importance is reflected in their role as a hedging tool, a medium of trading and a bridge connecting fiat currency with the crypto world. 1. The fiat-collateralized stablecoins are fully supported by fiat currencies such as the US dollar. The advantage is that the mechanism is simple and stable. The disadvantage is that they rely on the trust of centralized institutions. They represent the projects including USDT and USDC; 2. The cryptocurrency-collateralized stablecoins are issued through over-collateralized mainstream crypto assets. The advantages are decentralization and transparency. The disadvantage is that they face liquidation risks. The representative project is DAI. 3. The algorithmic stablecoins rely on the algorithm to adjust supply and demand to maintain price stability. The advantages are that they do not need to be collateral and have high capital efficiency. The disadvantage is that the mechanism is complex and the risk is high. There have been cases of dean-anchor collapse. They are still under investigation.

What is Huobi HTX red envelope? How to send and receive red envelopes? Huobi divides 1000U activities

Jul 30, 2025 pm 09:45 PM

What is Huobi HTX red envelope? How to send and receive red envelopes? Huobi divides 1000U activities

Jul 30, 2025 pm 09:45 PM

Table of Contents 1. What is Huobi HTX red envelope? 2. How to create and send red envelopes? 3. How to receive red envelopes? 1. Receive password red envelopes 2. Scan the QR code to receive red envelopes 3. Click on the red envelope link to receive red envelopes 4. Check the red envelopes and share more instructions: 1. What is Huobi HTX red envelope? Huobi HTX red envelopes support users to send cryptocurrencies to friends in the form of red envelopes. You can create cryptocurrency red envelopes with random or fixed amounts, and send them to friends by sending red envelope passwords, sharing links or posters. Your friends can receive it for free in Huobi HTXAPP or click on the link. Huobi HTX red envelopes also support unregistered users to receive them, and

The 5 most popular free market websites in 2025 Summary of currency circle market websites

Jul 29, 2025 pm 06:39 PM

The 5 most popular free market websites in 2025 Summary of currency circle market websites

Jul 29, 2025 pm 06:39 PM

Binance App data is the most authoritative and millisecond real-time, suitable for users who need one-stop transactions and price query; 2. The Ouyi App interface is refreshing and supports Web3 account integration, and the simplified version is more friendly to users who only need to query prices; 3. As a third-party aggregation platform, CoinGecko can compare prices across exchanges and use lightweight, suitable for research and analysis, but weak real-time; 4. Huobi App has stable functions and wide user base, but insufficient innovation and market share has declined; 5. Gate.io provides rich stable currency types and emerging project data, which is powerful but has a crowded interface, making it difficult for novices to get started.