Bond valuation is a crucial tool for anyone engaged in the financial sector, whether you are a personal investor, a financial analyst, or managing a portfolio. It aids in assessing whether a bond is fairly priced, overvalued, or undervalued by analyzing its anticipated cash flows and current market conditions. I often utilize Excel for bond valuation due to its adaptability, user-friendliness, and the availability of numerous built-in financial functions that simplify the calculation of bond prices.

In this article, I will dissect the bond valuation process into manageable steps, elucidate the key factors involved, and demonstrate how to use Excel to ascertain a bond's value. This guide will delve into the theoretical underpinnings of bond valuation, clarify the essential inputs required, and offer practical examples of implementing bond valuation using Excel.

Key Takeaways:

- Bond valuation assists in determining the fair price of a bond by calculating the present value of its future cash flows, which include coupon payments and the bond's face value.

- Essential components for bond valuation include face value, coupon rate, payment frequency, time to maturity, and the market interest rate (discount rate).

- The concept of present value is central to bond valuation, where future payments are discounted to reflect their current worth.

- Excel provides built-in functions, such as PV, to compute the present value of coupon payments and the bond's face value.

- The bond's value is the total of the present values of its coupon payments and face value, enabling investors to evaluate whether a bond is underpriced or overpriced.

Table of Contents

Introduction to Bond Valuation Calculator

What is Bond Valuation?

At its essence, bond valuation involves calculating the present value of a bond's future cash flows. These cash flows comprise periodic coupon payments (for coupon bonds) and the repayment of the bond's face value (principal) at maturity. The fundamental principle is to discount these future payments to the present using the prevailing market interest rate, or discount rate, to determine the bond's fair market price.

In simpler terms, bond valuation helps us ascertain a bond's current worth based on its future payment commitments. This is vital for investment decisions, as it indicates whether we are overpaying or getting a bargain for the bond.

Key Components of Bond Valuation

To conduct bond valuation, we require several critical pieces of data:

- Face Value (or Par Value): This represents the amount the bondholder will receive upon maturity. It typically stands at $1,000 for corporate bonds.

- Coupon Rate: The interest rate the bond pays, stated as a percentage of the face value. For example, a 5% coupon rate on a $1,000 bond means the bondholder receives $50 in interest annually.

- Coupon Payment Frequency: Bonds generally pay interest either annually or semi-annually. Knowing the payment frequency is crucial for calculating the bond's value.

- Time to Maturity: The duration in years (or months) until the bond reaches maturity and the face value is returned.

- Market Interest Rate (Discount Rate): This is the rate of return investors demand in the current market, reflecting the bond's risk level. It is used to discount the bond's future cash flows.

Understanding Present Value and Discounting

The concept of present value is pivotal in bond valuation. The rationale is that money received in the future is less valuable than the same amount received today because today's money can be invested to earn interest. The process of determining present value involves discounting future cash flows back to the present using the market interest rate.

For bonds, we discount both the coupon payments and the face value to the present, then sum them to ascertain the bond's total value.

Using Excel for Bond Valuation

Now, let's delve into the specifics of using Excel for bond valuation. Excel's built-in functions simplify bond valuation, and I will guide you through the process step-by-step.

Setting Up the Inputs in Excel

Before any calculations, it's vital to set up the key inputs in an Excel spreadsheet. Let's consider a bond with the following characteristics:

- Face Value: $1,000

- Coupon Rate: 5%

- Time to Maturity: 10 years

- Payment Frequency: Semi-annual (twice a year)

- Market Interest Rate: 4%

Calculating the Coupon Payments

The initial step involves calculating the amount of each coupon payment. The coupon payment is the face value multiplied by the coupon rate, then divided by the number of payments per year.

In Excel, you can use the following formula to calculate the semi-annual coupon payment:

= (Face Value * Coupon Rate) / Payments per Year

In our example, this would be:

So, the bondholder will receive $25 every six months.

Calculating the Present Value of Coupon Payments

The next step is to calculate the present value of the coupon payments. We'll use Excel's PV (Present Value) function for this. The syntax of the PV function is:

=PV(rate, nper, pmt, [fv], [type])

Where:

- rate: The market interest rate per period. In this case, it's the annual market interest rate divided by the number of payments per year.

- nper: The total number of periods (years to maturity multiplied by payments per year).

- pmt: The coupon payment per period.

For our example, the formula to calculate the present value of the coupon payments would look like this:

This provides the present value of the bond's coupon payments.

Calculating the Present Value of the Face Value

The bondholder will also receive the face value ($1,000) at maturity, so we need to calculate the present value of the face value using the same PV function. The formula in Excel would be:

This calculates the present value of the $1,000 that the bondholder will receive in 10 years.

Summing the Results

The bond's value is the sum of the present value of the coupon payments and the present value of the face value. You can sum the two PV calculations in Excel to get the total bond price.

For our example, the total bond value is:

This gives the bond's theoretical fair value in today's terms.

Additional Considerations

Premium vs. Discount Bonds

When the market interest rate falls below the bond's coupon rate, the bond will trade at a premium (above par value). Conversely, if the market interest rate exceeds the coupon rate, the bond will trade at a discount (below par value). Excel enables us to model both scenarios easily by adjusting the market interest rate input.

Zero-Coupon Bonds

For zero-coupon bonds, there are no periodic coupon payments. The bondholder only receives the face value at maturity. In this case, the bond's value is simply the present value of the face value.

You can calculate this in Excel by setting the coupon payment to zero in the PV function.

FAQ on Excel Bond Valuation

What is the formula for bond valuation?

The formula for bond valuation is the Present Value of Future Payments divided by the appropriate discount rate, known as Yield to Maturity (YTM). Specifically:

Bond Value = PV of Interest Payments PV of Face Value

How to calculate the value of a bond using Excel?

To calculate the value of a bond using Excel, utilize the PV function to find the present value of the coupon payments and the face value. The formula structure is:

=PV(rate/nper, nper, payment, fv)

Where 'rate' is the discount rate/YTM, 'nper' is the number of periods, 'payment' is the coupon payment, and 'fv' is the face value.

Alternatively, the PRICE function can be used for a more comprehensive bond valuation, considering the timing of the coupon payments.

How Do I Use the PRICE Function Specifically for Bonds?

To use the PRICE function specifically for bonds in Excel:

=PRICE(settlement, maturity, rate, yld, redemption, frequency, [basis])

- 'settlement' is the date the buyer acquires the bond.

- 'maturity' is when the bond expires.

- 'rate' is the bond's annual coupon rate.

- 'yld' is the bond's annual yield.

- 'redemption' is the value at maturity per $100 of face value.

- 'frequency' indicates the number of coupon payments per year.

- 'basis' (optional) defines the day count convention to use.

Ensure the dates are in Excel's date format and rates are represented as decimals.

What Are the Differences Between PV, FV, and PRICE When Valuing Bonds?

The PV (Present Value) function calculates the current value of a series of future cash flows, including bond coupon payments and principal repayment, at a certain discount rate. The FV (Future Value) function, in contrast, projects the value of an investment at a future date based on periodic, constant payments and a constant interest rate.

The PRICE function differs because it calculates the bond's price per $100 of face value, considering the expected yield, and is specifically designed for bonds. It accounts for the timing of coupon payments and the term until maturity, providing a clean bond price.

These functions address different aspects of bond valuation based on the financial data and desired outcomes.

Can Excel Calculate Bond Valuation on Any Given Date?

Yes, Excel can calculate bond valuation on any given date using functions such as PRICE or PV, as long as you provide the correct settlement date and other required parameters.

The above is the detailed content of Excel Bond Valuation Calculator – Step by Step Guide. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

![Fix Scroll Bar Missing Error in Excel [Troubleshooting Guide]](https://img.php.cn/upload/article/001/242/473/175816188366414.png?x-oss-process=image/resize,m_fill,h_207,w_330) Fix Scroll Bar Missing Error in Excel [Troubleshooting Guide]

Sep 18, 2025 am 10:18 AM

Fix Scroll Bar Missing Error in Excel [Troubleshooting Guide]

Sep 18, 2025 am 10:18 AM

The scroll bar plays a crucial role in navigating through vast amounts of data efficiently, and its sudden disappearance can disrupt your workflow. In this troubleshooting guide, we'll show you how to bring back the scroll bar in Excel and regain s

Why is my PPT file so large? A guide to diagnosing and fixing large PPT file sizes.

Sep 17, 2025 am 02:11 AM

Why is my PPT file so large? A guide to diagnosing and fixing large PPT file sizes.

Sep 17, 2025 am 02:11 AM

IfyourPowerPointfileisslowtoopenorsend,reduceitssizeby:1.Compressinghigh-resolutionimages.2.Replacingembeddedaudio/videowithlinkedfiles.3.Deletinghiddenorduplicateslides.4.CleaninguptheSlideMaster.5.SavinginoptimizedPPTXformat.

How to create a fillable form with checkboxes in Word

Sep 16, 2025 am 04:29 AM

How to create a fillable form with checkboxes in Word

Sep 16, 2025 am 04:29 AM

EnabletheDevelopertabviaFile>Options>CustomizeRibbonbycheckingDeveloper.2.InsertaCheckboxContentControlfromtheControlsgroupontheDevelopertabwhereneeded.3.Addmultiplecheckboxesbyrepeatingtheinsertionprocessandaligningthemneatlywithtextortables.4

How To Open Unknown File Extensions in Windows

Sep 19, 2025 am 09:33 AM

How To Open Unknown File Extensions in Windows

Sep 19, 2025 am 09:33 AM

Have you ever stumbled upon a file with a strange or unfamiliar extension? If yes, you're probably familiar with the annoyance of not knowing which program can open it. The good news is, there are effective ways to determine the correct software and

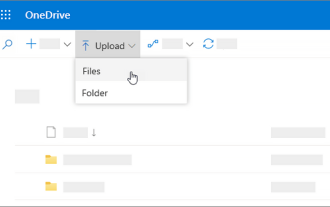

How to Save Your Document to OneDrive in Microsoft Word

Sep 21, 2025 am 11:36 AM

How to Save Your Document to OneDrive in Microsoft Word

Sep 21, 2025 am 11:36 AM

If you're working in Word and would like to save your document directly to OneDrive, the process is straightforward. Just follow these easy steps:Click on ‘File’Choose ‘Save As’Pick ‘OneDrive’ as your save locationSelect the appropriate folder—use On

How to save a PPT as a PDF?

Sep 21, 2025 am 01:18 AM

How to save a PPT as a PDF?

Sep 21, 2025 am 01:18 AM

Open the PPT file to be converted; 2. Click "File" to enter the background; 3. Select "Save As" and specify the save location; 4. Select "PDF" in "Save Type" to select quality and options; 5. Click "Save" to complete the conversion, and the PDF will retain the original layout and be suitable for sharing or printing.

How to insert a Word document into a PPT?

Sep 21, 2025 am 01:39 AM

How to insert a Word document into a PPT?

Sep 21, 2025 am 01:39 AM

ToinsertaWorddocumentintoPowerPoint,embeditasanobjectbygoingtoInsert→Object→Createfromfile,thenbrowseandselectthefile,optionallycheckingDisplayasiconorLinktofiletomaintainupdates;2.Forquickcontenttransfer,copytextfromWordandpasteintoPowerPointusingKe

How to Update Microsoft Mouse Driver in Windows

Sep 20, 2025 am 09:09 AM

How to Update Microsoft Mouse Driver in Windows

Sep 20, 2025 am 09:09 AM

Keeping your drivers up to date is essential, especially for peripherals like your mouse. Having the latest driver for your Microsoft mouse can help with compatibility and stability, allowing you to get the most out of your hardware whether you're