What is statistical arbitrage in cryptocurrencies? How does statistical arbitrage work?

Jul 30, 2025 pm 09:12 PM

Introduction to statistical arbitrage

Statistical arbitrage is a trading method that captures price mismatch in the financial market based on mathematical models. Its core philosophy stems from mean regression, that is, asset prices may deviate from long-term trends in the short term, but will eventually return to their historical average. Traders use statistical methods to analyze the correlation between assets and look for portfolios that usually change synchronously. When the price relationship of these assets is abnormally deviated, arbitrage opportunities arise.

In the cryptocurrency market, statistical arbitrage is particularly prevalent, mainly due to the inefficiency and drastic fluctuations of the market itself. Unlike traditional financial markets, cryptocurrencies operate around the clock and their prices are extremely vulnerable to breaking news, social media sentiment and technology upgrades. This continuous price fluctuation frequently creates pricing deviations, providing arbitrageurs with rich operating space. However, high volatility also means high risks, so accurate model construction and strict risk control are indispensable.

Cryptocurrencies have some unique attributes that make them an ideal area for statistical arbitrage. Due to the dispersion of the market, price differences often occur between different trading platforms, forming cross-market arbitrage opportunities. At the same time, mainstream currencies such as Bitcoin and Ethereum often show strong correlation, which is conducive to the implementation of strategies such as pairing trading. In addition, a massive amount of historical data can be used for backtesting and optimization of models. But at the same time, the high sensitivity of the market to external shocks also increases the possibility of strategy failure, making statistical arbitrage both attractive and challenging.

How statistical arbitrage works in cryptocurrencies

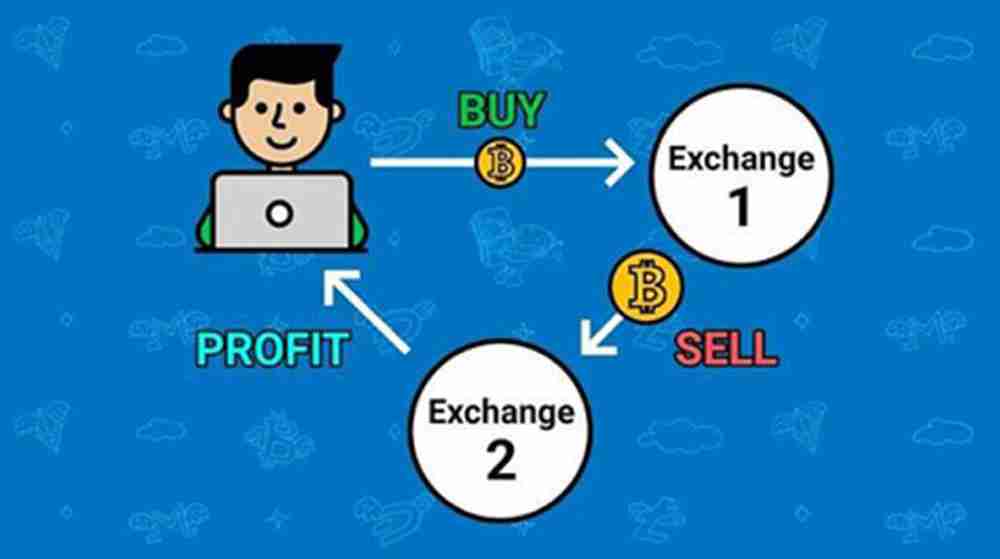

Cryptocurrency statistical arbitrage is identified through quantitative models and exploits short-term price imbalances among related digital assets. This strategy builds a profit mechanism based on the 24-hour market operation, violent volatility and dispersed exchanges. The entire process relies on data analysis, model prediction and automated execution. The specific operation steps are as follows:

- Identify high-relevant assets : The starting point of the strategy is to filter out cryptocurrencies with highly consistent price trends. For example, mainstream currencies or tokens with ecological project are often linked due to common market factors. Traders use statistical methods such as correlation coefficients and cointegration tests to measure the long-term equilibrium relationship between assets. Once the price is found to deviate from the historical mode, the trading signal can be triggered.

- Construction and verification of statistical models : historical price data is the basis of modeling. Through technologies such as mean regression, cointegration analysis and linear regression, traders judge whether the current price difference is significantly deviating from the normal state. The model needs to undergo strict backtesting to evaluate its performance in different market environments, ensure that the logic is stable before it is invested in real trading.

- Automated execution of trading strategies : Common strategies include paired trading (long undervalued assets, short overvalued assets) and triangular arbitrage (circulating trading between three currencies to capture the spread). Since the arbitrage window is fleeting, automation systems are crucial. The API interface provides real-time market conditions, trading robots realize millisecond ordering, and high-frequency trading systems can complete capture and close positions in a very short time.

- Responding to risk and execution challenges : Although the potential benefits are considerable, risks are equally prominent. Severe market fluctuations may lead to continuous expansion of price spreads rather than convergence; low-liquidity assets are difficult to quickly trade; transaction fees, slippage, and congestion in blockchain networks (such as soaring Gas fees) will compress profits. Therefore, traders must optimize the cost structure, select high-liquidity targets, and continuously monitor the performance of strategies to deal with emergencies.

To sum up, cryptocurrency statistical arbitrage combines data modeling, strategy design and automation technologies, aiming to gain benefits from market ineffectiveness. Although the technical threshold is high and risks coexist, it is still an efficient and scientific profit-making method in digital asset trading under reasonable risk control and continuous optimization.

Tools and technologies for cryptocurrency statistics arbitrage

Achieving cryptocurrency statistical arbitrage is inseparable from a series of professional tools and technical support. Programming languages such as Python and R are widely used in strategy development and backtesting because of their powerful data processing libraries (such as Pandas, NumPy, and Statsmodels). At the same time, dedicated trading robots such as Hummingbot and Trality support automatic trading across exchanges, helping users capture spread opportunities in real time and improve execution efficiency.

Obtaining high-quality real-time market data is the prerequisite for successful arbitrage. The API interface provided by mainstream exchanges such as Binance, Coinbase, and Kraken enables traders to obtain order book, K-line data and trading volume information with low latency. Rapid response to market changes is crucial for high-frequency arbitrage, and any delay can lead to missed opportunities or losses. To this end, many traders use cloud servers or dedicated hardware to deploy systems to ensure stability and speed.

Before real trading, the strategy must be fully verified. Backtest platforms such as QuantConnect and Backtrader allow traders to simulate strategy performance on historical data and adjust parameters to optimize return-risk ratios. With the development of artificial intelligence, machine learning algorithms are increasingly used in anomaly detection, trend prediction and dynamic portfolio adjustment, making statistical arbitrage systems more adaptable and intelligent.

Risks and challenges of cryptocurrency statistics

Statistical arbitrage faces multiple challenges in the crypto market, the primary issue is extreme volatility. The price of crypto assets can change drastically in a very short period of time, causing the originally expected convergence spread to continue to expand, thus causing the arbitrage position to fall into losses. Especially in small-cap currencies, insufficient liquidity makes large-value transactions likely to trigger price jumps, increasing slippage and difficulty in execution.

On the technical level, high on-chain handling fees (such as Ethereum network Gas fees) may swallow up meager profits, and network congestion is more likely to delay transaction confirmation, resulting in strategy failure. In addition, withdrawal restrictions between exchanges, API failures or market manipulation behaviors (such as false orders, pulling and smashing the market) will also interfere with the normal trading process. The uncertainty of regulatory policies also brings additional risks, and some regions may suddenly restrict crypto transactions or freeze accounts, affecting fund security and policy continuity.

in conclusion

Overall, statistical arbitrage provides cryptocurrency traders with a rational profit path based on data and algorithms. It combines statistical modeling, programmatic execution and risk management to find certain opportunities in market ineffectiveness. However, real challenges such as high volatility, technical bottlenecks and vague regulatory requirements require traders to have solid technical capabilities and rigorous risk awareness. Only by continuously optimizing the model, improving system stability and remaining vigilant can we gain a foothold in the complex and changeable crypto ecosystem for a long time.

The above is the detailed content of What is statistical arbitrage in cryptocurrencies? How does statistical arbitrage work?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

Domestic purchase of Bitcoin must be carried out through compliance channels, such as Hong Kong licensed exchanges or international compliance platforms; 2. Complete real-name authentication after registration, submit ID documents and address proof and perform facial recognition; 3. Prepare legal currency and recharge it to the trading account through bank transfer or electronic payment; 4. Log in to the platform to select Bitcoin trading pairs, set limit orders or market orders to complete the transaction; 5. Pay attention to market fluctuations and platform security, enable dual certification and comply with domestic regulatory policies; overall, investors should operate cautiously under the premise of compliance and participate in Bitcoin investment rationally.

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

The total amount of Bitcoin is 21 million, which is an unchangeable rule determined by algorithm design. 1. Through the proof of work mechanism and the issuance rule of half of every 210,000 blocks, the issuance of new coins decreased exponentially, and the additional issuance was finally stopped around 2140. 2. The total amount of 21 million is derived from summing the equal-scale sequence. The initial reward is 50 bitcoins. After each halving, the sum of the sum converges to 21 million. It is solidified by the code and cannot be tampered with. 3. Since its birth in 2009, all four halving events have significantly driven prices, verified the effectiveness of the scarcity mechanism and formed a global consensus. 4. Fixed total gives Bitcoin anti-inflation and digital yellow metallicity, with its market value exceeding US$2.1 trillion in 2025, becoming the fifth largest capital in the world

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

Jul 30, 2025 pm 09:33 PM

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

Jul 30, 2025 pm 09:33 PM

What are directory Maker and pending orders? How to calculate MakerFee? MakerFee calculation formula. Is it necessary to use limit orders? Taker and eat orders? How to calculate TakerFee How to determine whether you are Maker or Taker lazy package – Maker/taker fee spot maker/taker fee lazy package contract maker/taker fee lazy package How to reduce Maker/taker transaction fees for various virtual currency exchanges

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

The comparison between the opening price and the closing price can effectively judge the trend direction of the digital currency. 1. The opening price reflects the initial strength of long and short, which is significantly higher than the previous closing price and the increase in volume is a short-term bullish signal; 2. The closing price verifies the trend, breaking through the resistance level or continuously standing firm in the moving average is a sign of medium-term strength; 3. In combination of the combination analysis, the long positive line indicates a strong rise, the long negative line shows downward pressure, and the cross star indicates a possible reversal or stabilize; 4. Combining the moving average and the Bollinger band can enhance judgment. If the 5-day moving average is stable and the high opening is a long signal, the Bollinger band closes positive or oversold rebound; 5. It needs to be supplemented by capital flow and market sentiment. The high volume increase in the opening indicates that the main force enters the market. The high opening and high closing or low opening and low closing caused by major news will strengthen the trend. Investors should integrate K-line patterns, technical indicators and market trends

What is Binance Treehouse (TREE Coin)? Overview of the upcoming Treehouse project, analysis of token economy and future development

Jul 30, 2025 pm 10:03 PM

What is Binance Treehouse (TREE Coin)? Overview of the upcoming Treehouse project, analysis of token economy and future development

Jul 30, 2025 pm 10:03 PM

What is Treehouse(TREE)? How does Treehouse (TREE) work? Treehouse Products tETHDOR - Decentralized Quotation Rate GoNuts Points System Treehouse Highlights TREE Tokens and Token Economics Overview of the Third Quarter of 2025 Roadmap Development Team, Investors and Partners Treehouse Founding Team Investment Fund Partner Summary As DeFi continues to expand, the demand for fixed income products is growing, and its role is similar to the role of bonds in traditional financial markets. However, building on blockchain

Solana and the founders of Base Coin start a debate: the content on Zora has 'basic value'

Jul 30, 2025 pm 09:24 PM

Solana and the founders of Base Coin start a debate: the content on Zora has 'basic value'

Jul 30, 2025 pm 09:24 PM

A verbal battle about the value of "creator tokens" swept across the crypto social circle. Base and Solana's two major public chain helmsmans had a rare head-on confrontation, and a fierce debate around ZORA and Pump.fun instantly ignited the discussion craze on CryptoTwitter. Where did this gunpowder-filled confrontation come from? Let's find out. Controversy broke out: The fuse of Sterling Crispin's attack on Zora was DelComplex researcher Sterling Crispin publicly bombarded Zora on social platforms. Zora is a social protocol on the Base chain, focusing on tokenizing user homepage and content

How should novices allocate positions when trading cryptocurrency

Jul 30, 2025 pm 10:24 PM

How should novices allocate positions when trading cryptocurrency

Jul 30, 2025 pm 10:24 PM

Novice should reasonably allocate positions to control risks. Specific strategies include: 1. Use 5%-10% of the disposable funds to participate in high-risk assets, and the holding of a single token shall not exceed 2% of the total position; 2. Mainstream assets in diversified investment account for 60%-70%, medium-sized market capitalization projects shall not exceed 20%, and emerging tokens shall be controlled within 10%; 3. Adopt the pyramid position building method, with the first investment of 30%, 5%-added 20%, and after the trend is confirmed, the stop loss of 2-3 times is supplemented; 4. Set the stop loss of mainstream assets to 8%-12%, high-risk assets to 5%-8%, and the profit exceeds 15% and mobile stop loss is enabled; 5. Rebalance every quarter, partially take profits to increase by more than 50%, reduce positions by 10%, and maintain the initial asset ratio; the core principle is to disperse allocation and strictly control single products

Why do you say you choose altcoins in a bull market and buy BTC in a bear market

Jul 30, 2025 pm 10:27 PM

Why do you say you choose altcoins in a bull market and buy BTC in a bear market

Jul 30, 2025 pm 10:27 PM

The strategy of choosing altcoins in a bull market, and buying BTC in a bear market is established because it is based on the cyclical laws of market sentiment and asset attributes: 1. In the bull market, altcoins are prone to high returns due to their small market value, narrative-driven and liquidity premium; 2. In the bear market, Bitcoin has become the first choice for risk aversion due to scarcity, liquidity and institutional consensus; 3. Historical data shows that the increase in the bull market altcoins in 2017 far exceeded that of Bitcoin, and the decline in the bear market in 2018 was also greater. In 2024, funds in the volatile market will be further concentrated in BTC; 4. Risk control needs to be vigilant about manipulating traps, buying at the bottom and position management. It is recommended that the position of altcoins in a bull market shall not exceed 30%, and the position holdings of BTC in a bear market can be increased to 70%; 5. In the future, due to institutionalization, technological innovation and macroeconomic environment, the strategy needs to be dynamically adjusted to adapt to market evolution.