web3.0

web3.0

5 major economic events that crypto traders must not miss in August: Your BTC and ETH investment strategy

5 major economic events that crypto traders must not miss in August: Your BTC and ETH investment strategy

5 major economic events that crypto traders must not miss in August: Your BTC and ETH investment strategy

Jul 30, 2025 pm 09:00 PMTable of contents

- Key Points

- A brief overview of macro and policy in August

- Major events must be seen in August

- Weekly Economic Calendar Disassembly in August

- Week 1: August 1-7

- Week 2: August 8th – 14th

- Week 3: August 15th – 21st

- Week 4: August 22-28

- Week 5: August 29-31

- Risk management and precautions

- Frequently Asked Questions about August Economic Calendar

Key Points

- – The dates that affect Bitcoin and Ethereum’s biggest fluctuations are: August 1 (US non-farm employment data), August 12 (US CPI), August 21-23 (Jackson Hall Annual Meeting), and August 29 (Core PCE and second-quarter GDP).

- – August 12 is the expiration date of the Sino-US tariff truce, which may affect market risk preferences and the flow of stablecoin funds.

- – China data and PMI (Purchasing Managers Index) released in the middle of the month usually determine the risk preferences in the Asia-Pacific region and are important signals for trading BTC and ETH.

- – On the day of a critical event, using one order to cancel another (OCO) order using BTC/USDT and ETH/USDT futures can both capture fluctuations and avoid guessing directions.

- – Pay attention to on-chain signals: stablecoin minting and destruction, BTC staking inflows, ETH staking changes, and capture institutional layout trends at any time.

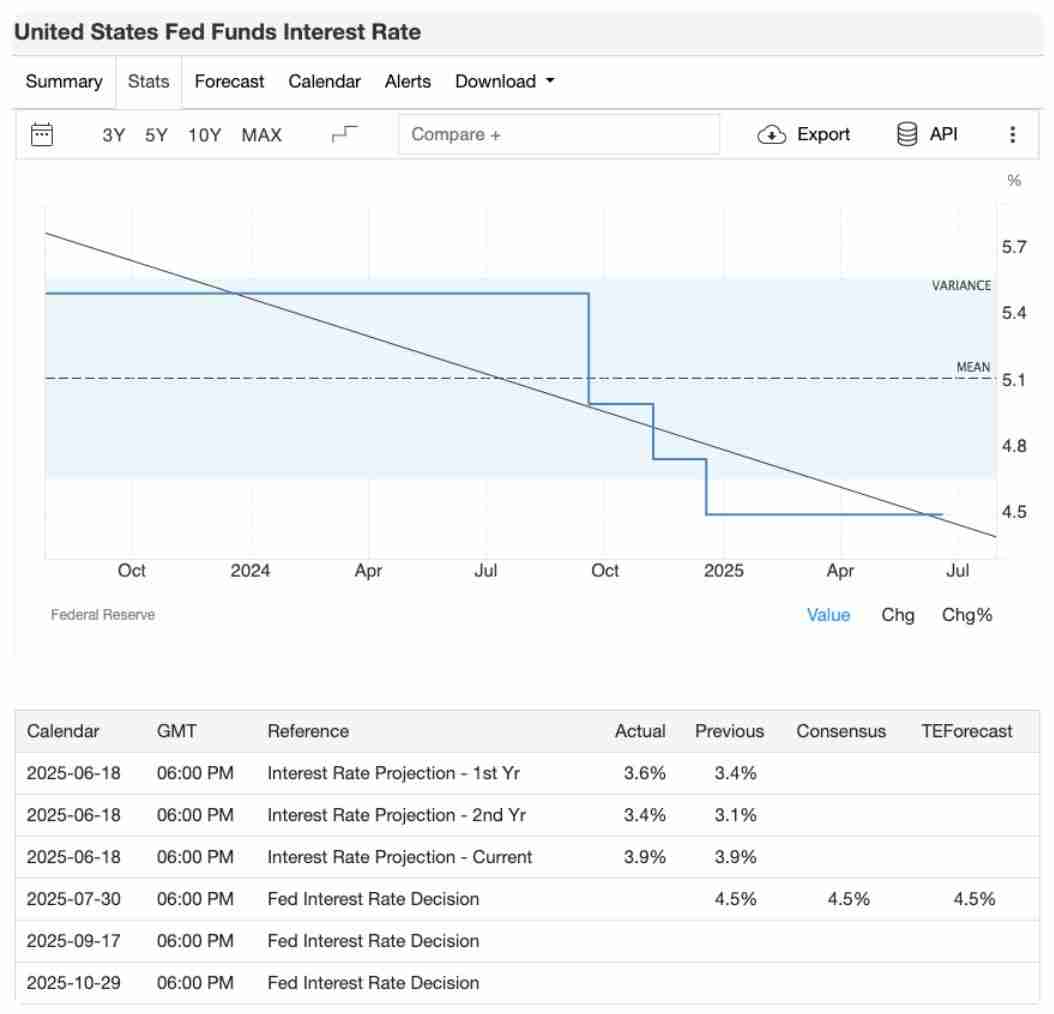

As August 2025 arrives, the global market is at a critical juncture. Although US inflation has fallen from its highs, it is still above the target level, and the Federal Reserve remains vigilant.

At the same time, global growth rates are significantly differentiated: Europe's growth has stagnated and its recovery is weak; China's recovery process is lagging; India and other emerging markets are ahead.

Against this backdrop, Bitcoin and Ethereum play dual roles.

They will rise with risk appetite - when investors chase high returns, they will fall back to the risk aversion attribute when encountering global risk events. On the other hand, as real interest rates are relatively low for a long time, and central banks repeatedly weigh the timing of interest rate hikes and interest rate cuts, they are increasingly regarded as "digital gold."

This August schedule is particularly intensive. U.S. employment and inflation data at the beginning of the month and the end of the month will affect the Fed's policy expectations; Chinese data and PMI in the middle of the month will test the resilience of the global economy; Jackson Hall annual meeting in late August will provide an important "barometer" for the Fed's future orientation.

Coupled with the geopolitical fluctuations caused by the expiration of the Sino-US tariff truce , traders need a clear timetable to decide when to increase their positions in BTC and ETH longs, when to use futures hedges, or to turn idle funds to pledges and earnings products such as XT Earn.

Let’s sort out the major schedule for August and prepare for trading.

A brief overview of macro and policy in August

Major events must be seen in August

August 1: US non-farm employment and unemployment rate★★★★

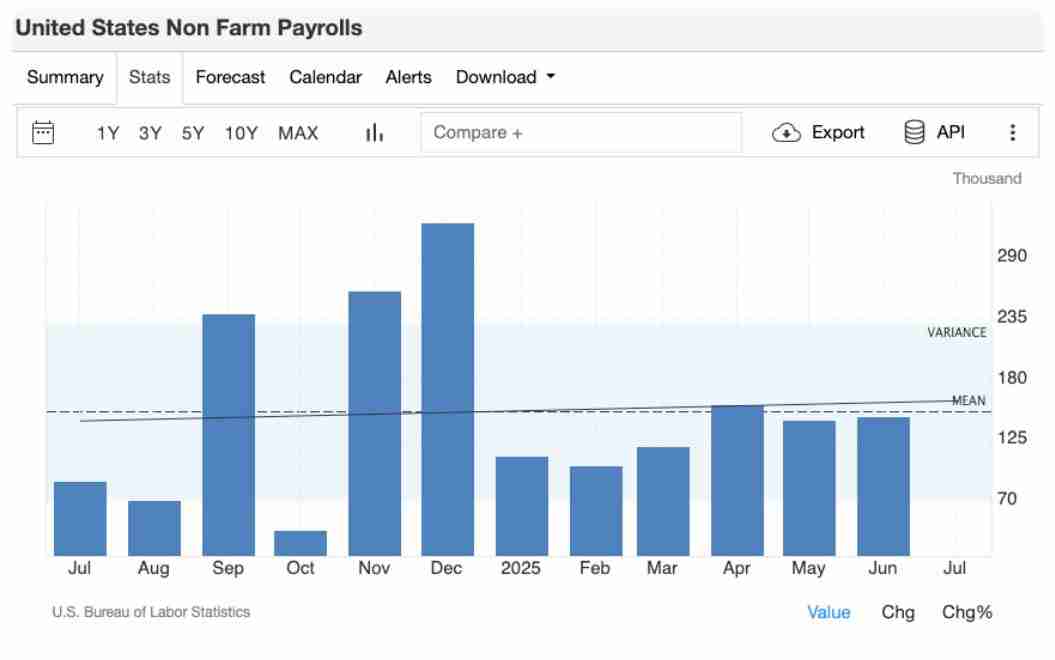

- – What to see : 147,000 new jobs were added last month, and the market expects to be about 102,000

- – Why it matters : A slowdown in employment increases expectations of rate cuts, usually driving Bitcoin and Ethereum up; conversely, strong data boosts the dollar and yields, triggering a cryptocurrency correction

- – Operation tips : Pay attention to the number of open contracts and capital rates of BTC/USDT futures and ETH/USDT futures

August 12: US CPI year-on-year (July) ★★★

- – What to look at : last month's inflation rate was 2.7%, expected to remain flat

- – Why it matters : Data consistent with expectations will keep the Fed waiting and see, and the market is relatively stable; if it is higher than expectations, yields and the US dollar will rise, which will lead to pressure on Bitcoin and Ethereum

- – Operation Tips : Track U.S. Treasury yields, DXY dollar index, and BTC/USDT spot and ETH/USDT spot trading volumes

Early August: China-US tariff truce expires★★★

- – What to see : The 90-day tariff suspension enters final stage

- – Why is important : If the truce is extended, market risk appetite will rebound and cryptocurrencies will benefit; if the truce is terminated, funds will often pour into stablecoins to avoid risks

- – Operation Tips : Monitor USDC coins and redemption volume, USD index changes, and the depth of BTC/USDT buying and selling orders

August 21–23: Jackson Hole Annual Meeting★★★★

- – What to see : Fed Chairman delivers important speech

- – Why it matters : Dove-dove-like wording may trigger a new round of rises in BTC and ETH; hawkish signals often lead to immediate sales

- – Operation Tips : Pay attention to federal funds futures prices, expected probability of CME Fed interest rates, and fund flows of BTC and ETH ETFs

August 29: Core PCE Year-on-Year-Overall & Second Quarter GDP Estimation★★★

- – What to look at : Core PCE is about 2.3% vs. 2.5%; GDP is about -0.5% vs. 2.5%

- – Why is important : If the economy picks up but inflation remains stubborn, interest rate cuts may be delayed, thereby increasing the risk-averse value of BTC; if PCE unexpectedly weakens, it may once again ignite the momentum of cryptocurrency upward momentum

- – Operation Tips : Pay close attention to changes in the size of Bitcoin ETFs’ management assets and the price trends of BTC/USDT

Weekly Economic Calendar Disassembly in August

Week 1: August 1-7

Two major data were received on August 1. The number of new non-agricultural jobs in the United States is expected to be about 102,000 in July, down from 147,000 in June. If employment growth slows down, the market will increase its bet on interest rate cuts, and Bitcoin and Ethereum will often rise in response; if the data is unexpectedly strong, the yields of the US dollar and Treasury bonds will rise, and BTC and ETH may fall back. The euro zone lightning CPI will also be released on the same day. The stable inflation of 2% annual growth usually keeps the ECB silent, and the volatility range between BTC/EUR and ETH/EUR may expand.

Image Credit: Trading Economics

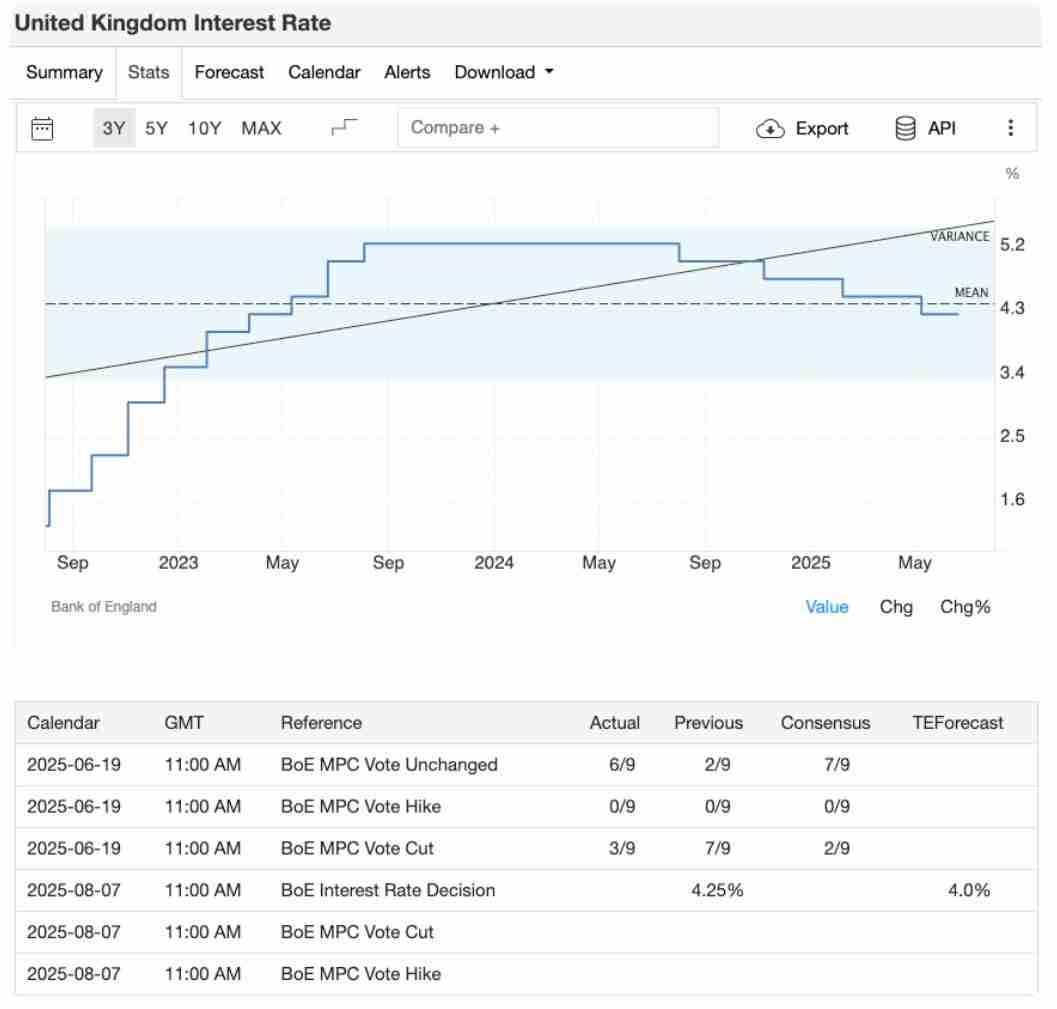

On August 7, the Bank of England meeting attracted much attention, and the market generally expected to lower interest rates by 25 basis points; interest rate cuts usually weaken the pound.

Image Credit: Trading Economics

Operation Tips

- – The volume of US holiday trading is usually low, and it is recommended to expand the stop loss range to prevent being swept out by the lightning market.

- – Pay attention to changes in futures open contracts and identify whether large investors choose to increase positions or exit.

- – Closely keep an eye on the depth of trading orders denominated by euros, and capture the sudden change in BTC/EUR demand.

Week 2: August 8th – 14th

The week was relatively calm, but it was also worth paying attention to. On August 14, the UK will release preliminary GDP data for the second quarter. If there is a contraction or significantly lower than expectations, it will often suppress global risk appetite, which will bring opportunities to buy BTC and ETH.

Image Credit: Trading Economics

Earlier this week, traders need to pay attention to the performance of the Asia-Pacific market, especially if there are policy signals from China, laying the groundwork for the formal release of industrial output and retail data next week.

Operation Tips

- – If the UK GDP unexpectedly weakens, you can find opportunities to buy on dips in the ETH/USDT spot market.

- – Track the trading volume of BTC/USDT futures in the Asia-Pacific region and grasp regional sentiment changes.

Week 3: August 15th – 21st

This week's data is intensive and has a decisive significance for the market direction. If the US CPI on August 12 (2.7% year-on-year) is consistent with expectations, it will usually support cryptocurrency gains; if it is higher than expectations, BTC and ETH tend to pull back quickly.

Image Credit: Trading Economics

Immediately after August 14, China will announce its retail and industrial output in July. If the data exceeds expectations, altcoins and mining-related tokens in the Asia-Pacific market will be boosted. If the People's Bank of China has cut interest rates or other liquidity support around August 20, the futures and spot trading on local exchanges may experience a significant recovery.

Image Credit: Trading Economics

On August 21, Flash PMI data from the United States, Europe and the United Kingdom will be welcomed. If the manufacturing industry continues to fall below the boom and bust line, it will often increase the risk preference of the crypto market; if the service industry data is significantly better than expected, it may temporarily suppress market expectations for interest rate cuts.

Operation Tips

- – Build positions in BTC and ETH in batches before the US CPI, and moderately reduce leverage and prevent risks.

- – You can set up a cross-knock stop loss order on ETH/USDT futures and BTC/USDT futures to catch fluctuations without predicting the direction.

- – Pay attention to the changes in the entrustment book of local exchanges after the release of China’s policy signals, and take the lead in capturing the initial market movement.

Week 4: August 22-28

From August 21 to 23, Jackson Hole's annual meeting took place, and the speech of the Federal Reserve Chairman was a market trend. Dove remarks often trigger a rebound in Bitcoin and Ethereum, while dove warnings will lead to a rapid decline.

Image Credit: Trading Economics

In the same week, the ECB will also release M3 broad money supply data. If the growth rate of M3 accelerates, it will help boost inflation expectations, thereby benefiting crypto assets; if the growth rate slows down, it may aggravate market concerns about economic slowdown and suppress risky assets.

Image Credit: Trading Economics

Operation Tips

- – During Jackson Hall, we paid attention to the flow of federal funds rate futures and ETF funds to judge the institutions’ real demand for BTC and ETH.

- – Track the amount of coins and destruction of stablecoins and figure out the trends of liquidity after changes in the euro zone’s currency supply.

Week 5: August 29-31

The end of the month is often the most intense. On August 29, the Federal Reserve Chairman's speech made another appearance, and welcomed the second-quarter GDP estimate and core PCE inflation data. If economic growth recovers and inflation remains stubborn, it will further postpone the expectation of interest rate cuts and enhance Bitcoin's "macro hedging" attributes; if PCE unexpectedly weakens, it may ignite the upward action energy of cryptocurrencies again.

Image Credit: Trading Economics

Operation Tips

- – Appropriately reduce leverage or turn to cross-period spread strategies to smooth out the end of the month.

- – After the Fed's speech, it closely tracked changes in the asset scale of Bitcoin ETFs and confirmed the inflow of institutional funds.

Risk management and precautions

Beware of false breakthroughs

- – Major events often start with “rumored buying” and “facts sold” after the data is released. When Bitcoin or Ethereum breaks through the key price, it is recommended to wait until the daily closing confirms before adding positions.

Prevent flash crashes

- – Big headlines can sometimes trigger instant killing, especially for small-cap currencies operated by leverage. Trading can be suspended immediately after release, or a looser stop loss can be set for such tokens.

Pay attention to slippage and spread

- – Market liquidity is prone to dry up when the holiday is approaching or when the policy is announced. Large BTC or ETH trading is recommended to split into multiple transactions, or be completed through off-market (OTC) to reduce slippage costs.

Pay attention to the "bottleneck" of stablecoins

- – Regulatory changes may cause stablecoin redemption to slow down. It is recommended to reserve a portion of funds in non-algorithmic dollar assets to prevent the inability to withdraw funds in time when the liquidity of stablecoins is suddenly tight.

Frequently Asked Questions about August Economic Calendar

1. Which August events are most critical to the crypto market?

The speeches were given by the US non-farm on August 1, the US CPI on August 12, the Jackson Hall annual meeting from August 21 to 23, and the secondary estimate of core PCE and second quarter GDP on August 29. These announcements often trigger the largest fluctuations in BTC and ETH.

2. How to prepare before major data is released?

It is recommended to build positions in bitcoin and Ethereum in batches a few days in advance, and then reduce leverage before the data is released. If on-chain liquidity is weakened, idle funds can be placed into earning products such as XT Earn.

3. What are the suitable ordering methods on the release date?

One order cancellation of another order (OCO) and a trade-to-trade stop loss order are most practical in the BTC/USDT or ETH/USDT futures market, and can capture the market without predicting the direction.

4. How to distinguish between true and false breakthroughs?

Real trends are usually accompanied by large trading volume. Whether it is spot or futures, if prices rise or fall, lack trading volume support, it is likely to be a short-term false breakthrough.

5. Do pledge strategies need to be adjusted when fluctuations are severe?

need. Blockbuster events will affect pledge yield and liquidity. Be sure to dynamically adjust the ratio of Bitcoin staking and Ethereum staking based on the on-chain staking inflow.

The above is the detailed content of 5 major economic events that crypto traders must not miss in August: Your BTC and ETH investment strategy. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

Domestic purchase of Bitcoin must be carried out through compliance channels, such as Hong Kong licensed exchanges or international compliance platforms; 2. Complete real-name authentication after registration, submit ID documents and address proof and perform facial recognition; 3. Prepare legal currency and recharge it to the trading account through bank transfer or electronic payment; 4. Log in to the platform to select Bitcoin trading pairs, set limit orders or market orders to complete the transaction; 5. Pay attention to market fluctuations and platform security, enable dual certification and comply with domestic regulatory policies; overall, investors should operate cautiously under the premise of compliance and participate in Bitcoin investment rationally.

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

The total amount of Bitcoin is 21 million, which is an unchangeable rule determined by algorithm design. 1. Through the proof of work mechanism and the issuance rule of half of every 210,000 blocks, the issuance of new coins decreased exponentially, and the additional issuance was finally stopped around 2140. 2. The total amount of 21 million is derived from summing the equal-scale sequence. The initial reward is 50 bitcoins. After each halving, the sum of the sum converges to 21 million. It is solidified by the code and cannot be tampered with. 3. Since its birth in 2009, all four halving events have significantly driven prices, verified the effectiveness of the scarcity mechanism and formed a global consensus. 4. Fixed total gives Bitcoin anti-inflation and digital yellow metallicity, with its market value exceeding US$2.1 trillion in 2025, becoming the fifth largest capital in the world

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

Jul 30, 2025 pm 09:33 PM

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

Jul 30, 2025 pm 09:33 PM

What are directory Maker and pending orders? How to calculate MakerFee? MakerFee calculation formula. Is it necessary to use limit orders? Taker and eat orders? How to calculate TakerFee How to determine whether you are Maker or Taker lazy package – Maker/taker fee spot maker/taker fee lazy package contract maker/taker fee lazy package How to reduce Maker/taker transaction fees for various virtual currency exchanges

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

The comparison between the opening price and the closing price can effectively judge the trend direction of the digital currency. 1. The opening price reflects the initial strength of long and short, which is significantly higher than the previous closing price and the increase in volume is a short-term bullish signal; 2. The closing price verifies the trend, breaking through the resistance level or continuously standing firm in the moving average is a sign of medium-term strength; 3. In combination of the combination analysis, the long positive line indicates a strong rise, the long negative line shows downward pressure, and the cross star indicates a possible reversal or stabilize; 4. Combining the moving average and the Bollinger band can enhance judgment. If the 5-day moving average is stable and the high opening is a long signal, the Bollinger band closes positive or oversold rebound; 5. It needs to be supplemented by capital flow and market sentiment. The high volume increase in the opening indicates that the main force enters the market. The high opening and high closing or low opening and low closing caused by major news will strengthen the trend. Investors should integrate K-line patterns, technical indicators and market trends

What is Binance Treehouse (TREE Coin)? Overview of the upcoming Treehouse project, analysis of token economy and future development

Jul 30, 2025 pm 10:03 PM

What is Binance Treehouse (TREE Coin)? Overview of the upcoming Treehouse project, analysis of token economy and future development

Jul 30, 2025 pm 10:03 PM

What is Treehouse(TREE)? How does Treehouse (TREE) work? Treehouse Products tETHDOR - Decentralized Quotation Rate GoNuts Points System Treehouse Highlights TREE Tokens and Token Economics Overview of the Third Quarter of 2025 Roadmap Development Team, Investors and Partners Treehouse Founding Team Investment Fund Partner Summary As DeFi continues to expand, the demand for fixed income products is growing, and its role is similar to the role of bonds in traditional financial markets. However, building on blockchain

Binance Exchange official website login registration portal

Jul 30, 2025 pm 09:03 PM

Binance Exchange official website login registration portal

Jul 30, 2025 pm 09:03 PM

Visit Binance official website and click the registration button to select individual users; 2. Fill in your email or mobile phone number and strong password to complete information registration; 3. Enter the identity authentication (KYC) stage to upload your ID and complete facial recognition; 4. Enter the registration information when logging in to your account and enable 2FA dual-factor authentication to improve security; 5. Be careful not to leak verification codes, enable anti-phishing codes, and use compliant substations such as Binance.US according to the region; 6. You can download the official app to achieve mobile operation; 7. If you fail to log in, you can reset your password, and contact customer service if you are delayed in authentication. It is recommended to set a whitelist and cold storage for funds security; the overall process is simple but you must strictly follow security specifications to ensure account security.

How should novices allocate positions when trading cryptocurrency

Jul 30, 2025 pm 10:24 PM

How should novices allocate positions when trading cryptocurrency

Jul 30, 2025 pm 10:24 PM

Novice should reasonably allocate positions to control risks. Specific strategies include: 1. Use 5%-10% of the disposable funds to participate in high-risk assets, and the holding of a single token shall not exceed 2% of the total position; 2. Mainstream assets in diversified investment account for 60%-70%, medium-sized market capitalization projects shall not exceed 20%, and emerging tokens shall be controlled within 10%; 3. Adopt the pyramid position building method, with the first investment of 30%, 5%-added 20%, and after the trend is confirmed, the stop loss of 2-3 times is supplemented; 4. Set the stop loss of mainstream assets to 8%-12%, high-risk assets to 5%-8%, and the profit exceeds 15% and mobile stop loss is enabled; 5. Rebalance every quarter, partially take profits to increase by more than 50%, reduce positions by 10%, and maintain the initial asset ratio; the core principle is to disperse allocation and strictly control single products

Why do you say you choose altcoins in a bull market and buy BTC in a bear market

Jul 30, 2025 pm 10:27 PM

Why do you say you choose altcoins in a bull market and buy BTC in a bear market

Jul 30, 2025 pm 10:27 PM

The strategy of choosing altcoins in a bull market, and buying BTC in a bear market is established because it is based on the cyclical laws of market sentiment and asset attributes: 1. In the bull market, altcoins are prone to high returns due to their small market value, narrative-driven and liquidity premium; 2. In the bear market, Bitcoin has become the first choice for risk aversion due to scarcity, liquidity and institutional consensus; 3. Historical data shows that the increase in the bull market altcoins in 2017 far exceeded that of Bitcoin, and the decline in the bear market in 2018 was also greater. In 2024, funds in the volatile market will be further concentrated in BTC; 4. Risk control needs to be vigilant about manipulating traps, buying at the bottom and position management. It is recommended that the position of altcoins in a bull market shall not exceed 30%, and the position holdings of BTC in a bear market can be increased to 70%; 5. In the future, due to institutionalization, technological innovation and macroeconomic environment, the strategy needs to be dynamically adjusted to adapt to market evolution.