web3.0

web3.0

Will Bitcoin hit a new high by analyzing the Bitcoin trend chart by gold cross-analyzing it?

Will Bitcoin hit a new high by analyzing the Bitcoin trend chart by gold cross-analyzing it?

Will Bitcoin hit a new high by analyzing the Bitcoin trend chart by gold cross-analyzing it?

Jul 25, 2025 am 06:03 AMTable of contents

- What is a golden cross and why is it so important in cryptocurrencies?

- Bitcoin Chart Analysis: Golden Cross with the Path of 150K USD

- Potential transaction settings

- A more macro perspective: macro trends drive bull market expectations

- Key considerations for using gold crossover for Bitcoin price prediction

- FAQ: Gold Cross and Bitcoin Price Outlook

- 1. What is a golden cross?

- 2. When was the last time Bitcoin formed a golden cross?

- 3. Does the gold cross guarantee price increases?

- 4. What are the current main support and resistance levels of Bitcoin?

- 5. How high can Bitcoin reach in this cycle?

- Conclusion: Is Bitcoin gold crossing a callback or an opportunity?

Bitcoin recently broke $123,000, a new high, but has not stayed for too long. Prices then fell back to about $117,000 and the market entered a cooling phase. This is normal; after a sharp rebound, prices will usually be paused or pulled back because traders will take profits and weaken momentum.

We can also see these signs in the wider cryptocurrency market. Market sentiment has become more cautious, and the cryptocurrency fear and greed index is no longer in the "extremely greedy" area.

Meanwhile, financing rates (i.e. the cost of holding long positions) have returned to relatively stable levels. Simply put, the hype begins to calm down.

But that doesn't mean the rebound is over. Many traders believe that the callback is actually a healthy correction rather than a weak signal. And there is a key reason for their optimism: Bitcoin’s golden cross on the daily chart. This may just be a fluctuation, indicating that a larger market is coming? This is exactly what we are about to discover.

In this article, we will explain what the golden cross means, why it is so important, and whether it can push Bitcoin to the $150,000 mark. We will explore historical context, technical goals, and key levels that need to be paid attention to next.

What is a golden cross and why is it so important in cryptocurrencies?

So, what exactly is this signal that makes traders pay attention to it again?

Golden Cross is a classic chart pattern that occurs when Bitcoin’s 50-day simple moving average (SMA) (reflects short-term price changes) breaks through the 200-day simple moving average. Simply put, it indicates that the market momentum has changed from bearish to bullish.

Source: BTC/USDT Trading Chart From BingX

This may sound technical, but historically, such crossovers often lead to huge price increases.

Please check the chart below:

Whenever Bitcoin crosses gold over a longer time frame, it usually follows a big rebound. In 2015, it triggered a 139% rebound. In 2016, the gold cross marked the beginning of a 2,200% bull market, and in 2020, the gold cross also heralds a wave of up to 1,190% rebound, with Bitcoin soaring from about $10,000 to nearly $70,000.

Now, again, we see the same signal flashing in May 2025, with the crossover happening at the price point of about $65,000. Bitcoin has risen by more than 12% so far, but history shows that the real market may still be ahead.

The BTC/USD chart highlights past golden crosses and historic rebounds. Source: Merlijn The Trader Through X

It is worth noting that the gold cross is a lagging indicator, which means it does not predict the uptrend before the rebound begins, but rather confirms that the trend is already strengthening. But when it combines with rising trading volume, healthy pullbacks, and strong macro support, it becomes a powerful tool for traders.

On the other hand, if the 50-day simple moving average (SMA) falls below the 200-day SMA, we will see the so-called death crossover, which is a warning sign of a potential downtrend.

But at present, the bull market still controls the market. If history repeats itself—even rhyme—the golden crossover may be laying the foundation for Bitcoin’s next major rally.

Bitcoin Chart Analysis: Golden Cross with the Path of 150K USD

?Although Bitcoin has recently dropped from $123K to around $117K, the overall structure of Bitcoin is still favoring bulls, and the chart tells us why.

The key technical indicator is the Golden Cross, which appeared on May 23, 2025, when the 50-day simple moving average (SMA) broke through the 200-day SMA. This bullish crossover, which appeared at about $93,000, confirmed a shift in market momentum just before Bitcoin broke through the long-term consolidation triangle.

Bitcoin surged nearly 48% after the gold crossover, reaching a record $123,315 at the end of June. This wave of upswing is not just a technical factor, it is supported by a clean breakout structure, rising trading volume and rebound from the trend line on the triangle.

Source: BTC/USDT Trading Chart on BingX

Although Bitcoin has declined since then, the technology remains positive.

The following are the specific decompositions:

? Golden Cross Confirmation: May 23, $93,000

? Real-time support area: $113,000–$115,000 (Fibonacci 0.382)

? Strong support: $110,754 (Fibonacci 0.5), and $107,666 (Fibonacci 0.618)

? Main technical bottom: $105,000–$108,000, close to the uptrend line and 50-day simple moving average (SMA)

? Key resistance levels: $123,000–$125,000; Bitcoin needs to break through this area at the daily closing price to confirm a new breakthrough

? Fibonacci expansion targets:

- First goal: $134,956

- Second goal: $150,204

This sorting pattern is not uncommon for a breakthrough to appear immediately. A pullback after a gold cross usually creates new accumulation areas to prepare for the next wave of gains. The key point is whether Bitcoin can stay above the $110,000–$113,000 area and rebound strongly to $123,000.

Potential transaction settings

? Admission option 1: Confirm rebound from the $113,000–$114,000 area

? Enter option 2: Breakthrough and backtest $125,000 or above

? Target:

- First goal: $134,000

- Second goal: $150,000

? Stop Loss Recommendation: Below $105,000 (below Fibonacci 0.618 and 50-day SMA support)

In short, the Golden Cross has achieved its first wave of trend. But if Bitcoin can hold on to key support and break through resistance again, we may be in the early stages of a larger rebound, possibly eventually moving towards $150,000.

A more macro perspective: macro trends drive bull market expectations

In addition to technical signals, Bitcoin’s rally is also driven by strong macroeconomic trends that continue to favor the market for bulls.

? The Fed maintains interest rates between 4.25% and 4.5%, but recent remarks from Fed Chairman Christopher Waller show that interest rate adjustments are coming. The market now expects interest rate cuts in the fourth quarter of 2025, and the first wave of interest rate cuts may occur in September. Historically, lower interest rates have weakened the dollar and flowed money into risky assets like Bitcoin.

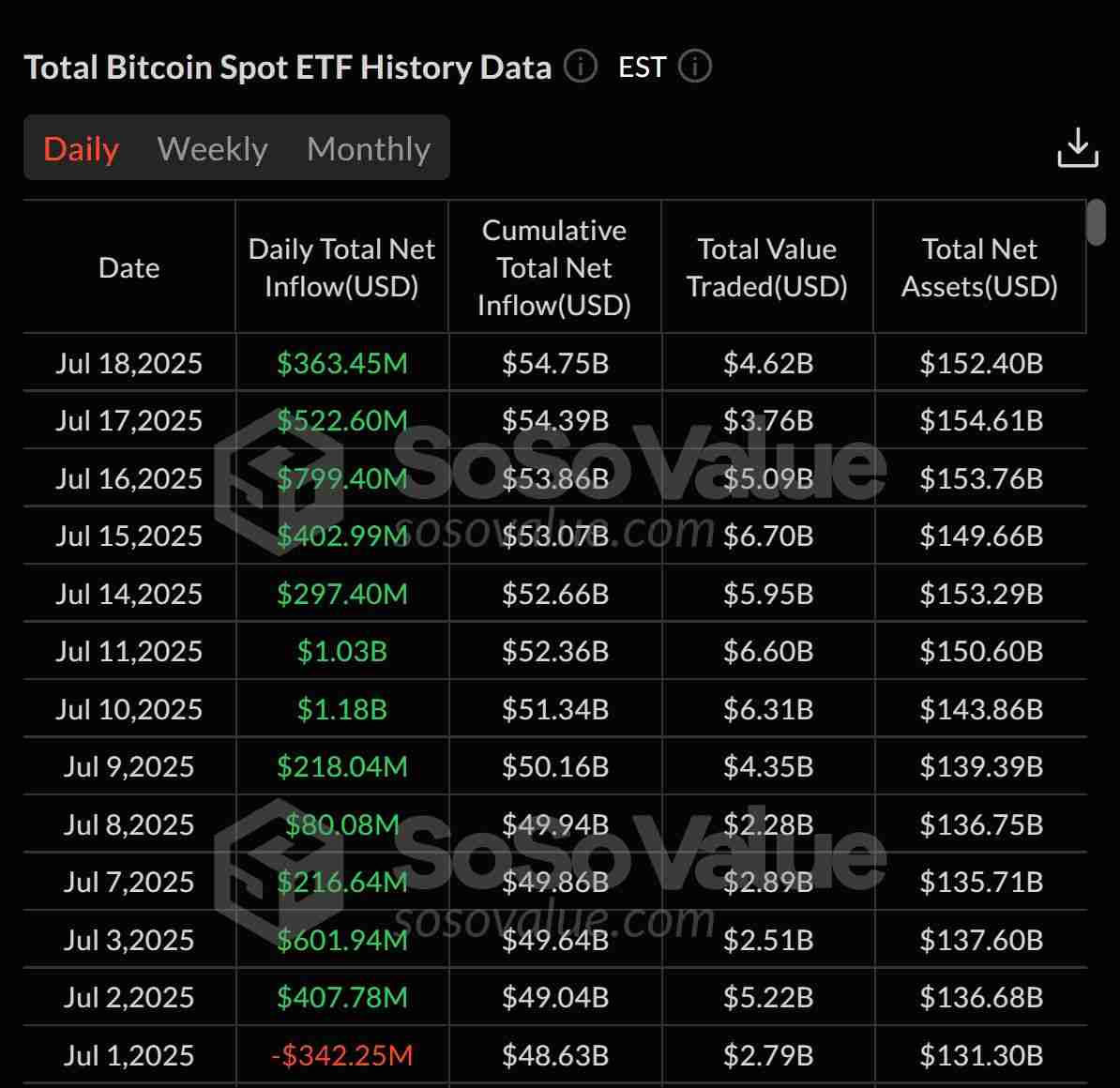

? Meanwhile, institutional demand is surging. The spot Bitcoin ETF, led by BlackRock's IBIT and Fidelity's FBTC, recorded $2.39 billion inflows in the first week of July alone, driving total assets over $152 billion. Such capital inflows cannot be ignored.

Spot Bitcoin ETF has inflowed funds for 12 consecutive days. Source: SoSoValue

? On the global market, the continued weakness of the yen and the euro has prompted investors to turn their funds to Bitcoin in response to the instability of fiat currencies. Meanwhile, the amount of Bitcoin held by businesses and countries is still increasing. Japan's Metaplanet currently has over 7,800 bitcoins, surpassing El Salvador's 5,750 bitcoins.

As Bitcoin’s dominance in the cryptocurrency market rises again, market confidence is clearly flowing back to large assets. Combined with the technical setting, the macro background also supports this view that the price of $150,000 is not only possible, but is actually increasingly possible.

Key considerations for using gold crossover for Bitcoin price prediction

The gold cross is a popular bullish signal, but it also has its limitations when predicting Bitcoin price movements. As a lag indicator, it usually reflects the momentum that has occurred, which makes it prone to false signals in more volatile markets. To improve accuracy, traders often use it in conjunction with other technical tools, such as the Relative Strength Index (RSI) to measure overbought, the Moving Average Convergence Diffusion Indicator (MACD) to confirm momentum, or use Bollinger to identify volatility and potential breakthrough areas. Using these indicators together can provide a more balanced perspective before making a trading decision.

FAQ: Gold Cross and Bitcoin Price Outlook

1. What is a golden cross?

The gold cross is a bullish chart pattern, formed when the 50-day simple moving average (SMA) breaks through the 200-day SMA. This indicates that market momentum is turning to buyers and is often seen as confirmation of a long-term uptrend.

2. When was the last time Bitcoin formed a golden cross?

The latest gold crossover appeared on May 23, 2025, when Bitcoin was trading at about $93,000. It is after a breakthrough in a long-term integration model and heralds the formation of a new high.

3. Does the gold cross guarantee price increases?

No, the gold cross does not guarantee price increases, but historically it usually heralds a major uptrend. It is considered a lag indicator, which means it confirms existing momentum rather than predicting future trends.

4. What are the current main support and resistance levels of Bitcoin?

? Resistance level: USD 123K–125K (all history high point area)

? Support level: 113K–115K USD (Fibonacci 0.382), 105K–108K USD (50-day SMA vs. Main Trend Line)

5. How high can Bitcoin reach in this cycle?

If the historical gold crossover pattern reappears and macro trends remain supportive, many analysts believe that $150,000 is a realistic upside target. You can also use BingX AI to analyze market trends and gain insights into Bitcoin price dynamics. However, remember that this is not financial advice. Always conduct DYOR (self-study) before making any trading decisions.

Conclusion: Is Bitcoin gold crossing a callback or an opportunity?

The latest gold cross on the Bitcoin daily chart reinforces the long-term bullish trend, even as Bitcoin pulls back from an all-time high of nearly $123,000. Historically, this pattern often marked the beginning, not the end of a major rebound.

This pullback may just be a healthy adjustment, allowing momentum and market sentiment to cool down and prepare for the next wave of rise. But for the rebound to continue, Bitcoin must return and break through the $123,000 to $125,000 resistance zone with strong trading volume.

If the breakthrough is effective, Bitcoin may climb to $150,000 in the next few months, both technically and macro-context.

However, this is still a market driven by confirmation and momentum. Waiting for critical levels to be confirmed and operating in accordance with risk management will be crucial to navigating the most explosive phase that Bitcoin may enter.

This article is for reference information only and does not constitute financial advice. The cryptocurrency market is highly volatile and involves significant risks. Please be sure to research and consult a financial advisor before making investment decisions.

Here’s the article about analyzing Bitcoin trend charts through gold cross-analysis. Will Bitcoin hit a new high? That’s all for the article. For more related content on Bitcoin future analysis, please search for previous articles on this site or continue browsing the related articles below. I hope everyone will support this site in the future!

The above is the detailed content of Will Bitcoin hit a new high by analyzing the Bitcoin trend chart by gold cross-analyzing it?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

1. First, ensure that the device network is stable and has sufficient storage space; 2. Download it through the official download address [adid]fbd7939d674997cdb4692d34de8633c4[/adid]; 3. Complete the installation according to the device prompts, and the official channel is safe and reliable; 4. After the installation is completed, you can experience professional trading services comparable to HTX and Ouyi platforms; the new version 5.0.5 feature highlights include: 1. Optimize the user interface, and the operation is more intuitive and convenient; 2. Improve transaction performance and reduce delays and slippages; 3. Enhance security protection and adopt advanced encryption technology; 4. Add a variety of new technical analysis chart tools; pay attention to: 1. Properly keep the account password to avoid logging in on public devices; 2.

USDT virtual currency account activation guide USDT digital asset registration tutorial

Aug 01, 2025 pm 11:36 PM

USDT virtual currency account activation guide USDT digital asset registration tutorial

Aug 01, 2025 pm 11:36 PM

First, choose a reputable digital asset platform. 1. Recommend mainstream platforms such as Binance, Ouyi, Huobi, Damen Exchange; 2. Visit the official website and click "Register", use your email or mobile phone number and set a high-strength password; 3. Complete email or mobile phone verification code verification; 4. After logging in, perform identity verification (KYC), submit identity proof documents and complete facial recognition; 5. Enable two-factor identity verification (2FA), set an independent fund password, and regularly check the login record to ensure the security of the account, and finally successfully open and manage the USDT virtual currency account.

Binance download official website https Binance APP download link official website https

Aug 01, 2025 pm 11:21 PM

Binance download official website https Binance APP download link official website https

Aug 01, 2025 pm 11:21 PM

Binance APP is a world-leading digital asset service application, providing users with safe and convenient trading experience and comprehensive market information. Through its official mobile client, users can grasp the latest market trends, manage personal digital assets, and conduct diversified trading operations anytime and anywhere. This article will introduce in detail how to obtain and install the Binance APP through official channels, as well as its core functions and usage techniques, to help users use the platform safely and efficiently.

JD Stablecoin Official Website Where to buy JD Stablecoin

Aug 01, 2025 pm 06:51 PM

JD Stablecoin Official Website Where to buy JD Stablecoin

Aug 01, 2025 pm 06:51 PM

Currently, JD.com has not issued any stablecoins, and users can choose the following platforms to purchase mainstream stablecoins: 1. Binance is the platform with the largest transaction volume in the world, supports multiple fiat currency payments, and has strong liquidity; 2. OKX has powerful functions, providing 7x24-hour customer service and multiple payment methods; 3. Huobi has high reputation in the Chinese community and has a complete risk control system; 4. Gate.io has rich currency types, suitable for exploring niche assets after purchasing stablecoins; 5. There are many types of currency listed on KuCoin, which is conducive to discovering early projects; 6. Bitget is characterized by order transactions, with convenient P2P transactions, and is suitable for social trading enthusiasts. The above platforms all provide safe and reliable stablecoin purchase services.

Will Ethereum callback 2000? A brief overview of Ethereum's trends in recent years

Aug 01, 2025 pm 10:39 PM

Will Ethereum callback 2000? A brief overview of Ethereum's trends in recent years

Aug 01, 2025 pm 10:39 PM

The price fluctuations of ETH have touched the hearts of countless investors, and discussions about whether its prices will bottom out again have never stopped. This article will review the price trends of Ethereum in recent years, and combine current market fundamentals and technical indicators to explore whether it is possible to pull back to the key support level of US$2,000, providing readers with a multi-dimensional market observation perspective.

Ouyi app download and trading website Ouyi exchange app official version v6.129.0 download website

Aug 01, 2025 pm 11:27 PM

Ouyi app download and trading website Ouyi exchange app official version v6.129.0 download website

Aug 01, 2025 pm 11:27 PM

Ouyi APP is a professional digital asset service platform dedicated to providing global users with a safe, stable and efficient trading experience. This article will introduce in detail the download method and core functions of its official version v6.129.0 to help users get started quickly. This version has been fully upgraded in terms of user experience, transaction performance and security, aiming to meet the diverse needs of users at different levels, allowing users to easily manage and trade their digital assets.

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

First, choose a reputable trading platform such as Binance, Ouyi, Huobi or Damen Exchange; 1. Register an account and set a strong password; 2. Complete identity verification (KYC) and submit real documents; 3. Select the appropriate merchant to purchase USDT and complete payment through C2C transactions; 4. Enable two-factor identity verification, set a capital password and regularly check account activities to ensure security. The entire process needs to be operated on the official platform to prevent phishing, and finally complete the purchase and security management of USDT.

Ouyi · Official website registration portal | Support Chinese APP download and real-name authentication

Aug 01, 2025 pm 11:18 PM

Ouyi · Official website registration portal | Support Chinese APP download and real-name authentication

Aug 01, 2025 pm 11:18 PM

The Ouyi platform provides safe and convenient digital asset services, and users can complete downloads, registrations and certifications through official channels. 1. Obtain the application through official websites such as HTX or Binance, and enter the official address to download the corresponding version; 2. Select Apple or Android version according to the device, ignore the system security reminder and complete the installation; 3. Register with email or mobile phone number, set a strong password and enter the verification code to complete the verification; 4. After logging in, enter the personal center for real-name authentication, select the authentication level, upload the ID card and complete facial recognition; 5. After passing the review, you can use the core functions of the platform, including diversified digital asset trading, intuitive trading interface, multiple security protection and all-weather customer service support, and fully start the journey of digital asset management.