web3.0

web3.0

Bitcoin dominance has dropped sharply, Ethereum has performed strongly, and the copycat season is ready to go

Bitcoin dominance has dropped sharply, Ethereum has performed strongly, and the copycat season is ready to go

Bitcoin dominance has dropped sharply, Ethereum has performed strongly, and the copycat season is ready to go

Jul 24, 2025 pm 11:36 PMTable of contents

- Bitcoin market share fell by 5.84% in a single week, the biggest drop in three years

- The altcoin seasonal index rose to 54, hitting a new high this year

- The weather vane of the altcoin market——ETH trend is strong

- Mainstream altcoins are making efforts, and the peak altcoins season has quietly begun?

- Macro variables are still key, and the direction of the FCC policy has attracted attention

Bitcoin (BTC) dominance has weakened significantly, the altcoin season index has steadily climbed, and market funds are gradually flowing to mainstream alternative tokens such as Ethereum (ETH). ETH has performed well recently, with a strong price breaking through the $3,800 mark, becoming the focus of market attention. Does this round of market herald the arrival of the "peak season of altcoin"? This article will conduct in-depth analysis of current market trends.

? Bitcoin market share fell by 5.84% in a single week, the biggest drop in three years

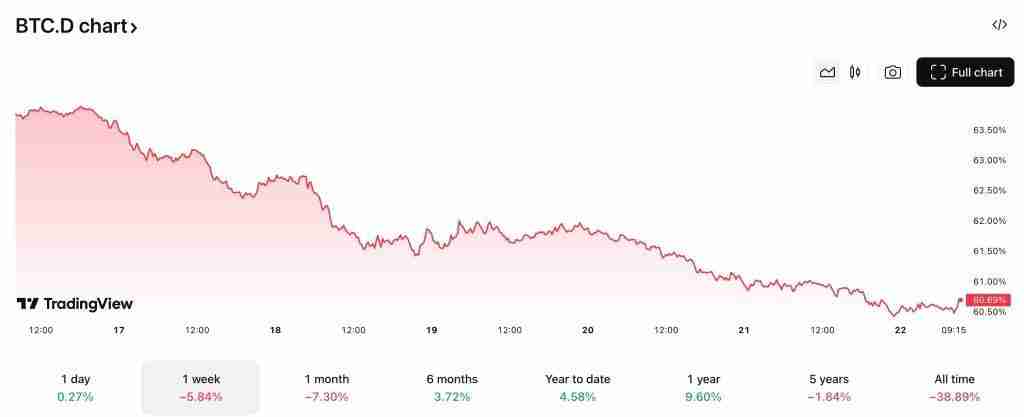

According to the latest data from TradingView, as of July 22, Bitcoin's market share continued to decline, falling to 60.69%, with a cumulative decline of 7.3% this month, the lowest level in the past five months; the single-week decline reached 5.84 percentage points, the worst weekly decline since June 2022.

It should be emphasized that the decline in BTC's dominance this time is not due to its own sharp pullback, but because Ethereum and a number of mainstream altcoins performed strongly, with the increase far exceeding Bitcoin, thus "squeezing" BTC's share of the total market value. Not long ago, the indicator once approached 66%. The rapid decline now reflects a structural change in market capital allocation.

Related Reading: What is Bitcoin’s dominance? BTC's market share is approaching 65%, what impact will it have on the cryptocurrency market?

? The altcoin seasonal index rose to 54, hitting a new high this year

CoinMarketCap data shows that the current Altcoin Season Index has climbed to 54, reaching its peak this year. This means that 54% of the top 100 crypto assets with market caps have exceeded Bitcoin in the past 90 days. Although there is still a gap from the recognized "counterfeit season" launch standard (75% outperforms BTC), the current trend has clearly shown that the overall momentum of altcoins is increasing.

Although only about half of the altcoins outperform Bitcoin at present and there is still room for a full explosion, market potential is accumulating. According to CMC statistics, the index was only 30 in May this year, and it hit its annual high of 87 in December 2024. If funds continue to pour into ETH and related popular projects, a new round of Altseason may be expected to start. The top ten altcoins with the current 90-day increase include: PENGU, SPX, CFX, VIRTUAL, WIF, etc.

Related Reading: What is an altcoin? What are there? 2025 latest altcoin ranking and potential coin recommendations

The weather vane of the altcoin market——ETH trend is strong

Recently, the market focus has clearly shifted to ETH, which has always been regarded as the "barometer" of the altcoin market. Market data shows that the ETH quote on July 22 was US$3,735, with a 24-hour turnover of more than US$46 billion, an increase of more than 20% in the past seven days, and once surged to more than US$3,850 during the session, setting a new high since February 2024.

On-chain information reveals that World Liberty Financial (WLF), a Trump family-affiliated investment institution, has purchased a total of 66,275 ETH from November 29, 2024 to March 5, 2025, with an average holding cost of about US$3,243. Recently, WLF made another move on July 18, spending US$3 million to increase its holdings of 861 ETH. As of now, its total ETH holdings have reached 70,143, with a market value of approximately US$251 million based on the current price.

The main factors driving ETH rise include:

- Spot ETFs continue to attract money, and institutions continue to increase their investment: BlackRock, SharpLink Gaming, WLF and other institutions continue to flow into Ethereum spot ETFs. Since the product was launched, net inflows have been achieved for 11 consecutive trading days. Among them, the daily inflow on July 16 was as high as US$727 million, and the next day it recorded US$602 million, providing solid support for ETH prices.

- On-chain activity rebounds, DeFi rebounds : Data shows that the average daily transaction volume of Ethereum network has increased from about 1.1 million in April to 1.4 million at present. At the same time, buying in Asia is active, capital fee rates rise, and the use rate of DeFi protocols rebounds, jointly boosting ETH.

Related reading: 2025 Ethereum Eco Series Token Summary: Which Ethereum chain currencies will benefit from the rise of Ethereum?

Mainstream altcoins are making efforts, and the peak altcoins season has quietly begun?

In addition to ETH, mainstream altcoins such as XRP, SOL, and LINK have also strengthened one after another, and the market's attention to whether the "copy season" is coming is increasing. Data shows that XRP rose more than 24% this week, with a market value exceeding US$210 billion, ranking third in the world, second only to BTC and ETH.

Typically, the collective rise of altcoins is often led by ETH. If this round of rise continues, it may drive a wider capital flow into the mainstream and small and medium-sized token markets. However, BTCC analysts pointed out that the current overall monthly trading volume of altcoins is still lower than the annual average, and the market may be in the consolidation stage, and comprehensive rotation still needs to be observed and confirmed.

"Although ETH and some mainstream altcoins have shown strength, this round of rise is mainly driven by institutions, and whether it can spread to the entire market remains to be verified," said Presto Research analyst Min Jung.

In addition, this round of market lacks strong emerging narrative support, and some projects are facing pressure to unlock tokens, so the overall rotation rhythm is still relatively cautious.

Related Reading: What does token unlock mean? Why do you need attention? Latest token unlocking schedule in July 2025

Macro variables are still key, and the direction of the FCC policy has attracted attention

The subsequent trend of the crypto market, especially whether Bitcoin can maintain the current range, is still highly dependent on US macroeconomic data and monetary policy trends. Next, we need to focus on key indicators such as the number of initial unemployment benefits, manufacturing and service industry PMI, which will affect the judgment of the Federation's interest rate resolution on July 30.

According to CME FedWatch tools, the market generally expects that the meeting will keep interest rates unchanged between 4.25% and 4.50%, and the high interest rate environment may last longer. However, once a clear signal of interest rate cuts is released in the future, it may inject a new round of upward momentum into the crypto market.

Overall, the market is currently in the stage of rebalancing the capital structure. Although the "copy season" has not been fully established, relevant positive signals are gradually gathering, and the game between price and market sentiment has entered a critical period. Analysts and forecasts have been made that the "altcoin peak season" may officially arrive in August or September. Until then, the market may still face greater volatility risks.

The above is the detailed content of Bitcoin dominance has dropped sharply, Ethereum has performed strongly, and the copycat season is ready to go. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

1. Ordinary users can purchase Ethereum through mainstream digital asset trading platforms such as Binance, Ouyi OK, HTX Huobi, etc. The process includes registering an account, identity authentication, binding payment methods and trading through market or limit orders. The assets can be stored on the platform or transferred to personal money sacrificial pie; 2. Ethereum has no fixed issuance limit, with about 72 million initial issuance, and it is continuously issued through the PoS mechanism and the destruction mechanism is introduced due to EIP-1559, which may achieve deflation; 3. Before investing, you need to understand the risk of high volatility, enable two-factor verification to ensure account security, and learn asset custody methods such as hardware or software money sacrificial pie; 4. Ethereum is the core platform of decentralized applications, DeFi protocols and NFT ecosystem, supporting the operation of smart contracts and promoting digital asset rights confirmation and flow

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

Ethereum is a decentralized application platform based on smart contracts, and its native token ETH can be obtained in a variety of ways. 1. Register an account through centralized platforms such as Binance and Ouyiok, complete KYC certification and purchase ETH with stablecoins; 2. Connect to digital storage through decentralized platforms, and directly exchange ETH with stablecoins or other tokens; 3. Participate in network pledge, and you can choose independent pledge (requires 32 ETH), liquid pledge services or one-click pledge on the centralized platform to obtain rewards; 4. Earn ETH by providing services to Web3 projects, completing tasks or obtaining airdrops. It is recommended that beginners start from mainstream centralized platforms, gradually transition to decentralized methods, and always attach importance to asset security and independent research, to

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

1. First, ensure that the device network is stable and has sufficient storage space; 2. Download it through the official download address [adid]fbd7939d674997cdb4692d34de8633c4[/adid]; 3. Complete the installation according to the device prompts, and the official channel is safe and reliable; 4. After the installation is completed, you can experience professional trading services comparable to HTX and Ouyi platforms; the new version 5.0.5 feature highlights include: 1. Optimize the user interface, and the operation is more intuitive and convenient; 2. Improve transaction performance and reduce delays and slippages; 3. Enhance security protection and adopt advanced encryption technology; 4. Add a variety of new technical analysis chart tools; pay attention to: 1. Properly keep the account password to avoid logging in on public devices; 2.

Binance download official website https Binance APP download link official website https

Aug 01, 2025 pm 11:21 PM

Binance download official website https Binance APP download link official website https

Aug 01, 2025 pm 11:21 PM

Binance APP is a world-leading digital asset service application, providing users with safe and convenient trading experience and comprehensive market information. Through its official mobile client, users can grasp the latest market trends, manage personal digital assets, and conduct diversified trading operations anytime and anywhere. This article will introduce in detail how to obtain and install the Binance APP through official channels, as well as its core functions and usage techniques, to help users use the platform safely and efficiently.

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

First, choose a reputable trading platform such as Binance, Ouyi, Huobi or Damen Exchange; 1. Register an account and set a strong password; 2. Complete identity verification (KYC) and submit real documents; 3. Select the appropriate merchant to purchase USDT and complete payment through C2C transactions; 4. Enable two-factor identity verification, set a capital password and regularly check account activities to ensure security. The entire process needs to be operated on the official platform to prevent phishing, and finally complete the purchase and security management of USDT.

USDT virtual currency account activation guide USDT digital asset registration tutorial

Aug 01, 2025 pm 11:36 PM

USDT virtual currency account activation guide USDT digital asset registration tutorial

Aug 01, 2025 pm 11:36 PM

First, choose a reputable digital asset platform. 1. Recommend mainstream platforms such as Binance, Ouyi, Huobi, Damen Exchange; 2. Visit the official website and click "Register", use your email or mobile phone number and set a high-strength password; 3. Complete email or mobile phone verification code verification; 4. After logging in, perform identity verification (KYC), submit identity proof documents and complete facial recognition; 5. Enable two-factor identity verification (2FA), set an independent fund password, and regularly check the login record to ensure the security of the account, and finally successfully open and manage the USDT virtual currency account.

JD Stablecoin Official Website Where to buy JD Stablecoin

Aug 01, 2025 pm 06:51 PM

JD Stablecoin Official Website Where to buy JD Stablecoin

Aug 01, 2025 pm 06:51 PM

Currently, JD.com has not issued any stablecoins, and users can choose the following platforms to purchase mainstream stablecoins: 1. Binance is the platform with the largest transaction volume in the world, supports multiple fiat currency payments, and has strong liquidity; 2. OKX has powerful functions, providing 7x24-hour customer service and multiple payment methods; 3. Huobi has high reputation in the Chinese community and has a complete risk control system; 4. Gate.io has rich currency types, suitable for exploring niche assets after purchasing stablecoins; 5. There are many types of currency listed on KuCoin, which is conducive to discovering early projects; 6. Bitget is characterized by order transactions, with convenient P2P transactions, and is suitable for social trading enthusiasts. The above platforms all provide safe and reliable stablecoin purchase services.

Will Ethereum callback 2000? A brief overview of Ethereum's trends in recent years

Aug 01, 2025 pm 10:39 PM

Will Ethereum callback 2000? A brief overview of Ethereum's trends in recent years

Aug 01, 2025 pm 10:39 PM

The price fluctuations of ETH have touched the hearts of countless investors, and discussions about whether its prices will bottom out again have never stopped. This article will review the price trends of Ethereum in recent years, and combine current market fundamentals and technical indicators to explore whether it is possible to pull back to the key support level of US$2,000, providing readers with a multi-dimensional market observation perspective.