After years of legislative and diplomatic buildup, economic studies and Canadian insistence that this was about fairness in taxation — not trade provocation — Ottawa canceled the tax just hours before collections were set to begin. The abrupt reversal came after President Trump labeled the DST policy a “blatant attack” on the U.S., and threatened to halt trade negotiations unless Canada retracted its stance.

Thus, in an increasingly familiar geopolitical maneuver, one nation’s effort to impose taxes on U.S. tech firms collided head-on with Washington’s red line: protecting Silicon Valley's profits.

At its heart, Canada’s DST was simple: a 3% tax on the Canadian revenues of large digital companies, specifically those earning more than CA $20 million annually from Canadian users. Any revenue generated in Canada through activities like movie streaming, online shopping, or ad clicks would have been subject to this tax.

What Was Taxed By the Digital Services Tax?

The tax would have applied to digital services revenue dating back to 2022, potentially requiring U.S. companies such as Amazon, Google, Apple, and Meta to pay two years of retroactive taxes — amounting to billions in previously uncollected funds.

Canadian officials maintained that this was about fixing a gap in the current tax system — much like Italy had argued before. Tech firms generate massive profits from Canadian consumers but often pay little or no tax within Canada. As seen in Italy, however, trying to exert control over digital taxation of U.S. earnings carries consequences.

The backlash arrived quickly and forcefully. Trump suspended trade talks with Canada, labeling the DST a “deal breaker” and warning of steep tariffs on Canadian exports if the tax went into effect. In response, Ottawa gave in.

This pattern is not new. France introduced a similar tax in 2019, only to pause enforcement after Washington threatened tariffs on luxury goods like champagne and handbags. India, Italy, and the United Kingdom have all attempted to implement DST policies, each time followed by swift pushback from the U.S. and a return to negotiation.

In every case, the U.S. position remains unchanged — these taxes unfairly target American corporations. And sometimes, they do, at least indirectly, due to the dominance of U.S. firms in global digital markets. This makes seemingly neutral taxes discriminatory in practice.

A Broken Global Framework

Canada’s withdrawal doesn’t mark the end of this issue — nor did similar pullbacks in France, Italy, and India. It’s simply another episode in a recurring cycle. Across the globe, governments are grappling with the reality of tech firms generating enormous income from users within their borders while avoiding legal and taxable presence. The existing international tax treaties weren’t designed for cloud computing or billion-dollar advertising platforms.

With no unified global framework, national governments improvise; they introduce unilateral digital taxes not to provoke trade wars, but because they’re unwilling to continue losing vast sums of potential tax revenue.

The Organisation for Economic Co-operation and Development has been working on a global agreement under the Pillar One and Pillar Two initiatives to reallocate taxing rights and establish minimum tax rates. However, progress is painfully slow — years of negotiations, missed deadlines, and postponed implementation dates have left many waiting.

This puts national governments in a difficult spot. They must choose between doing nothing and forfeiting billions, or acting unilaterally and risking U.S. retaliation — which often results in retreating to the negotiating table with less leverage than before. Either way, it’s a no-win scenario.

Outlook

Canada may have backed down, but this story isn’t over. The fundamental imbalance between where profits are earned and where they are taxed remains unresolved.

The U.S. continues to argue that any DST imposed on big tech firms is inherently discriminatory. Other countries maintain that the current system is the real injustice. Without meaningful progress toward a binding global framework, we will keep witnessing the same conflict play out, merely dubbed with different voices.

Until there is a genuine, enforceable international agreement, digital tax policy will be less about sound fiscal policy and more about who holds the most leverage.

The above is the detailed content of What Is Canada's Digital Services Tax?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Remember the flood of open-source Chinese models that disrupted the GenAI industry earlier this year? While DeepSeek took most of the headlines, Kimi K1.5 was one of the prominent names in the list. And the model was quite cool.

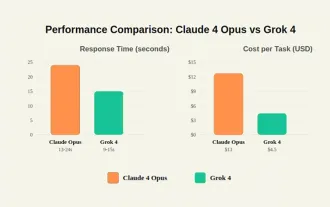

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

By mid-2025, the AI “arms race” is heating up, and xAI and Anthropic have both released their flagship models, Grok 4 and Claude 4. These two models are at opposite ends of the design philosophy and deployment platform, yet they

10 Amazing Humanoid Robots Already Walking Among Us Today

Jul 16, 2025 am 11:12 AM

10 Amazing Humanoid Robots Already Walking Among Us Today

Jul 16, 2025 am 11:12 AM

But we probably won’t have to wait even 10 years to see one. In fact, what could be considered the first wave of truly useful, human-like machines is already here. Recent years have seen a number of prototypes and production models stepping out of t

Context Engineering is the 'New' Prompt Engineering

Jul 12, 2025 am 09:33 AM

Context Engineering is the 'New' Prompt Engineering

Jul 12, 2025 am 09:33 AM

Until the previous year, prompt engineering was regarded a crucial skill for interacting with large language models (LLMs). Recently, however, LLMs have significantly advanced in their reasoning and comprehension abilities. Naturally, our expectation

Build a LangChain Fitness Coach: Your AI Personal Trainer

Jul 05, 2025 am 09:06 AM

Build a LangChain Fitness Coach: Your AI Personal Trainer

Jul 05, 2025 am 09:06 AM

Many individuals hit the gym with passion and believe they are on the right path to achieving their fitness goals. But the results aren’t there due to poor diet planning and a lack of direction. Hiring a personal trainer al

6 Tasks Manus AI Can Do in Minutes

Jul 06, 2025 am 09:29 AM

6 Tasks Manus AI Can Do in Minutes

Jul 06, 2025 am 09:29 AM

I am sure you must know about the general AI agent, Manus. It was launched a few months ago, and over the months, they have added several new features to their system. Now, you can generate videos, create websites, and do much mo

Leia's Immersity Mobile App Brings 3D Depth To Everyday Photos

Jul 09, 2025 am 11:17 AM

Leia's Immersity Mobile App Brings 3D Depth To Everyday Photos

Jul 09, 2025 am 11:17 AM

Built on Leia’s proprietary Neural Depth Engine, the app processes still images and adds natural depth along with simulated motion—such as pans, zooms, and parallax effects—to create short video reels that give the impression of stepping into the sce

What Are The 7 Types Of AI Agents?

Jul 11, 2025 am 11:08 AM

What Are The 7 Types Of AI Agents?

Jul 11, 2025 am 11:08 AM

Picture something sophisticated, such as an AI engine ready to give detailed feedback on a new clothing collection from Milan, or automatic market analysis for a business operating worldwide, or intelligent systems managing a large vehicle fleet.The