ETH2025 price forecast: market share falls below 10%, can ETH return to above $4,000?

Mar 04, 2025 am 09:03 AMEthereum price forecast for 2025: Challenges and opportunities for $4,000

This article will explore the price trend of Ethereum (ETH) in 2025, analyze its potential catalysts and barriers, and provide different forecast ranges.

Review and Outlook: In the past year, ETH prices have fluctuated dramatically, exceeding US$4,000 in 2024, and then pulled back. This volatility highlights the importance of in-depth market analysis. In the future, prices will be affected by multiple factors such as technological upgrades (such as Ethereum 2.0), regulatory environment and market sentiment. Successful technology upgrades could drive ETH prices to reach or exceed $4,000 by 2025.

$4,000 Target: Drivers & Challenges:

Key drivers of ETH return and breaking through $4,000 include the booming development of decentralized finance (DeFi) and the continued growth in demand for ETH, as well as institutional investments brought about by the popularity of Ethereum ETFs.

However, scalability issues, high transaction fees, and competition from other smart contract platforms may hinder ETH prices. The implementation of EIP-1559 and the transition to a proof of stake mechanism are expected to alleviate some scalability issues and may bring about the deflation effect of ETH.

Market share: The way to survive under continuous competition:

ETH's market share has fallen below 10%, raising concerns about its long-term position. Nevertheless, a strong developer community and a wide decentralized application (dApps) ecosystem remain a solid foundation. Whether the technological advantages and ecosystem advantages can be used to regain market share will directly affect its price trend.

Institutional Investment: Potential Game Changeers:

The participation of institutional investors is a key factor in ETH's future price trend. The increasing recognition of blockchain technology by institutions has brought huge growth potential to Ethereum. The continued growth in institutional investment may become a key driver for ETH prices to exceed $4,000. However, regulatory reviews and compliance requirements can also present challenges.

Price forecast for 2025: Multiple perspectives gathered:

The forecasts for ETH prices in 2025 vary greatly, with an optimistic estimate that it may reach US$7500-10,000, while the more conservative forecast is between US$2670-5,990, with an average price of approximately US$4,330. Some analysts predict that the ETH price may reach $4184.11 in February 2025, with an average trading price of $3633.09.

Technical analysis:

- Support level: $2700 is the key support level, and falling below this level may cause the price to fall further to $2100.

- Resistance level: $2750-2800 is the main resistance level facing ETH.

- Moving Average: ETH is currently higher than the key long-term moving average, and the overall trend is bullish.

Market sentiment:

The market sentiment is mixed, and long-term holders and institutional investors continue to increase their holdings, but short-term indicators show downward risks.

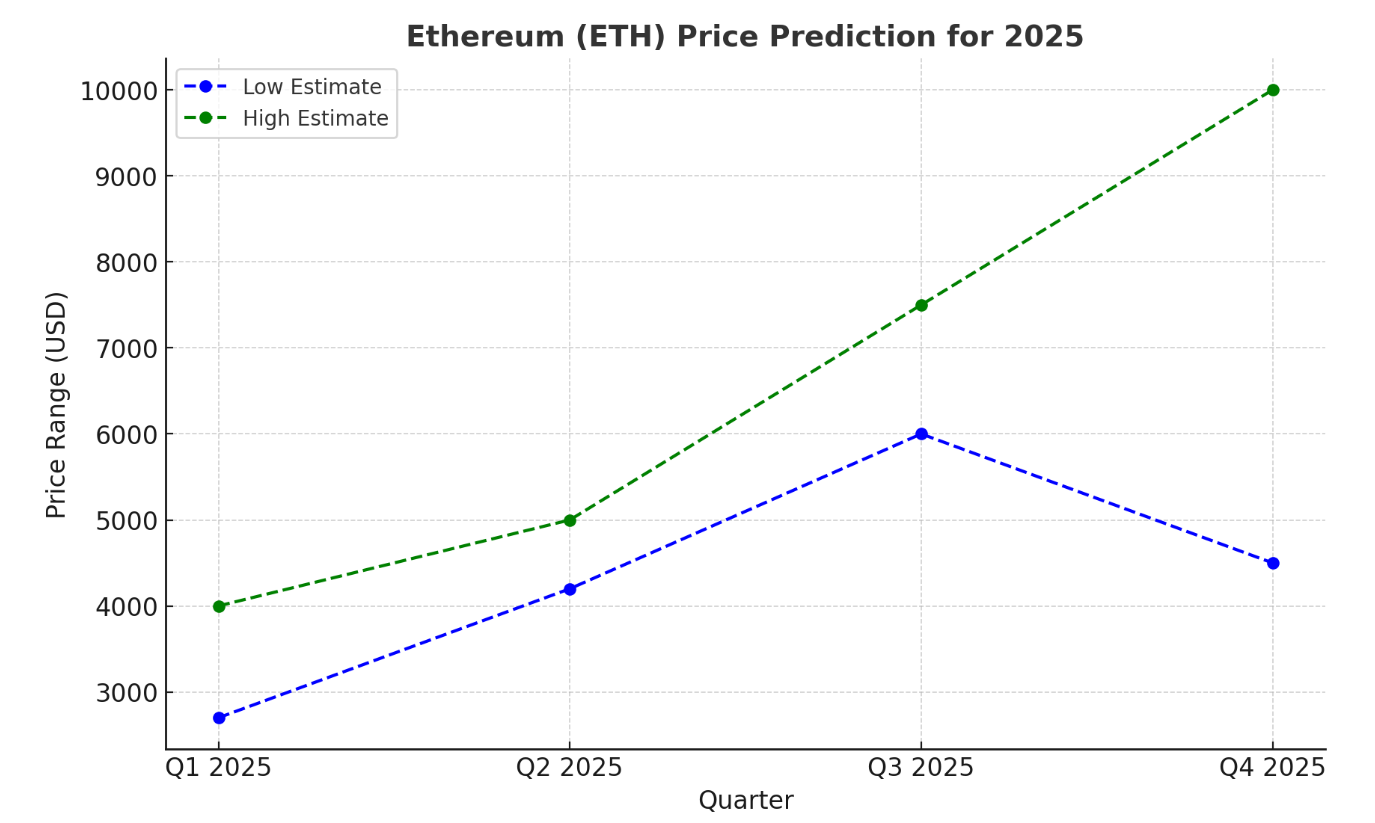

Quarterly Forecast:

- First quarter: $2700-4000, affected by market sentiment and technological development.

- Q2: $4200-5000 (after breaking through resistance), but macroeconomic and regulatory factors will play an important role.

- Q3: $6000-7500 (DeFi and NFT adoption rate increase), but market volatility may increase.

- Fourth quarter: Optimistic estimate is $7500-10,000, and conservative estimate is $4500-6,500, affected by annual strategy and technology upgrades.

Market analysis:

The future price of ETH will be affected by factors such as institutional investment, regulation and technology upgrades. The continued growth of institutional investment, favorable regulatory policies and successful technological upgrades will all benefit ETH prices.

Future Outlook:

ETH's development in 2025 is full of opportunities and challenges. While the $4,000 goal is challenging, its strong ecosystem and continuous innovation give it significant growth potential. Investors should pay close attention to key factors such as technology upgrades, market share and institutional investment.

The above is the detailed content of ETH2025 price forecast: market share falls below 10%, can ETH return to above $4,000?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to check the main trends of beginners in the currency circle

Jul 31, 2025 pm 09:45 PM

How to check the main trends of beginners in the currency circle

Jul 31, 2025 pm 09:45 PM

Identifying the trend of the main capital can significantly improve the quality of investment decisions. Its core value lies in trend prediction, support/pressure position verification and sector rotation precursor; 1. Track the net inflow direction, trading ratio imbalance and market price order cluster through large-scale transaction data; 2. Use the on-chain giant whale address to analyze position changes, exchange inflows and position costs; 3. Capture derivative market signals such as futures open contracts, long-short position ratios and liquidated risk zones; in actual combat, trends are confirmed according to the four-step method: technical resonance, exchange flow, derivative indicators and market sentiment extreme value; the main force often adopts a three-step harvesting strategy: sweeping and manufacturing FOMO, KOL collaboratively shouting orders, and short-selling backhand shorting; novices should take risk aversion actions: when the main force's net outflow exceeds $15 million, reduce positions by 50%, and large-scale selling orders

Ethereum ETH latest price APP ETH latest price trend chart analysis software

Jul 31, 2025 pm 10:27 PM

Ethereum ETH latest price APP ETH latest price trend chart analysis software

Jul 31, 2025 pm 10:27 PM

1. Download and install the application through the official recommended channel to ensure safety; 2. Access the designated download address to complete the file acquisition; 3. Ignore the device safety reminder and complete the installation as prompts; 4. You can refer to the data of mainstream platforms such as Huobi HTX and Ouyi OK for market comparison; the APP provides real-time market tracking, professional charting tools, price warning and market information aggregation functions; when analyzing trends, long-term trend judgment, technical indicator application, trading volume changes and fundamental information; when choosing software, you should pay attention to data authority, interface friendliness and comprehensive functions to improve analysis efficiency and decision-making accuracy.

The Ethereum price rose by more than 20% in 7 days. What is the reason behind it?

Jul 31, 2025 pm 10:48 PM

The Ethereum price rose by more than 20% in 7 days. What is the reason behind it?

Jul 31, 2025 pm 10:48 PM

The recent surge of Ethereum price by more than 20% is mainly driven by four major factors: 1. The Cancun Upgrade is approaching, especially the "prototype data sharding" technology introduced by EIP-4844 will significantly reduce the transaction costs of Layer 2, improve network scalability, and attract investors to make advance arrangements; 2. The DeFi ecosystem continues to flourish, and the total value of locked positions (TVL) has grown steadily. New protocols such as liquid staking derivatives (LSD) and restaking (Restaking) have risen, increasing the rigid demand for ETH as a Gas fee and pledged assets; 3. The market has strong expectations for the approval of Ethereum spot ETF, believing that it will provide convenient channels for institutional investors, introduce a large amount of funds and enhance market confidence.

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

How many Ethereum has issued in total? Where do ordinary people buy Ethereum?

Jul 31, 2025 pm 10:57 PM

1. Ordinary users can purchase Ethereum through mainstream digital asset trading platforms such as Binance, Ouyi OK, HTX Huobi, etc. The process includes registering an account, identity authentication, binding payment methods and trading through market or limit orders. The assets can be stored on the platform or transferred to personal money sacrificial pie; 2. Ethereum has no fixed issuance limit, with about 72 million initial issuance, and it is continuously issued through the PoS mechanism and the destruction mechanism is introduced due to EIP-1559, which may achieve deflation; 3. Before investing, you need to understand the risk of high volatility, enable two-factor verification to ensure account security, and learn asset custody methods such as hardware or software money sacrificial pie; 4. Ethereum is the core platform of decentralized applications, DeFi protocols and NFT ecosystem, supporting the operation of smart contracts and promoting digital asset rights confirmation and flow

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

What is Ethereum? What are the ways to obtain Ethereum ETH?

Jul 31, 2025 pm 11:00 PM

Ethereum is a decentralized application platform based on smart contracts, and its native token ETH can be obtained in a variety of ways. 1. Register an account through centralized platforms such as Binance and Ouyiok, complete KYC certification and purchase ETH with stablecoins; 2. Connect to digital storage through decentralized platforms, and directly exchange ETH with stablecoins or other tokens; 3. Participate in network pledge, and you can choose independent pledge (requires 32 ETH), liquid pledge services or one-click pledge on the centralized platform to obtain rewards; 4. Earn ETH by providing services to Web3 projects, completing tasks or obtaining airdrops. It is recommended that beginners start from mainstream centralized platforms, gradually transition to decentralized methods, and always attach importance to asset security and independent research, to

BTC digital currency account registration tutorial: Complete account opening in three steps

Jul 31, 2025 pm 10:42 PM

BTC digital currency account registration tutorial: Complete account opening in three steps

Jul 31, 2025 pm 10:42 PM

First, select well-known platforms such as Binance Binance or Ouyi OKX, and prepare your email and mobile phone number; 1. Visit the official website of the platform and click to register, enter your email or mobile phone number and set a high-strength password; 2. Submit information after agreeing to the terms of service, and complete account activation through the email or mobile phone verification code; 3. After logging in, complete identity authentication (KYC), enable secondary verification (2FA), and regularly check security settings to ensure account security. After completing the above steps, you can successfully create a BTC digital currency account.

Digital Currency Recharge Safety Guide: Prevent Operational Mistakes

Jul 31, 2025 pm 10:33 PM

Digital Currency Recharge Safety Guide: Prevent Operational Mistakes

Jul 31, 2025 pm 10:33 PM

1. Choose a reputable trading platform; 2. Confirm currency and network type; 3. Check the official recharge address; 4. Ensure the network security environment; 5. Double check the head and tail characters of the address; 6. Confirm the amount and decimal points; 7. Pay attention to the minimum recharge amount; 8. Fill in necessary labels or notes; 9. Beware of clipboard hijacking; 10. Don’t trust the non-official channel address; 11. Test the small amount before large recharge; 12. Save the transaction ID for inquiry; 13. Wait patiently for network confirmation; 14. Contact customer service in time when the account is not arrived. To ensure the safety of digital currency recharge, the above steps must be strictly followed. From platform selection to information verification to risk prevention, every step needs to be carefully operated. Finally, through retaining vouchers and timely communication, the asset is securely received, and avoid negligence.

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

1. First, ensure that the device network is stable and has sufficient storage space; 2. Download it through the official download address [adid]fbd7939d674997cdb4692d34de8633c4[/adid]; 3. Complete the installation according to the device prompts, and the official channel is safe and reliable; 4. After the installation is completed, you can experience professional trading services comparable to HTX and Ouyi platforms; the new version 5.0.5 feature highlights include: 1. Optimize the user interface, and the operation is more intuitive and convenient; 2. Improve transaction performance and reduce delays and slippages; 3. Enhance security protection and adopt advanced encryption technology; 4. Add a variety of new technical analysis chart tools; pay attention to: 1. Properly keep the account password to avoid logging in on public devices; 2.