Companies are increasingly publicizing workforce reductions even as they pour resources into artificial intelligence, according to The Wall Street Journal. Yet, only one company among them — Microsoft — has managed to outperform the broader market.

A deeper analysis of the eight firms spotlighted — Microsoft, Wells Fargo, Loomis, Bank of America, Verizon, Amazon, Intel, and Union Pacific — reveals a telling picture for investors: collectively, their stocks have risen just 9.3% year-to-date through July 25, slightly above the S&P 500’s 8.9% gain, based on data from Google Finance.

Here’s why investors should be cautious about buying into companies that highlight AI-driven layoffs:

- Publicizing job cuts may help executives justify AI spending to their boards, but it doesn’t significantly lift stock performance.

- Share prices typically climb when companies consistently exceed revenue and earnings forecasts and raise forward-looking guidance — a track record most of these eight firms have lacked over the past four quarters.

- Unless AI is used to open new growth avenues, the productivity improvements touted during layoffs are unlikely to generate superior returns for shareholders.

Microsoft stands out as the sole company in this group to both beat and raise guidance across the last four quarters. Given its tangible growth from AI initiatives, its stock appears to be the only one among the eight with strong potential for above-market returns.

Eight Companies Highlighting AI-Related Workforce Reductions

The average stock performance of these AI-focused cost-cutters is barely outpacing the S&P 500 in 2025.

Below is a breakdown of each company, their year-to-date stock change as of July 25, and key statements regarding staffing changes:

- Microsoft (stock price increase: 22.7%). Microsoft plans to eliminate an additional 9,000 positions, bringing total job cuts to 15,000 in two months. The goal, per the Journal, is to “reorient its business to AI.” In a July 24 memo, CEO Satya Nadella acknowledged the emotional toll of the layoffs on leadership.

- Wells Fargo ( 20%). With headcount down 23% over five years, CEO Charlie Scharf stated on the latest earnings call that attrition is “our friend,” emphasizing organic reduction without forced layoffs.

- Loomis ( 12.3%). The Swedish cash logistics firm is expanding while reducing staff, the Journal noted, highlighting operational efficiency gains.

- Bank of America ( 9.4%). Employee numbers have dropped from 300,000 to 212,000, with another 1,500 roles cut in 2025 alone. AI tools now assist wealth advisors with client information, 17,000 coders use AI-assisted programming, and an AI chatbot handles trade reconciliations for 750 employees, CEO Brian Moynihan told the Journal.

- Verizon ( 7.1%). Headcount has declined by 4% over the past year. CEO Hans Vestberg praised the company’s efficiency in resource management, saying he was “very happy with that,” as reported by the Journal.

- Amazon ( 5.1%). Since 2022, Amazon has cut around 27,000 employees, TechCrunch reported. More reductions are expected due to generative AI. In a June message, CEO Andy Jassy told staff that AI will reshape work: “We will need fewer people doing some of the jobs today, and more people doing different kinds of work.”

- Intel ( 2.4%). The semiconductor leader plans to cut 15% of its workforce and streamline middle management. “We need to rightsize and scale back the company,” CEO Lip-Bu Tan said on July 24, per the Journal.

- Union Pacific (-4.4%). The rail company reported record labor productivity despite a 3% drop in staff, the Journal noted, attributing gains to improved operational efficiency.

Why Layoff Announcements Don’t Boost Investor Returns

Announcements of job cuts rarely deliver meaningful value to shareholders. At best, such news leads to a temporary 2% bump in stock price — and only if investors believe the layoffs are part of a coherent AI-driven productivity strategy.

Even then, any positive reaction tends to fade within one to three trading days, according to academic research like Stock investors’ reaction to layoff announcements: A meta-analysis. If layoffs are perceived as a response to weak demand or lack a clear strategic rationale, stock returns often flatline or dip.

So what actually drives shareholder value? Evidence shows stock prices rise when companies exceed expectations and upgrade their outlooks. “Positive earnings surprises and upward revisions in guidance usually trigger positive market reactions,” according to studies such as Warp Speed Price Moves: Jumps after Earnings Announcements.

Why Microsoft’s Stock Looks Poised for Further Gains

Microsoft has clearly outpaced the other seven firms in consistently exceeding revenue and earnings per share (EPS) forecasts and providing optimistic future guidance over the past four quarters.

Specifically, Microsoft has surpassed both revenue and EPS estimates in each of the last four quarters and issued forward guidance that, at times, exceeded analyst consensus.

These results suggest the company is successfully monetizing its AI investments, particularly through growing demand for its cloud and AI-powered services, as discussed in its Q1 2025 earnings call.

Why Amazon and Intel’s Layoffs Haven’t Lifted Their Stocks

Amazon and Intel have underperformed the S&P 500 over the past year, largely because they’ve failed to consistently beat revenue expectations or deliver encouraging guidance.

Amazon, for example, met or exceeded EPS forecasts every quarter but often fell short on revenue. Additionally, investors have reacted negatively to the company’s conservative outlook for upcoming quarters, Yahoo! Finance reported.

Intel faced a different set of issues. While it consistently beat revenue estimates over the last four quarters, it frequently missed EPS targets and issued guidance below investor expectations — signaling ongoing difficulties in its turnaround efforts, according to Investing.com.

Companies that heavily promote job reductions risk alienating top talent, potentially hampering innovation and long-term growth. For better returns, investors may want to focus on firms that not only invest in AI but also consistently exceed performance expectations and raise guidance — turning technological adoption into real, measurable growth.

The above is the detailed content of Job Cuts Rarely Benefit Investors. Microsoft May Be The Exception. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

AI Investor Stuck At A Standstill? 3 Strategic Paths To Buy, Build, Or Partner With AI Vendors

Jul 02, 2025 am 11:13 AM

AI Investor Stuck At A Standstill? 3 Strategic Paths To Buy, Build, Or Partner With AI Vendors

Jul 02, 2025 am 11:13 AM

Investing is booming, but capital alone isn’t enough. With valuations rising and distinctiveness fading, investors in AI-focused venture funds must make a key decision: Buy, build, or partner to gain an edge? Here’s how to evaluate each option—and pr

AGI And AI Superintelligence Are Going To Sharply Hit The Human Ceiling Assumption Barrier

Jul 04, 2025 am 11:10 AM

AGI And AI Superintelligence Are Going To Sharply Hit The Human Ceiling Assumption Barrier

Jul 04, 2025 am 11:10 AM

Let’s talk about it. This analysis of an innovative AI breakthrough is part of my ongoing Forbes column coverage on the latest in AI, including identifying and explaining various impactful AI complexities (see the link here). Heading Toward AGI And

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Remember the flood of open-source Chinese models that disrupted the GenAI industry earlier this year? While DeepSeek took most of the headlines, Kimi K1.5 was one of the prominent names in the list. And the model was quite cool.

Future Forecasting A Massive Intelligence Explosion On The Path From AI To AGI

Jul 02, 2025 am 11:19 AM

Future Forecasting A Massive Intelligence Explosion On The Path From AI To AGI

Jul 02, 2025 am 11:19 AM

Let’s talk about it. This analysis of an innovative AI breakthrough is part of my ongoing Forbes column coverage on the latest in AI, including identifying and explaining various impactful AI complexities (see the link here). For those readers who h

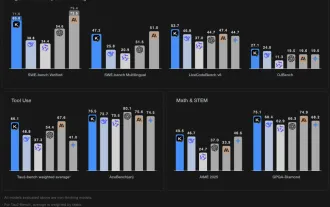

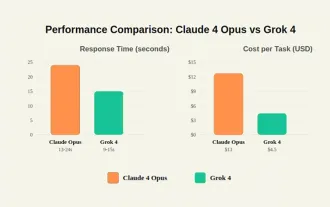

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

By mid-2025, the AI “arms race” is heating up, and xAI and Anthropic have both released their flagship models, Grok 4 and Claude 4. These two models are at opposite ends of the design philosophy and deployment platform, yet they

Chain Of Thought For Reasoning Models Might Not Work Out Long-Term

Jul 02, 2025 am 11:18 AM

Chain Of Thought For Reasoning Models Might Not Work Out Long-Term

Jul 02, 2025 am 11:18 AM

For example, if you ask a model a question like: “what does (X) person do at (X) company?” you may see a reasoning chain that looks something like this, assuming the system knows how to retrieve the necessary information:Locating details about the co

This Startup Built A Hospital In India To Test Its AI Software

Jul 02, 2025 am 11:14 AM

This Startup Built A Hospital In India To Test Its AI Software

Jul 02, 2025 am 11:14 AM

Clinical trials are an enormous bottleneck in drug development, and Kim and Reddy thought the AI-enabled software they’d been building at Pi Health could help do them faster and cheaper by expanding the pool of potentially eligible patients. But the

Senate Kills 10-Year State-Level AI Ban Tucked In Trump's Budget Bill

Jul 02, 2025 am 11:16 AM

Senate Kills 10-Year State-Level AI Ban Tucked In Trump's Budget Bill

Jul 02, 2025 am 11:16 AM

The Senate voted 99-1 Tuesday morning to kill the moratorium after a last-minute uproar from advocacy groups, lawmakers and tens of thousands of Americans who saw it as a dangerous overreach. They didn’t stay quiet. The Senate listened.States Keep Th