Nuro, Uber And Lucid Join Robotaxi Race. Will Luxury Be Key?

Jul 25, 2025 am 11:11 AMNuro was formed by two top engineers I worked with in the earliest days of Waymo. Until recently, their goal has been to attack the more tractable pure delivery market with a custom delivery robot about half the size of traditional cars. They received a large investment and hoped to be a delivery service company with their robots. Those robots, which have no place for a human driver, are among the few vehicles to operate without human supervision on public streets in the USA, and indeed the world. They recently announced the plan to pivot towards licencing their self-driving design to partners who want to do robotaxi, delivery or other applications, rather than do it themselves.

Uber, most people know, is top brand in selling rides as a service, except in Asia. They do it with semi-independent human drivers. After a failed effort to develop their own self-driving system, which was traded to Aurora for stock, they have recently been booking rides for Waymo and have announced partnerships with several companies developing robotaxis, including VW/MOIA/MobilEye, Momenta, Motional, May and to some degree with WeRide, Baidu, Volvo, AVRide and as noted, Aurora. In this case though, they are making multi-hundred-million dollar investmants in both Lucid and Nuro.

Lucid will build the vehicles, integrating Nuro’s hardware design into the vehicles. Uber will own them and operate them and integrate them into the Uber app. Lucid is known as a high-end EV maker, though at modest volumes. Their stock saw major gains with this announcement. Lucid has a reputation for quality, and they are one of the very few to create a new car company in the USA recently, but as a luxury OEM, they are to some degree the odd one out in this trio. The partnership calls for the production of at least 20,000 cars over the next 6 years (Lucid currently makes about 10,000 per year but is growing.)

ForbesNuro Switches From Delivery Business To ‘Driver’ ProviderBy Brad TempletonNuro’s role is fairly clear. They have the software stack and hardware design. The actual hardware components are largely off-the-shelf including the NVidia Thor processor, and cameras, radars and LIDARs from different suppliers. For now, the software stack is the key component of a robotaxi. While there are many other components, including hardware, vehicles, infrastructure, or the network of riders and app that Uber has, these are not trivial but they are not the rare rocket science ingredient. A software stack ready to deploy in public with sufficient safety takes a lot of work and time, working through a very long tail of problems. It’s not easy to duplicate--or so Nuro hopes. Since the robotaxi business is the business of selling rides, Uber’s market-leader position is also unique, though the actual components, like the app and the backend, have been built by many companies and aren’t that hard to recreate. Building vehicles to spec is a capability found all over the world, though doing it at scale for low cost is harder.

Hardware/Vehicle Cost

Right now, vehicle hardware cost is not super important for robotaxi developers. Most of them have a literal laser focus on making their system work safely, and reducing cost in the future will be work but requires no breakthroughs. Only Tesla and some lower-funded startups have cared a lot about cost. Now that companies are scaling, the view on that will change. Right now Waymo uses expensive Jaguars, but they planned to switch to low-cost Zeekrs, a plan that may be scuttled by tariffs. They’re also working with more mid-priced Hyundai Ioniq 5s. Tesla plans a dedicated Cybercab which takes advantage of the fact that a robotaxi needs far less hardware than a consumer human driven car, they say they will make it for under $30,000. Making cars is Tesla’s strong suit. Baidu claims their 6th gen vehicle has a hardware cost of $28,000--the Chinese are the best a low-cost car manufacturing. Amazon’s Zoox is making a more expensive custom built vehicle because they believe they can differentiate from competitors with the features found only in the custom vehicle, but in time and at scale it should be possible to make it cheaper.

Competition and Luxury

Right now, there’s no robotaxi competition. Companies either are alone in their territory, or they are not in active commercial operation with full fleets, so they’re not taking business from one another. The question is, when does that change, and when it does, on what do they compete, and how important are price and luxury?

When companies begin to compete, the cost of the hardware will start to matter, because depreciation becomes the largest single component of the cost of a robotaxi ride. I estimate from 20-30% of the cost-of-goods sold. There are many factors in which robotaxi services will compete but the largest will be things like cost, wait time, service area and luxury of ride.

At the start, a luxury ride make sense. Why skimp, when you’re trying to make it work and keep customers happy, not improve margins. It’s a bit strange, though, because Nuro is touting how their new design with the Lucid saved a lot of money by replacing a lot of processing with the new Nvidia Thor--just to spend it on the Gravity, which typically sells around $100,000. But later this decade they will compete, and margins will matter. It’s an open question if, when competing, offering luxury will be important or if price will matter most. Nuro’s deal with Lucid doesn’t require that all 20,000 cars ordered be the Gravity, so in future a lower cost vehicle could come, though Lucid doesn’t currently make one.

Nuro also says that because the Gravity is an electric, mostly drive-by-wire vehicle, it already has a fair bit of the hardware and redundencies they want in a design, and this reduces some costs.

Uber may place the Lucid in their UberSelect or UberBlack categories, which are pricier than regular UberX, but command higher fees. They are, based on most reports, a much smaller fraction of rides than UberX. Most Uber riders are price-conscious.

The coming landscape

The picture is blurry, but now we can see some plans that players for the competition that will come later in this decade:

- Nuro Lucid: Luxury ride, medium sensor cost, sold through Uber

- Uber: A selection of vehicles from many vendors at different price points (as they do today with human drivers.)

- Waymo: Low priced Zeekr and medium priced Ioniq 5, with scale of first mover, sold directly by them but possibly also through companies like Uber at Waymo’s terms.

- Tesla Cybercab: Low cost vehicle made by them, lower cost rides. However, no working robotaxi as yet and vehicle not in production. Existing Teslas higher cost.

- Tesla “Network” using customer cars: Probably not practical, or only used during peak demand periods at higher prices. Off-lease Teslas could offer low cost rides if self-driving is achieved.

- Zoox: Custom vehicle, initially higher cost but with special abilities like face-to-face seating, 4-wheel steering, instant reversibility for more flexible pickup experiences and internal space.

- Baidu Apollo: Low cost vehicles and rides, not available in USA but strong competitor outside. Pony, WeRide: Similar but not as far along. Chinese vehicles will be lowest cost outside USA.

- Wayve, Aurora, MobilEye/MOIA, many others: No working robotaxi yet. VW/MOIA has ID Buzz van, somewhat costly but spacious.

- May: Only in very early operations, vehicles not yet set.

All of this is in flux and subject to change. Indeed, in spite of Nuro’s announcement of ordering 20,000 Lucid vehicles, there have been many declarations of large orders from other companies, including Waymo, that were just aspirations, and never came to pass.

The above is the detailed content of Nuro, Uber And Lucid Join Robotaxi Race. Will Luxury Be Key?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

AI Investor Stuck At A Standstill? 3 Strategic Paths To Buy, Build, Or Partner With AI Vendors

Jul 02, 2025 am 11:13 AM

AI Investor Stuck At A Standstill? 3 Strategic Paths To Buy, Build, Or Partner With AI Vendors

Jul 02, 2025 am 11:13 AM

Investing is booming, but capital alone isn’t enough. With valuations rising and distinctiveness fading, investors in AI-focused venture funds must make a key decision: Buy, build, or partner to gain an edge? Here’s how to evaluate each option—and pr

AGI And AI Superintelligence Are Going To Sharply Hit The Human Ceiling Assumption Barrier

Jul 04, 2025 am 11:10 AM

AGI And AI Superintelligence Are Going To Sharply Hit The Human Ceiling Assumption Barrier

Jul 04, 2025 am 11:10 AM

Let’s talk about it. This analysis of an innovative AI breakthrough is part of my ongoing Forbes column coverage on the latest in AI, including identifying and explaining various impactful AI complexities (see the link here). Heading Toward AGI And

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Remember the flood of open-source Chinese models that disrupted the GenAI industry earlier this year? While DeepSeek took most of the headlines, Kimi K1.5 was one of the prominent names in the list. And the model was quite cool.

Future Forecasting A Massive Intelligence Explosion On The Path From AI To AGI

Jul 02, 2025 am 11:19 AM

Future Forecasting A Massive Intelligence Explosion On The Path From AI To AGI

Jul 02, 2025 am 11:19 AM

Let’s talk about it. This analysis of an innovative AI breakthrough is part of my ongoing Forbes column coverage on the latest in AI, including identifying and explaining various impactful AI complexities (see the link here). For those readers who h

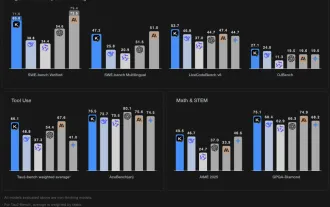

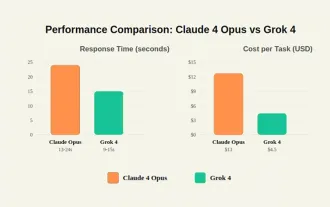

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

By mid-2025, the AI “arms race” is heating up, and xAI and Anthropic have both released their flagship models, Grok 4 and Claude 4. These two models are at opposite ends of the design philosophy and deployment platform, yet they

Chain Of Thought For Reasoning Models Might Not Work Out Long-Term

Jul 02, 2025 am 11:18 AM

Chain Of Thought For Reasoning Models Might Not Work Out Long-Term

Jul 02, 2025 am 11:18 AM

For example, if you ask a model a question like: “what does (X) person do at (X) company?” you may see a reasoning chain that looks something like this, assuming the system knows how to retrieve the necessary information:Locating details about the co

This Startup Built A Hospital In India To Test Its AI Software

Jul 02, 2025 am 11:14 AM

This Startup Built A Hospital In India To Test Its AI Software

Jul 02, 2025 am 11:14 AM

Clinical trials are an enormous bottleneck in drug development, and Kim and Reddy thought the AI-enabled software they’d been building at Pi Health could help do them faster and cheaper by expanding the pool of potentially eligible patients. But the

Senate Kills 10-Year State-Level AI Ban Tucked In Trump's Budget Bill

Jul 02, 2025 am 11:16 AM

Senate Kills 10-Year State-Level AI Ban Tucked In Trump's Budget Bill

Jul 02, 2025 am 11:16 AM

The Senate voted 99-1 Tuesday morning to kill the moratorium after a last-minute uproar from advocacy groups, lawmakers and tens of thousands of Americans who saw it as a dangerous overreach. They didn’t stay quiet. The Senate listened.States Keep Th