The research captures a pivotal moment in the adoption of enterprise AI. With generative AI deployments accelerating within the enterprise, the gap between aspiration and execution is becoming increasingly consequential.

NetApp’s report sheds light on where organizations stand, where internal misalignments persist, and what infrastructure foundations matter most as enterprises transition from pilot projects to production AI systems.

The AI Business Imperative

A central insight from the survey is that AI success hinges less on vision and more on operational readiness. Across geographies, most organizations, 88%, report themselves as “mostly or fully ready” for AI, with 81% piloting or scaling AI initiatives. Despite this apparent momentum, the research identified critical gaps between CEO expectations and IT capabilities that threaten to derail these efforts.

The study indicates that many organizations lack deep investments in foundational infrastructure, such as secure, scalable data platforms. This can undermine their ability to scale from proof-of-concept to full production deployments effectively.

The Global Competitive Landscape

When executives were asked which region will lead AI innovation over the next five years, 43% pointed to the United States as the likely winner. Nearly two-thirds of American respondents backed their own country, while Chinese executives showed a similar home-country bias, suggesting that these perceptions may be influenced by nationalistic confidence.

Unsurprisingly, China emerges as America's primary challenger for AI dominance, with 43% of Chinese respondents predicting their nation will lead in AI development. This confidence stems from massive infrastructure investments and aggressive scaling strategies. However, the report reveals a critical weakness in China's approach: a dangerous misalignment between CEO ambitions and IT execution capabilities.

Even here, a readiness gap exists. While 92% of Chinese CEOs claim their companies have active AI projects, only 74% of their IT leaders agree. This 18-point gap suggests Chinese executives are overcounting their AI progress, creating unrealistic expectations that will limit long-term competitiveness.

By contrast, American companies exhibit a much stronger alignment, with CEO and IT assessments matching closely at 77% and 86%, respectively.

India and the United Kingdom acknowledge their underdog status, with nearly one-third of executives in both countries reporting additional pressure to compete against the perceived leaders of the United States and China. This recognition drives focused investment strategies that position these markets as potential disruptors in specific AI verticals.

The Impact of Data Infrastructure

NetApp’s research identifies the adoption of an intelligent data infrastructure as a decisive factor separating AI leaders from AI followers. Enterprises need data systems that are accessible, secure, and scalable to generate trusted outcomes from their AI investments. Without this foundation, even the most ambitious AI strategies can fail to deliver results.

That’s not to say that there’s only one correct approach. The report indicates that the deployment of AI infrastructure frequently follows divergent competitive philosophies across various regions. Chinese respondents, for example, prioritize scalability above all else, with 35% ranking it as their top capability, compared to just 24% globally. This reflects a sprint strategy focused on immediate market impact.

American, British, and Indian companies, on the other hand, take a different approach, emphasizing integration with existing systems to build sustainable long-term advantages.

These strategic differences have real consequences. The survey found that 79% of executives fear their AI initiatives will produce broken models and biased insights due to poor data foundations.

Companies that shortcut infrastructure development to accelerate AI deployment often discover their rushed approach creates more problems than solutions.

The Data Infrastructure Arms Race

The AI infrastructure market is a battlefield where no established technology supplier can afford to fall behind. NetApp chief marketing officer Gabie Boko told me that it's precisely for this reason that NetApp commissions surveys like this one. It's one of the ways it understands the challenges its customers face.

NetApp approaches this market with its Intelligent Data Infrastructure, which enables scalable, secure, and operationally efficient AI and data-driven workloads. Unlike legacy storage architectures or ad hoc cloud deployments, NetApp integrates data management, governance, and observability directly into its hybrid cloud platform.

The NetApp Intelligent Data Infrastructure supports AI-native patterns, like model training, fine-tuning, and inference, by providing consistent performance, global data access, and real-time visibility across edge, core, and cloud environments. NetApp’s approach emphasizes integration over layered complexity across the full spectrum of enterprise data needs, not just AI. It’s a strong play.

NetApp isn’t alone in this market. Dell Technologies, for example, offers its Dell AI Data Platform to support its Dell AI Factory offerings. Dell’s solution combines its broad portfolio of storage solutions with Nvidia’s AI Data Platform to address enterprise AI challenges. HPE and Pure Storage each take similar, if less opinionated, approaches.

Beyond the traditional storage landscape, disruptors like VAST Data and WEKA are also players, taking a more targeted approach to addressing the problem. Innovations like its Augmented Memory Grid and the recently announced NeuralMesh microservices architecture give WEKA a compelling play for reliable, performant, and operational efficient AI infrastructure at scale. WEKA’s is an AI-first solution, lacking some of the broader enterprise-focused capabilities found in general-purpose mainstream storage.

VAST Data takes things even further, packaging several AI tools together into an opinionated hyper-converged AI stack that it calls the VAST AI OS. This HCAI approach makes VAST less of a direct competitor to the rest of the storage market and more of a competitor to full-stack AI solutions. It should be evaluated as such.

The competitive intensity in this market illustrates a broader market reality and reinforces NetApp’s findings: AI infrastructure is a critical battleground for long-term customer relationships. Companies that lose this race risk becoming irrelevant as AI becomes central to business operations.

Analyst’s Take: The Road Ahead

NetApp’s findings convey a clear message: successful AI implementation requires more than just cutting-edge technology. Organizations must achieve perfect alignment between executive vision and operational execution while building scalable infrastructure foundations. Companies that master this combination will establish lasting competitive advantages.

The global nature of AI competition also has an impact, creating complex challenges for multinational organizations. Companies operating across regions must navigate different regulatory environments, talent markets, and customer expectations while maintaining consistent AI capabilities. Success requires adapting strategies to local conditions while preserving global coherence.

The report says that “one of the most significant success factors in the AI Space Race will be data infrastructure and data management, supported by cloud solutions that are agile, secure, and scalable. Successful organizations need an intelligent data infrastructure in place to ensure unfettered AI innovation." It’s hard to disagree with that.

NetApp’s AI Space Race study reinforces its position in the enterprise data infrastructure market. By framing the readiness conversation around organizational alignment and data strategy, NetApp shifts the focus from compute horsepower to the broader challenge of holistically managing the enterprise data lifecycle.

It’s an approach aligned with current trends across the AI infrastructure ecosystem, where storage, observability, and data orchestration increasingly dictate scalability. NetApp’s emphasis on full-stack integration, particularly within multi-cloud environments, differentiates it from infrastructure players that focus purely on on-premises or hyperscaler-native AI stacks. It's a compelling story.

Disclosure: Steve McDowell is an industry analyst, and NAND Research is an industry analyst firm, that engages in, or has engaged in, research, analysis and advisory services with many technology companies, including those named in this article: Dell Technologies, Hewlett Packard Enterprise, NetApp, NVIDIA, Pure Storage, VAST Data, and WEKA. No company mentioned was involved in the writing of this article. Mr. McDowell does not hold any equity positions with any company mentioned.

The above is the detailed content of The Impact Of Data Infrastructure On Global AI Leadership. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

AI Investor Stuck At A Standstill? 3 Strategic Paths To Buy, Build, Or Partner With AI Vendors

Jul 02, 2025 am 11:13 AM

AI Investor Stuck At A Standstill? 3 Strategic Paths To Buy, Build, Or Partner With AI Vendors

Jul 02, 2025 am 11:13 AM

Investing is booming, but capital alone isn’t enough. With valuations rising and distinctiveness fading, investors in AI-focused venture funds must make a key decision: Buy, build, or partner to gain an edge? Here’s how to evaluate each option—and pr

AGI And AI Superintelligence Are Going To Sharply Hit The Human Ceiling Assumption Barrier

Jul 04, 2025 am 11:10 AM

AGI And AI Superintelligence Are Going To Sharply Hit The Human Ceiling Assumption Barrier

Jul 04, 2025 am 11:10 AM

Let’s talk about it. This analysis of an innovative AI breakthrough is part of my ongoing Forbes column coverage on the latest in AI, including identifying and explaining various impactful AI complexities (see the link here). Heading Toward AGI And

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Kimi K2: The Most Powerful Open-Source Agentic Model

Jul 12, 2025 am 09:16 AM

Remember the flood of open-source Chinese models that disrupted the GenAI industry earlier this year? While DeepSeek took most of the headlines, Kimi K1.5 was one of the prominent names in the list. And the model was quite cool.

Future Forecasting A Massive Intelligence Explosion On The Path From AI To AGI

Jul 02, 2025 am 11:19 AM

Future Forecasting A Massive Intelligence Explosion On The Path From AI To AGI

Jul 02, 2025 am 11:19 AM

Let’s talk about it. This analysis of an innovative AI breakthrough is part of my ongoing Forbes column coverage on the latest in AI, including identifying and explaining various impactful AI complexities (see the link here). For those readers who h

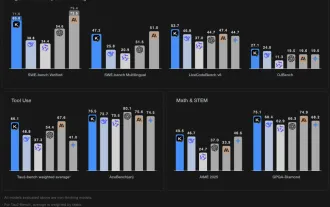

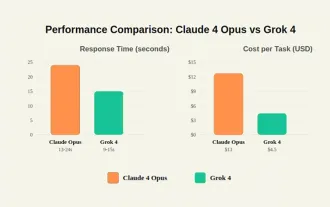

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

Grok 4 vs Claude 4: Which is Better?

Jul 12, 2025 am 09:37 AM

By mid-2025, the AI “arms race” is heating up, and xAI and Anthropic have both released their flagship models, Grok 4 and Claude 4. These two models are at opposite ends of the design philosophy and deployment platform, yet they

Chain Of Thought For Reasoning Models Might Not Work Out Long-Term

Jul 02, 2025 am 11:18 AM

Chain Of Thought For Reasoning Models Might Not Work Out Long-Term

Jul 02, 2025 am 11:18 AM

For example, if you ask a model a question like: “what does (X) person do at (X) company?” you may see a reasoning chain that looks something like this, assuming the system knows how to retrieve the necessary information:Locating details about the co

Senate Kills 10-Year State-Level AI Ban Tucked In Trump's Budget Bill

Jul 02, 2025 am 11:16 AM

Senate Kills 10-Year State-Level AI Ban Tucked In Trump's Budget Bill

Jul 02, 2025 am 11:16 AM

The Senate voted 99-1 Tuesday morning to kill the moratorium after a last-minute uproar from advocacy groups, lawmakers and tens of thousands of Americans who saw it as a dangerous overreach. They didn’t stay quiet. The Senate listened.States Keep Th

This Startup Built A Hospital In India To Test Its AI Software

Jul 02, 2025 am 11:14 AM

This Startup Built A Hospital In India To Test Its AI Software

Jul 02, 2025 am 11:14 AM

Clinical trials are an enormous bottleneck in drug development, and Kim and Reddy thought the AI-enabled software they’d been building at Pi Health could help do them faster and cheaper by expanding the pool of potentially eligible patients. But the