What does Quasimodo mean? How to use Quasimodo trading strategy to trade in 2025?

May 26, 2025 pm 07:36 PMWhat does Quasimodo mean? How to use Quasimodo trading strategy?

The Quasimodo trading strategy is a unique strategy to identify potential buy and sell areas. In 2025, the strategy has evolved significantly through new variants such as AI-driven pattern recognition, nesting and fractal Quasimodo (QM), as well as integration with the decentralized finance (DeFi) platform.

Quasimodo strategy remains extremely profitable for cryptocurrency trading, now has enhanced risk management techniques and demonstrates impressive performance metrics such as the 72% win rate of the continuity model. Modern traders use the Quasimodo model to optimize liquidity provision, earnings farms and arbitrage opportunities in the evolving crypto market.

Let’s learn more about it with the editor of Script Home!

Latest developments in Quasimodo strategy in 2025

Quasimodo trading strategies have evolved significantly since their inception, bringing significant advancements in applied technology and market integration in 2025. As the cryptocurrency market matures, this model-based approach regains attention among professional traders.

Enhanced AI pattern recognition

In 2025, the automated trading system now integrates advanced machine learning algorithms designed specifically for identifying Quasimodo patterns with higher accuracy. These systems can:

- Simultaneously detect pattern formation within multiple time frames

- The probability coefficient of calculation mode completion - adjust the entry/exit point according to market volatility indicators

-

Filter false signals by association with volume indicator

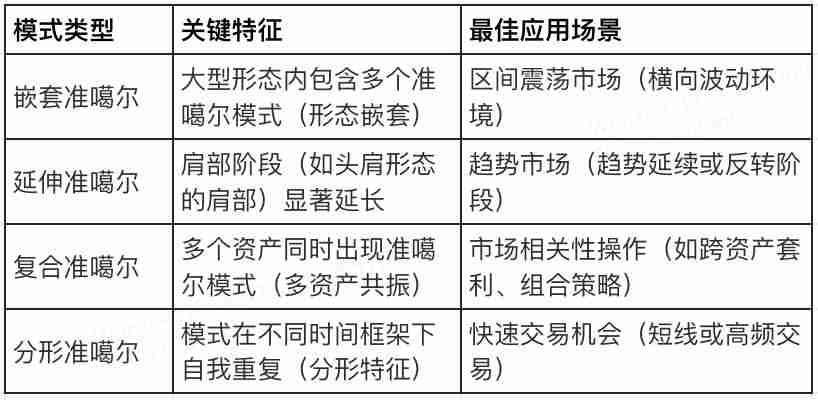

Modern Quasimodo variant

The trading platform now identifies several specialized Quasimodo variants that have proven to be effective under current market conditions:

Integration with Decentralized Finance (DeFi) transactions

The Quasimodo strategy has found new applications in the decentralized financial ecosystem. Platform users now adopt these modes under the following circumstances:

- Provide regular entry and exit for liquidity - Optimize revenue farm position management

- Identify potential price differences in algorithmic stablecoins

- Discover arbitrage opportunities between different liquidity pools

Risk management enhancement

Hyundai Quasimodo trading integrates complex risk management technologies tailored to cryptocurrency volatility:

- Position Size Based on Model Quality Score - Dynamic Stop Loss Using Volatility Adjustment Percentage

- Multi-stage take-profit target consistent with key support/resistance levels

- Relevance hedging with complementary assets

Performance metrics

Recent transaction data show that when implementing the Quasimodo strategy correctly, the performance is impressive:

Quasimodo trading strategy continues to show outstanding results under the market conditions in 2025. Its adaptability to various market stages and its integration with modern trading technology consolidates its position as an indispensable tool for serious cryptocurrency traders. As the market evolves, the structural simplicity and technical robustness of this model ensures its continued correlation in global trading instruments. ”

What’s attractive about cryptocurrency trading is that there are multiple strategies that can be used to trade for profit. It's like there are multiple routes to choose from to a destination, except that some routes are faster, some are slower, some are more risky, and some are less risky. In trading, profit is the destination that all traders want to “reach”.

It is worth noting that there are many ways or “routes” to “reach this destination.” Although many traders are familiar with patterns and strategies such as head and shoulders top, double top and triple top bottom, effective trading strategies are not common, and Quasimodo trading strategies are such an effective strategy. Next, this article will take you through this strategy and how to use it to profit from the crypto market.

What is a Quasimodo trading strategy?

Quasimodo trading strategy is a pattern composed of a series of swing lows and swing highs that are often used to detect trend reversals. This pattern looks similar to the head and shoulders pattern and the reverse head and shoulders pattern. Quasimodo is named after the hunchback of a cartoon character. The following figure shows a hunchback cartoon character with a similar shape to this transaction, Quasimodo.

Early Quasimodo strategies were only used to discover trend reversals. However, more variants of this trading strategy have been found recently. These variants can also be used to identify opportunities for entry in a continuation trend. The Quasimodo strategy can be subdivided into Quasimodo reversal pattern (QMR) and Quasimodo continuation pattern (QMC).

Quasimodo Reverse Pattern (QMR)

Quasimodo Reversal Pattern (QMR) appears at the end of a long-term trend, indicating that it may be bullish or bearish. The bearish reversal pattern is formed after a bull market or price rebound in cryptocurrencies. Often, with higher highs and higher lows comes price increases.

When the buyer loses momentum and a ultimate higher high appears with a higher low, another higher high will form. But in the QMR pattern, higher highs are followed by lower lows rather than higher lows. The emergence of lower lows indicates that the buyer may soon lose the price war at this time.

After the lower lows, the lower highs will form. The price level of the new lower highs formed is usually at the same price level as the first higher high, but below the second higher high. The following image shows this intuitively. Please note that prices fail to continue to create higher highs and higher lows.

Source: TradingView

The bullish reversal pattern is exactly the opposite of the bearish reversal pattern. It is formed after a long-term downward trend. The Quasimodo structure can be found at the bottom of the trend.

How to trade Quasimodo Reversal Pattern

Quasimodo reversal patterns can be found within any time range. After the pattern is discovered, the trader can confirm entry using the reversal signal within another time range. The reversal signal may be a swallowing candlestick or a morning or evening star candlestick.

To trade QMR mode, you must determine the entry point, set stop loss (SL) and take profit (TP). As shown in the figure below, the entry point for BTC/USDT trading and the recommended stop loss and take profit points are shown.

Source: TradingView

Stop loss : The stop loss should be set at a certain distance above the highest point, that is, the position of the head of the chart.

Entry Point : The entry point should be near the first higher high point. After the price fails to form a higher high, the entry point begins to form a new lower high.

Take Profit : Traders usually set multiple take profits. This prevents them from exiting the transaction too early or too late. The first take-profit point can be set near the high point before the price rises. The second take-profit point can be set near the higher and lower points at the beginning of the rebound.

Advantages of Quasimodo Reversal Form

Quasimodo Inversion morphology is effective: when the morphology is found, the possibility of inversion is very high.

The QMR pattern provides traders with high risk returns. That is, traders in the QMR pattern earn more profits and less losses.

The shape and pattern are unique and easy to identify. When switching to a line chart, the pattern can be more easily identified in the chart.

Quasimodo reversal allows traders to enter early compared to other chart patterns: traders using head and shoulders patterns must wait for a neckline to break through, while trend reversal traders can confirm entry points faster.

Quasimodo The disadvantages of reversal patterns

For manual trading strategies, it is also difficult to encode into trading algorithms.

It is usually risky. Whales or market promoters can use the trading psychology of retail traders to obtain liquidity. When manipulating the QMR pattern to create obvious entry, it may cause losses for retail traders.

Quasimodo Continuation Form (QMC)

Quasimodo Continuation Pattern (QMC) is a QM Pattern formed when the trend continues. Quasimodo shapes can also be found at the continuation point of the trend. The shape at this time usually occurs after the reversal. When the market reverses and forms another Quasimodo pattern, traders offer a second chance to capture the trend. The QMC shape is exactly the same as the conventional Quasimodo shape, except that the former appears as a continuation form.

Source: TradingView

As shown in the figure above, the Quasimodo continuation pattern formed after the Quasimodo reversal pattern is shown. The QMC pattern creates another opportunity for traders to increase their buying positions.

How to trade Quasimodo Continue the pattern

The trading method of the QMC pattern is similar to that of the QMR pattern. For bullish continuation patterns, the entry point is set at a lower initial low, or as if it is near the level of the shoulders of the pattern. The stop loss is set slightly below the last swing low, or similar to the position at the head of the pattern. Take profit can be set near the beginning of the previous downtrend.

Source: TradingView

What is Quasimodo manipulation?

It should be noted that the Quasimodo reversal form has a major disadvantage, that is, it can be manipulated by big players. When whales find areas with potentially high liquidity (i.e., buy or sell orders), they can use these price levels to make a profit for themselves.

Quasimodo manipulation occurs when the price of a cryptocurrency or financial instrument fails to reverse in the expected entry area. Marketers often cause this manipulation to occur. Most of the time, when this happens, the price tends to pull back towards a failed entry. Other times, prices will continue to develop along their trajectory without retracement. To protect yourself from Quasimodo, always set a stop loss.

How to get better entry?

Although Quasimodo trading patterns are also available without indicators and other trading tools, traders can add these trading tools to obtain better entry prices.

Trend Line: It may be helpful to draw a trend line that is coordinated with support and resistance levels. When trendlines are consistent with the expected entry point of a buying and selling transaction, the chances of successful transactions will increase.

Candlestick: Bullish swallowing candlesticks usually confirm a bullish trend reversal, while bearish swallowing candlesticks confirm a bearish price reversal. The chances of success increase when bullish engulfing candlesticks are found near the entry point of the bullish Quasimodo reversal. The chances of success will also increase when a bearish swallows the candlestick around the bearish Quasimodo reversal candlestick.

Relative Strength Index (RSI): The RSI indicator can confirm entry. When the slope of RSI falls near the peak of the bullish trend, it may indicate that the bullish trend is weakening. The bearish trend almost ends when the slope increases and a bullish Quasimodo is found. This further confirms the trend reversal.

The difference between the reversal form and the head and shoulder form

Quasimodo's reversal pattern is similar to the head and shoulders pattern. Although the psychology behind the formation of the two forms is the same, the entry point and risk-return rate are different. The low points of the left and right shoulders of the head and shoulders pattern are equal or almost equal; while in the Quasimodo reversal pattern, the low points on the right side of the chart are significantly lower than the low points on the left side of the chart.

In addition, the entry point for the head and shoulders pattern is usually located near the neckline. But the entry point of the short-selling market is near the peak of the lower highs.

Summarize

Quasimodo reversal patterns are not as famous as they are compared to other trading patterns or strategies that cryptocurrency traders often use. However, this trading pattern is effective and can be used to detect reversal trends as soon as possible.

This trading strategy is mainly used in Forex and comprehensive indexes, but can also be used to trade cryptocurrencies. If an earlier entry is missed, traders can use the Quasimodo continuation pattern to obtain a second entry opportunity. There is no doubt that using this trading strategy outweighs the benefits.

The above is the detailed content of What does Quasimodo mean? How to use Quasimodo trading strategy to trade in 2025?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 digital currency exchanges in 2025, ranking of virtual digital currency app trading platforms, ranking of top ten

Jun 05, 2025 am 10:54 AM

Top 10 digital currency exchanges in 2025, ranking of virtual digital currency app trading platforms, ranking of top ten

Jun 05, 2025 am 10:54 AM

The rankings of the top ten digital currency exchanges in 2025 are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Bitfinex, 9. Gemini, 10. Bitstamp. These platforms all provide a variety of cryptocurrency transactions and convenient mobile applications. Registration requires passing the official website or application, completing email verification and setting up two-step verification (2FA).

The most complete version of the top ten exchanges in the currency circle and the advantages and disadvantages analysis

Jun 04, 2025 pm 11:48 PM

The most complete version of the top ten exchanges in the currency circle and the advantages and disadvantages analysis

Jun 04, 2025 pm 11:48 PM

The top ten exchanges in the currency circle include Binance, Ouyi, Huobi, Gate.io, Kraken, Coinbase, Bitfinex, Bittrex, Poloniex and KuCoin. 1. Binance is known for its high transaction volume and rich trading pairs, but its user interface is complex. 2. Ouyi provides diversified financial products with strong technical support, but the withdrawal speed is slow. 3. Huobi has a long history, but the transaction volume has decreased and the handling fees are high. 4. Gate.io has a wide variety of tokens, low handling fees, but has a small market share.

Top 10 digital currency exchanges download rankings Top 10 digital currency trading software download rankings

Jun 05, 2025 am 10:21 AM

Top 10 digital currency exchanges download rankings Top 10 digital currency trading software download rankings

Jun 05, 2025 am 10:21 AM

Top 10 digital currency exchanges download rankings: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Bitfinex, 9. Gemini, 10. Bitstamp, these platforms provide a variety of cryptocurrency transactions and convenient mobile applications. Registration requires passing the official website or application, completing email verification and setting up two-step verification (2FA).

Global currency exchange ranking 2025 currency circle latest ranking full version

Jun 04, 2025 pm 11:45 PM

Global currency exchange ranking 2025 currency circle latest ranking full version

Jun 04, 2025 pm 11:45 PM

The rankings of global currency exchanges in 2025 are: 1. Binance, 2. Ouyi, 3. Huobi, 4. Gate.io. Binance leads in trading volume, liquidity and globalization, with Ouyi following closely behind with technical support and emerging market layout, Huobi performed well in compliance and global layout, and Gate.io is known for supporting innovative projects and emerging markets.

How to query your administrator password for oracle database

Jun 04, 2025 pm 10:06 PM

How to query your administrator password for oracle database

Jun 04, 2025 pm 10:06 PM

Directly querying administrator passwords is not recommended in terms of security. The security design principle of Oracle database is to avoid storing passwords in plain text. Alternative methods include: 1. Reset the SYS or SYSTEM user password using SQL*Plus; 2. Verify the encrypted password through the DBMS_CRYPTO package.

The inventory and advantages and disadvantages of the top ten exchanges in the currency circle are complete version

Jun 04, 2025 pm 11:51 PM

The inventory and advantages and disadvantages of the top ten exchanges in the currency circle are complete version

Jun 04, 2025 pm 11:51 PM

The top ten exchanges in the currency circle have their own advantages and disadvantages. The choice needs to consider security, liquidity, fees, interface and compliance. 1. Newbie people should choose Coinbase or Bittrex because of its user-friendliness and high security. 2. Professional investors should choose Binance or OKEx because of their high liquidity and diversified trading products.

The latest ranking of the market app in the currency circle. The latest ranking of the market app in the currency circle for free.

Jun 05, 2025 am 10:30 AM

The latest ranking of the market app in the currency circle. The latest ranking of the market app in the currency circle for free.

Jun 05, 2025 am 10:30 AM

The top ten most popular virtual currency exchanges in the currency circle are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Bitfinex, 9. Gate.io, 10. Bitstamp. These exchanges have their own characteristics and provide a variety of financial products including spot trading, futures trading, staking services and lending services. The registration process requires email verification and KYC certification.

Ranking of the top ten digital currency free exchanges in 2025 The latest ranking of the top ten digital currency trading platform apps

Jun 05, 2025 am 10:45 AM

Ranking of the top ten digital currency free exchanges in 2025 The latest ranking of the top ten digital currency trading platform apps

Jun 05, 2025 am 10:45 AM

Ranking of the top ten digital currency free exchanges in 2025: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bitfinex, 7. KuCoin, 8. Bittrex, 9. Gemini, 10. Poloniex, these exchanges provide free spot trading services, and each has its own advantages, such as an efficient trading system, rich currency support, strong liquidity and user-friendly interface, etc., to ensure the safety of user assets.