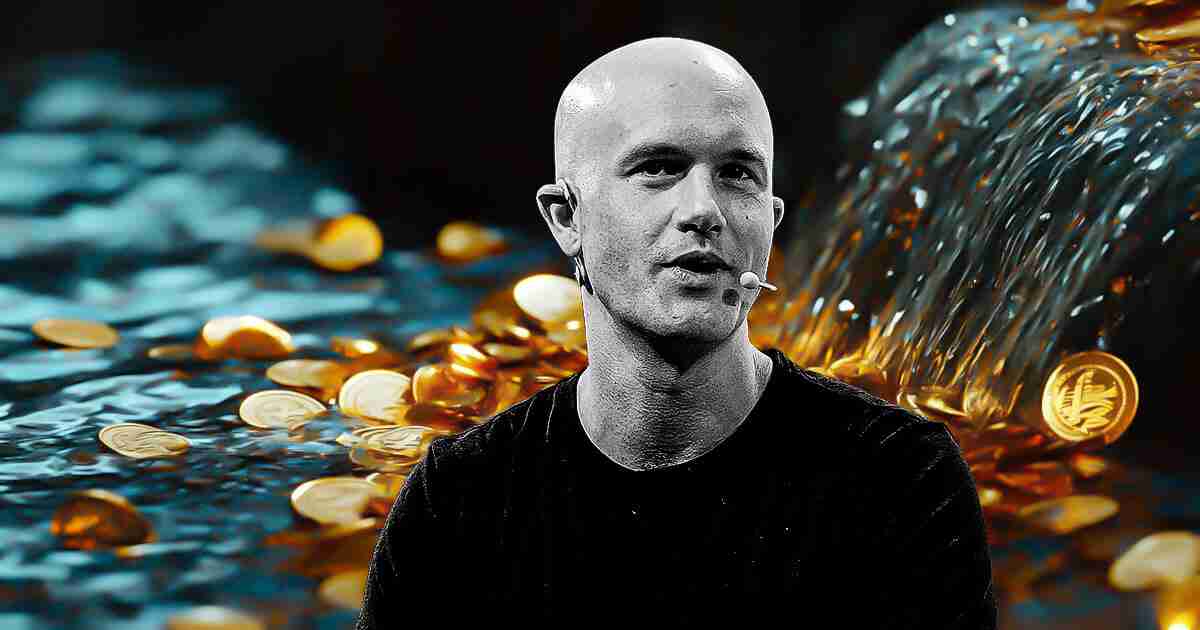

Coinbase CEO Brian Armstrong calls on lawmakers to support Stablecoin legislation

Apr 20, 2025 pm 08:24 PMCoinbase CEO Brian Armstrong called on U.S. lawmakers to support a stablecoin bill that allows consumers to earn interest income directly from their dollar stablecoin holdings. He believes this move will be a "win-win" situation.

Armstrong elaborated on this view in a blog post on March 31 and argued that the next stage of stablecoin innovation must include the "OnChain Interest" mechanism. The mechanism will allocate the proceeds generated by stablecoin reserve assets, such as short-term U.S. Treasury bonds, to stablecoin holders.

Currently, stablecoin issuers face legal uncertainty as they cannot share interest with users without violating securities laws or engaging in activities deemed to be “investment banking.” Banks have long enjoyed regulatory exemptions for providing interest accounts, while stablecoin issuers lack such exemptions.

Armstrong believes:

"Consumers should get more. Open on-chain interest will drive us to improve the system, ultimately benefit consumers and drive this innovation to grow within the United States."

A fairer financial future

Stablecoins have been widely adopted as a digital representative of fiat currencies, but Armstrong believes its potential has not been fully released. He pointed out that although the average federal funds rate in 2024 is 4.75%, the interest income of most consumer savings accounts is well below 0.5%, or even below the inflation rate (about 3%), resulting in a decline in actual purchasing power.

Armstrong pointed out:

“On-chain interest will democratize gains in market interest rates, allowing ordinary people to maintain and increase wealth more equitably.”

He further highlighted the potential of stablecoins to change financial channels globally. Billions of people around the world cannot easily obtain the dollar or are forced to use local currencies with unstable value and rapidly depreciating.

By allowing stablecoins to claim interest, the United States can attract a large number of new users around the world, creating a financial system that is instant, transparent and easy to access with just an internet connection.

Armstrong added:

“No bank outlets are required, no high overdraft fees or remittance fees. This is a financial channel that is equal to everyone, powered by cryptocurrencies.”

Strategic Advantages to the U.S. Economy

Armstrong also explains how to combine the allowable on-chain interest on stablecoin with broader U.S. economic policy goals.

Stablecoin issuers are already one of the main buyers of U.S. Treasury bonds, and their purchases are even more than many foreign governments. If global consumers can earn interest from dollar stablecoins, the resulting increase in adoption will further increase demand for government bonds, enhance the dollar's position in the global financial system, and stimulate economic growth through higher consumer spending and investment.

Armstrong said:

“More interest from consumers means more spending, savings and investments – which will boost growth across the economy holding stablecoins.”

However, Armstrong warns that the U.S. could miss trillions of dollars in global financial flows in the coming decades without promptly incorporating on-chain interest into new stablecoin legislation. He urged lawmakers to quickly formulate clear legal provisions to ensure regulated stablecoin issuers can allocate interest to users without triggering complex disclosure requirements or exposing issuers to the securities laws.

Armstrong concluded:

“At a time when the government and Congress are actively involved in stablecoin regulation, we have a unique opportunity. We can modernize the system to benefit consumers or stick to an outdated middle-level institutional model.”

The above is the detailed content of Coinbase CEO Brian Armstrong calls on lawmakers to support Stablecoin legislation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

How to buy Bitcoin in the country? Detailed explanation of domestic Bitcoin purchase methods

Jul 30, 2025 pm 10:36 PM

Domestic purchase of Bitcoin must be carried out through compliance channels, such as Hong Kong licensed exchanges or international compliance platforms; 2. Complete real-name authentication after registration, submit ID documents and address proof and perform facial recognition; 3. Prepare legal currency and recharge it to the trading account through bank transfer or electronic payment; 4. Log in to the platform to select Bitcoin trading pairs, set limit orders or market orders to complete the transaction; 5. Pay attention to market fluctuations and platform security, enable dual certification and comply with domestic regulatory policies; overall, investors should operate cautiously under the premise of compliance and participate in Bitcoin investment rationally.

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

Why is Bitcoin with a ceiling? Why is the maximum number of Bitcoins 21 million

Jul 30, 2025 pm 10:30 PM

The total amount of Bitcoin is 21 million, which is an unchangeable rule determined by algorithm design. 1. Through the proof of work mechanism and the issuance rule of half of every 210,000 blocks, the issuance of new coins decreased exponentially, and the additional issuance was finally stopped around 2140. 2. The total amount of 21 million is derived from summing the equal-scale sequence. The initial reward is 50 bitcoins. After each halving, the sum of the sum converges to 21 million. It is solidified by the code and cannot be tampered with. 3. Since its birth in 2009, all four halving events have significantly driven prices, verified the effectiveness of the scarcity mechanism and formed a global consensus. 4. Fixed total gives Bitcoin anti-inflation and digital yellow metallicity, with its market value exceeding US$2.1 trillion in 2025, becoming the fifth largest capital in the world

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

How to judge market trends based on the opening and closing prices of digital currencies

Jul 30, 2025 pm 10:33 PM

The comparison between the opening price and the closing price can effectively judge the trend direction of the digital currency. 1. The opening price reflects the initial strength of long and short, which is significantly higher than the previous closing price and the increase in volume is a short-term bullish signal; 2. The closing price verifies the trend, breaking through the resistance level or continuously standing firm in the moving average is a sign of medium-term strength; 3. In combination of the combination analysis, the long positive line indicates a strong rise, the long negative line shows downward pressure, and the cross star indicates a possible reversal or stabilize; 4. Combining the moving average and the Bollinger band can enhance judgment. If the 5-day moving average is stable and the high opening is a long signal, the Bollinger band closes positive or oversold rebound; 5. It needs to be supplemented by capital flow and market sentiment. The high volume increase in the opening indicates that the main force enters the market. The high opening and high closing or low opening and low closing caused by major news will strengthen the trend. Investors should integrate K-line patterns, technical indicators and market trends

How should novices allocate positions when trading cryptocurrency

Jul 30, 2025 pm 10:24 PM

How should novices allocate positions when trading cryptocurrency

Jul 30, 2025 pm 10:24 PM

Novice should reasonably allocate positions to control risks. Specific strategies include: 1. Use 5%-10% of the disposable funds to participate in high-risk assets, and the holding of a single token shall not exceed 2% of the total position; 2. Mainstream assets in diversified investment account for 60%-70%, medium-sized market capitalization projects shall not exceed 20%, and emerging tokens shall be controlled within 10%; 3. Adopt the pyramid position building method, with the first investment of 30%, 5%-added 20%, and after the trend is confirmed, the stop loss of 2-3 times is supplemented; 4. Set the stop loss of mainstream assets to 8%-12%, high-risk assets to 5%-8%, and the profit exceeds 15% and mobile stop loss is enabled; 5. Rebalance every quarter, partially take profits to increase by more than 50%, reduce positions by 10%, and maintain the initial asset ratio; the core principle is to disperse allocation and strictly control single products

Why do you say you choose altcoins in a bull market and buy BTC in a bear market

Jul 30, 2025 pm 10:27 PM

Why do you say you choose altcoins in a bull market and buy BTC in a bear market

Jul 30, 2025 pm 10:27 PM

The strategy of choosing altcoins in a bull market, and buying BTC in a bear market is established because it is based on the cyclical laws of market sentiment and asset attributes: 1. In the bull market, altcoins are prone to high returns due to their small market value, narrative-driven and liquidity premium; 2. In the bear market, Bitcoin has become the first choice for risk aversion due to scarcity, liquidity and institutional consensus; 3. Historical data shows that the increase in the bull market altcoins in 2017 far exceeded that of Bitcoin, and the decline in the bear market in 2018 was also greater. In 2024, funds in the volatile market will be further concentrated in BTC; 4. Risk control needs to be vigilant about manipulating traps, buying at the bottom and position management. It is recommended that the position of altcoins in a bull market shall not exceed 30%, and the position holdings of BTC in a bear market can be increased to 70%; 5. In the future, due to institutionalization, technological innovation and macroeconomic environment, the strategy needs to be dynamically adjusted to adapt to market evolution.

How do novices judge the time of buying the bottom and escaping the top when trading cryptocurrency

Jul 30, 2025 pm 10:18 PM

How do novices judge the time of buying the bottom and escaping the top when trading cryptocurrency

Jul 30, 2025 pm 10:18 PM

To accurately grasp the market turning point, we need to combine four bottom signals, top warnings, volume-price relationships, cycle resonance and position management. 1. The bottom area signals include: panic selling accompanied by historical high trading volume; perpetual contract funds turn negative for more than 48 hours; fear and greed index continues to be below 20; weekly RSI enters the oversold zone (<30). 2. The top warning signs are: non-professional investors are keen to discuss "permanent rise"; the inflow of stablecoin exchanges reaches a three-month peak; the giant whale address transfers more than 5% of assets to the exchange; the daily line continuously shows a long upper shadow accompanied by a shrinking volume. 3.

Which coins should be paid attention to when decorating the layout in August? What type of cryptocurrency has more potential

Jul 30, 2025 pm 10:15 PM

Which coins should be paid attention to when decorating the layout in August? What type of cryptocurrency has more potential

Jul 30, 2025 pm 10:15 PM

The layout of altcoins in August should focus on three types of assets: mainstream application revival, meme cultural outbreak and technological iteration innovation. 1. Value reshaping type priority XRP (target $5), SOL (breaking through $204 or hitting $300), HNT (halving catalysis, target $4.82); 2. Meme emotional type focus on WIF (impact $1.45) and T6900 (FOMO mechanism 427% pledge); 3. Technology breakthrough type focus on HYPER (Layer2, pledged 1000%), TIA (modular blockchain), TICS (cross-border payment pre-sale); 4. Event-driven type focus on OP (if it stands firm after unlocking or test $1.0) and SUI (breaking through $4.35 to see 4.

How to operate cryptocurrency transactions in batches by novices

Jul 30, 2025 pm 10:21 PM

How to operate cryptocurrency transactions in batches by novices

Jul 30, 2025 pm 10:21 PM

Batch operation is the core strategy to deal with cryptocurrency market fluctuations, which can effectively control risks and protect principal. 1. The equal-to-batch position building method divides funds into 3-5 shares, and buys one share for every 5% drop in price. The first position building is at least 10% away from the support level, which is suitable for fluctuating market conditions; 2. The pyramid-type increase invests 30% of the funds in the first transaction after the trend is confirmed, and the price decreases and increases positions when the price breaks through key resistance. The total number of times does not exceed 3 times to ensure that the cost of holding is lower than the market price; 3. The reverse pyramid-taking stop-profit technique sells 20%-30% of the position at the first target position, and the second target position is reduced by 40%-50%.