web3.0

web3.0

What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis

What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis

What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis

Mar 03, 2025 pm 07:36 PMJupiter: Leading DEX aggregator in the Solana ecosystem

This article will explore Jupiter, the leading decentralized exchange (DEX) aggregator in the Solana ecosystem. Jupiter integrates the liquidity of multiple DEXs to provide users with the best price, lowest slippage and efficient trading experience.

Jupiter's core advantages:

- Price advantages: By aggregating multiple DEXs, ensure that users get the best transaction price.

- Speed ??advantage: Use Solana's high TPS to achieve extremely low transaction delays.

- Cost Advantage: Solana's Gas costs are cheaper than other blockchains.

Jupiter Main functions:

1. DEX aggregation: Jupiter integrates the liquidity of multiple DEXs such as Raydium, Orca, Serum, etc., providing users with: the best transaction price, the lowest slippage and transaction cost, as well as fast transaction execution. Its parallel processing architecture is significantly better than the aggregators on other EVM chains.

2. Swap trading and limit order:

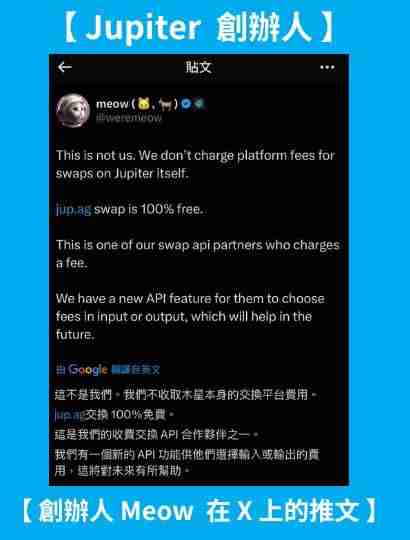

- Jupiter Swap: Users can easily exchange tokens, and the system automatically selects the optimal trading path. The platform itself does not charge additional fees, only DEX transaction fees and Solana network fees are required. It should be noted that some partners using the Jupiter API may charge additional fees.

- Jupiter Limit: Users can set price orders and automatically execute when the market price reaches the target to ensure that the transaction is completed at an ideal price. The handling fee is only 0.1%.

3. DCA & VA: On-chain fixed investment and value average method:

Jupiter provides two intelligent investment tools: DCA (regular fixed investment) and VA (value average method), helping users reduce market volatility risks and achieve long-term stable investment.

4. Perps Perpetual Contract:

Jupiter provides perpetual contracts such as SOL, ETH, WBTC, etc., with a leverage range of 1.1x – 100x, and supports the use of Solana intra-ecological tokens as margin.

$JUP Token Economics:

- Token name: Jupiter ($JUP)

- Total supply: 7 billion pieces (30% cut)

- Main uses: Community governance, voting decision-making, Launchpad investment and platform handling fee discounts.

Token allocation: In August 2024, the Jupiter community cut the token supply by 30% through a proposal to reduce future selling pressure and enhance market confidence.

Future development of Jupiter: Jupiter will continue to improve DEX aggregation technology, expand cross-chain transactions, and strengthen DAO governance. The ultimate goal is to become the world's leading DeFi transaction infrastructure.

Conclusion:

Jupiter has become the leading DEX aggregator on Solana with its powerful features and the advantages of the Solana ecosystem, and has great development potential. The maturity of $JUP tokens and the development of LFG Launchpad will further promote the prosperity of the Jupiter and Solana DeFi ecosystems.

The above is the detailed content of What is the Jupiter platform? What is the relationship with Solana? One article will give you a complete analysis. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

btc trading platform latest version app download 5.0.5 btc trading platform official website APP download link

Aug 01, 2025 pm 11:30 PM

1. First, ensure that the device network is stable and has sufficient storage space; 2. Download it through the official download address [adid]fbd7939d674997cdb4692d34de8633c4[/adid]; 3. Complete the installation according to the device prompts, and the official channel is safe and reliable; 4. After the installation is completed, you can experience professional trading services comparable to HTX and Ouyi platforms; the new version 5.0.5 feature highlights include: 1. Optimize the user interface, and the operation is more intuitive and convenient; 2. Improve transaction performance and reduce delays and slippages; 3. Enhance security protection and adopt advanced encryption technology; 4. Add a variety of new technical analysis chart tools; pay attention to: 1. Properly keep the account password to avoid logging in on public devices; 2.

Binance download official website https Binance APP download link official website https

Aug 01, 2025 pm 11:21 PM

Binance download official website https Binance APP download link official website https

Aug 01, 2025 pm 11:21 PM

Binance APP is a world-leading digital asset service application, providing users with safe and convenient trading experience and comprehensive market information. Through its official mobile client, users can grasp the latest market trends, manage personal digital assets, and conduct diversified trading operations anytime and anywhere. This article will introduce in detail how to obtain and install the Binance APP through official channels, as well as its core functions and usage techniques, to help users use the platform safely and efficiently.

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

USDT virtual currency purchase process USDT transaction detailed complete guide

Aug 01, 2025 pm 11:33 PM

First, choose a reputable trading platform such as Binance, Ouyi, Huobi or Damen Exchange; 1. Register an account and set a strong password; 2. Complete identity verification (KYC) and submit real documents; 3. Select the appropriate merchant to purchase USDT and complete payment through C2C transactions; 4. Enable two-factor identity verification, set a capital password and regularly check account activities to ensure security. The entire process needs to be operated on the official platform to prevent phishing, and finally complete the purchase and security management of USDT.

Will Ethereum callback 2000? A brief overview of Ethereum's trends in recent years

Aug 01, 2025 pm 10:39 PM

Will Ethereum callback 2000? A brief overview of Ethereum's trends in recent years

Aug 01, 2025 pm 10:39 PM

The price fluctuations of ETH have touched the hearts of countless investors, and discussions about whether its prices will bottom out again have never stopped. This article will review the price trends of Ethereum in recent years, and combine current market fundamentals and technical indicators to explore whether it is possible to pull back to the key support level of US$2,000, providing readers with a multi-dimensional market observation perspective.

USDT virtual currency account activation guide USDT digital asset registration tutorial

Aug 01, 2025 pm 11:36 PM

USDT virtual currency account activation guide USDT digital asset registration tutorial

Aug 01, 2025 pm 11:36 PM

First, choose a reputable digital asset platform. 1. Recommend mainstream platforms such as Binance, Ouyi, Huobi, Damen Exchange; 2. Visit the official website and click "Register", use your email or mobile phone number and set a high-strength password; 3. Complete email or mobile phone verification code verification; 4. After logging in, perform identity verification (KYC), submit identity proof documents and complete facial recognition; 5. Enable two-factor identity verification (2FA), set an independent fund password, and regularly check the login record to ensure the security of the account, and finally successfully open and manage the USDT virtual currency account.

JD Stablecoin Official Website Where to buy JD Stablecoin

Aug 01, 2025 pm 06:51 PM

JD Stablecoin Official Website Where to buy JD Stablecoin

Aug 01, 2025 pm 06:51 PM

Currently, JD.com has not issued any stablecoins, and users can choose the following platforms to purchase mainstream stablecoins: 1. Binance is the platform with the largest transaction volume in the world, supports multiple fiat currency payments, and has strong liquidity; 2. OKX has powerful functions, providing 7x24-hour customer service and multiple payment methods; 3. Huobi has high reputation in the Chinese community and has a complete risk control system; 4. Gate.io has rich currency types, suitable for exploring niche assets after purchasing stablecoins; 5. There are many types of currency listed on KuCoin, which is conducive to discovering early projects; 6. Bitget is characterized by order transactions, with convenient P2P transactions, and is suitable for social trading enthusiasts. The above platforms all provide safe and reliable stablecoin purchase services.

How to obtain digital currency BTC? What are the differences between btc and digital currency?

Aug 01, 2025 pm 11:15 PM

How to obtain digital currency BTC? What are the differences between btc and digital currency?

Aug 01, 2025 pm 11:15 PM

There are four main ways to obtain BTC: 1. Register and exchange it with fiat currency or other digital assets through centralized trading platforms such as Binance, OK, Huobi, and Gate.io; 2. Participate in P2P platforms to directly trade with individuals, and pay attention to the credit risks of the counterparty; 3. Provide goods or services to accept BTC as payment; 4. Participate in airdrops, competitions and other platform reward activities to obtain a small amount of BTC. The core difference between BTC and digital currency is: 1. BTC is a type of digital currency, which belongs to a genus relationship; 2. BTC adopts a proof of work (PoW) mechanism, while other digital currencies may use various technologies such as proof of stake (PoS); 3. BTC emphasizes the value storage function of "digital gold", and other digital currencies may focus on payment efficiency or

Bitcoin ETF funds continue to flow in! Why do institutional investors add positions crazily?

Aug 01, 2025 pm 06:21 PM

Bitcoin ETF funds continue to flow in! Why do institutional investors add positions crazily?

Aug 01, 2025 pm 06:21 PM

There are four core reasons why institutional investors have crazy increase in their holdings in Bitcoin ETFs: First, Bitcoin ETFs provide compliant and convenient investment channels, solving the problems of institutions in safe custody and regulatory compliance; Second, under macroeconomic uncertainty, Bitcoin is regarded as "digital gold", with anti-inflation attributes and meeting asset allocation needs; Third, market FOMO sentiment spreads, and leading institutions' entry triggers a follow-up effect, seizing the first-mover advantage; Fourth, the brand endorsement of professional custody institutions and top asset management companies has enhanced trust and eliminated security concerns. These factors jointly promote the large-scale influx of institutional funds, marking the beginning of crypto assets entering the mainstream financial system.